Less-than-truckload carrier XPO beat first-quarter expectations on Wednesday ahead of the market open.

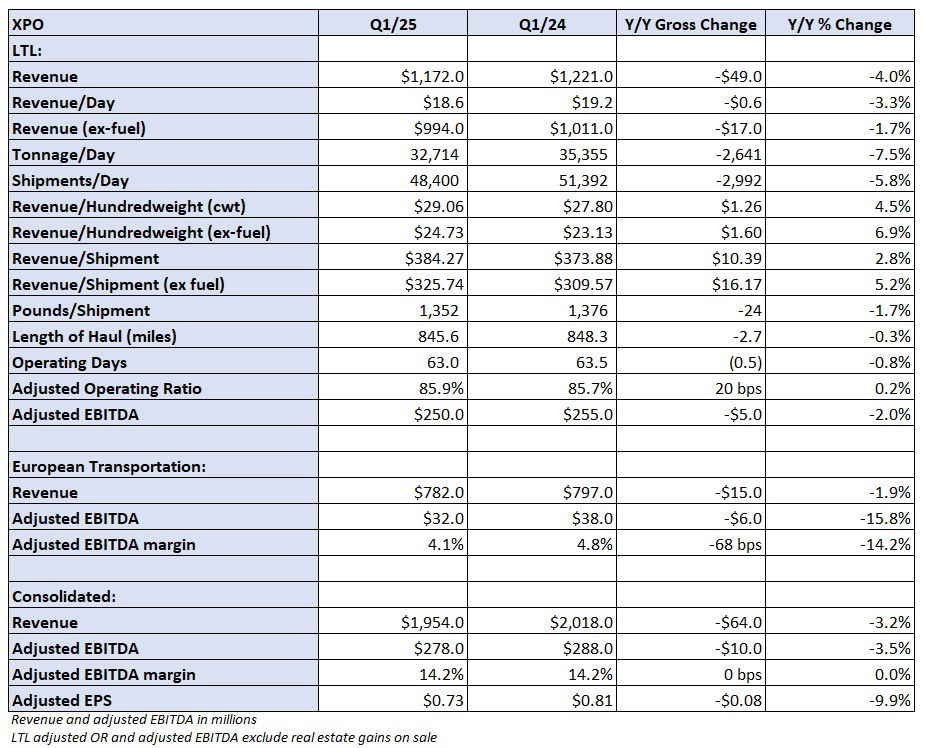

XPO (NYSE: XPO) reported adjusted earnings per share of 73 cents, which was 8 cents better than the consensus estimate but 8 cents lower year over year. The adjusted EPS number excluded transaction and restructuring costs.

“Our plan is driving results, with a long runway for margin expansion, supported by superior service and high-return investments in our network,” said CEO Mario Harik in a news release. “We’re executing to achieve years of outperformance, regardless of the freight market environment.”

Click for full report – “XPO sees runway to higher margins even if downcycle lingers”

The company’s LTL unit reported revenue of $1.17 billion, a 4% y/y decline (down 3.3% on a per-day basis). Tonnage per day was down 7.5%, but revenue per hundredweight, or yield, was up 4.5% (6.9% higher excluding fuel surcharges).

The tonnage decline was the combination of a 5.8% decline in daily shipments and a 1.7% decline in weight per shipment. The lower shipment weights were a tailwind to the yield metric.

Tonnage and yields were basically flat with the fourth quarter. The company has improved revenue per shipment in each quarter for the past two years.

Click for full report – “XPO sees runway to higher margins even if downcycle lingers”

The LTL segment reported an 85.9% adjusted operating ratio (inverse of operating margin), 20 basis points worse y/y but 30 bps better sequentially. The result outperformed the normal seasonal trend of 50 bps of sequential margin degradation.

Purchased transportation expense was reduced by 53% y/y (down 320 bps y/y as a percentage of revenue). The company continues to reduce linehaul miles executed by third-party operators.

“This brings our cumulative improvement in adjusted operating ratio to 370 basis points over two years in a soft freight environment,” said Harik.

XPO’s European transportation segment reported a 1.9% y/y decline in revenue to $782 million. It recorded an adjusted earnings before interest, taxes, depreciation and amortization margin of 4.1%, which was 70 bps worse y/y.

Shares of XPO were up 6.7% in premarket trading on Wednesday.

XPO will host a call to discuss first-quarter results with analysts on Wednesday at 8:30 a.m. EDT.