The number of container ships at anchor off California is down from the all-time high, but that doesn’t necessarily mean the U.S. import boom is winding down.

“If you think the worst is over, be cautious,” warned Michael Braun, vice president of customer solutions at Norway-based Xeneta, a company that tracks container contract rates. “In some cases, it could stay as difficult or get worse — especially in the U.S.,” said Braun during an online presentation Tuesday.

“It is more and more clear that the situation we are currently in is going to stay here for some time. If you had asked me a half-year ago what would happen, I would say we’d see some relief after Chinese New Year. But everything is dragging on longer than previously expected.

“We’re now pretty sure that the peak situation we currently see is going to last throughout the whole summer, without any kind of [letup before] the peak season we usually see in the summer.”

According to Braun, “What we’re seeing now is that demand from the shipper side is going to last. We are still seeing a number of shippers who have twice their regular monthly demand as they’re stocking up warehouses or coping with additional demand.”

Stimulus checks to juice retail spending

Ed Hyman, head of economic research at New York-based Evercore ISI, said in a client note on Tuesday that his bank’s survey of retailers showed a “stunning” sentiment surge last week. Results are expected to remain “super strong” this week.

Hyman estimated that $240 billion in stimulus checks arrived last week and an additional $100 billion will arrive this week. Much of this could be spent quickly. If $100 billion is spent by the end of the month, Q2 consumer spending would jump 12%.

According to Alan Murphy, CEO of Sea-Intelligence in Copenhagen, Denmark, “In the past 29 years, the U.S. has never seen such a low level of retail inventory relative to sales as in January. And this is despite the boom in import cargo.”

Murphy added, “The growth rate in spending on goods in January was higher than at any point during the second half of 2020. In other words, the boom in the U.S. in terms of goods is accelerating. It is not slowing down.

“These developments lead to the conclusion that the pressure on the containerized supply chain into the U.S. will not abate in the near-term future,” cautioned Murphy. “If anything, the January data points to an increase in the strength of the boom. Especially as retailers struggle to not only keep up with sales growth, but also, to replenish their inventories.”

Boardrooms focus on cost surge

Xeneta collects comprehensive data on ocean shipping contract rates. As of Tuesday, its data showed that long-term rates on the Asia-West Coast route were up 50% year-on-year, to $2,640 per forty-foot equivalent unit (FEU). Spot rates on that route were $4,056 per FEU, up 156% year-on-year.

The company estimated that long-term rates on the Asia-East Coast route were up 28% year-on-year, to $3,659 per FEU. The average rate in the short-term market for that route was $5,058 per FEU, up 79% year-on-year.

Xeneta’s long-term rate estimate for the Asia-West Coast market mirrors statements made Monday by ZIM (NYSE: ZIM) CEO Eli Glickman, who disclosed that ZIM’s contract rates this year were up 50%.

Such extreme rate hikes have negative implications for U.S. importers — and are now receiving attention at the highest levels.

“Usually, ocean freight is not at the center of attention, only covering a couple of percent of indirect procurement spend,” noted Braun. “Nowadays, some of the largest shippers are facing additional [annual] invoices of $50 million-$100 million. That’s definitely something that gets attention at the global-shareholder level and of course at the board-of-director level. The board level attention is extreme.

“Everybody thought this was going to be a quick storm. That it was going to be over in a quarter and everything would go back to normal. The longer it takes, the more companies need to start to rethink their whole strategy.

“Because this is not working anymore. Additional costs cannot be just passed on to consumers. We’re clearly seeing more and more companies starting to rethink their whole procurement and transportation strategy.”

The latest from San Pedro Bay

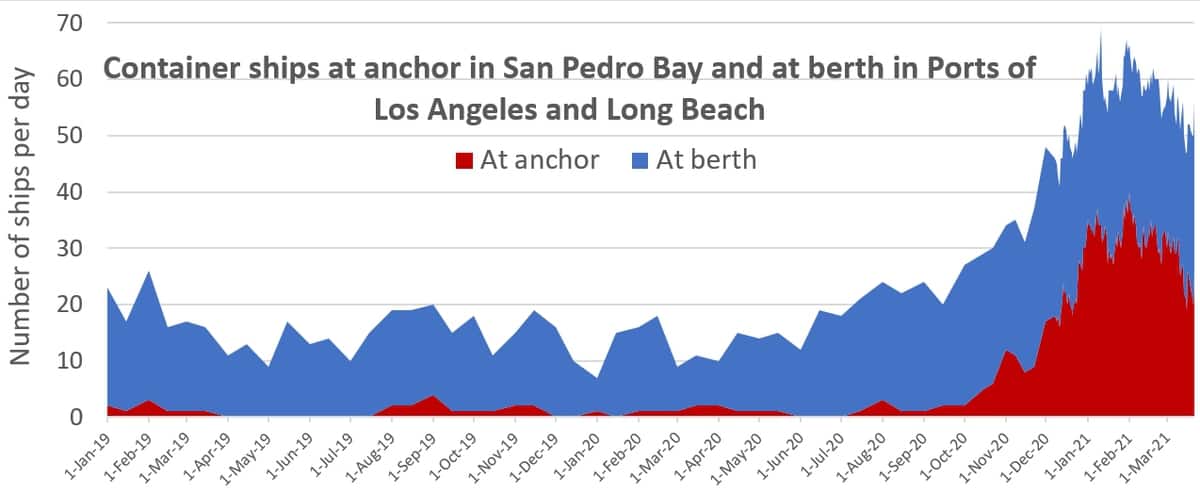

The import spotlight has been on container-shipping congestion in Los Angeles/Long Beach and San Pedro Bay — the most visible manifestation of America’s COVID-era import spike.

New statistics provided to American Shipper by the Marine Exchange of Southern California show some improvements. However, the numbers are still very high.

The all-time record for container ships stuck at anchor — 40 — was hit on Feb. 1. The record for the combined number of container ships either at anchor or at the berths — 67 — was reached two days earlier, on Jan. 30.

This year’s low for box ships at anchor — 19 — was recorded on March 19. The same day saw this year’s low for combined ships at both anchor and berths: 47.

Sounds promising. But the numbers have crept up over the past week. As of Tuesday, there were 25 at anchor and 30 at the berths. To put that in context: Between Jan. 1 and Tuesday, an average of 58.2 ships were either at anchor or berth on any given day. The number on Tuesday was just 5% below this year-to-date average.

In other words, as analysts at Xeneta and Sea-Intelligence pointed out, the U.S. import system is not out of the woods yet. Click for more FreightWaves/American Shipper articles by Greg Miller

MORE ON CONTAINER SHIPPING: ZIM: US importers buckle, sign contracts early, pay 50% more: see story here. Ocean carriers hold all the cards in contract talks with shippers: see story here. New video shows massive scope of California box-ship traffic jam: see story here.

More data: