No one needs to tell the users of transport services how high freight rates have climbed during the past two years. But recently released producer price data from the federal government provides empirical evidence to support the painful anecdotes.

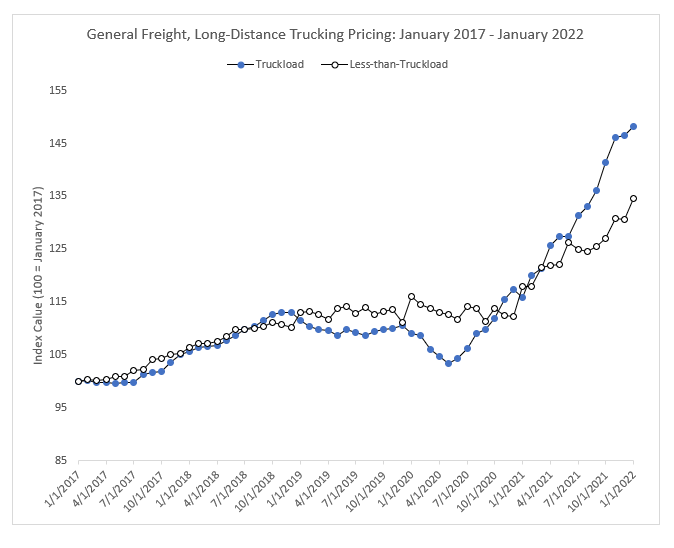

The numbers are striking. Import air cargo rates rose 80% from January 2020 through January 2022, due largely to a massive curtailment of belly cargo capacity, which in normal times accounts for about half of international air commerce. Freight brokerage rose by 45% over that time. Rates for truckload, LTL and specialized transportation increased 25%. Parcel rates rose 14.7%, while prices for warehousing services increased 20.5%, with much of that coming after July 2021 as demand spiked hard due to the ripple effect of supply chain bottlenecks at various U.S. seaports.

“We have never seen anything like this before,” said Jason Miller, associate professor of logistics at Michigan State University’s Eli Broad College of Business, referring to the extent of the increases. Miller built a series of charts from the data, which came from the Department of Labor’s Bureau of Labor Statistics and the U.S. Census Bureau.

The good news, at least for some users, is that January’s numbers may be the worst of it, Miller said. For example, his data indicates that demand for truckload services has plateaued as consumers throttle back on what has been an unprecedented two-year spending orgy. At the same time, more truckload supply is entering the market, helping to tamp down rates. The risk for truckload rate declines in the second half of the year is quite high.

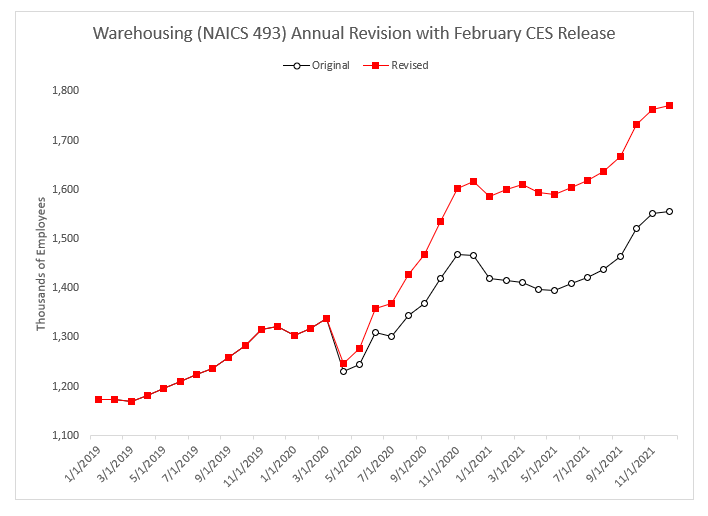

The warehouse labor force also expanded dramatically, with the government making massive upward revisions of labor participation beginning as far back as May 2020 (see chart). From January 2018 through January 2022, warehouse employment in the U.S. rose 59.3% or 647,200 workers, Miller said, citing government data.

LTL still has plenty of pricing runway, Miller said. LTL carriers’ prices have risen substantially less than the truckload sector since the start of the COVID-19 pandemic, according to his data (see chart). LTL carriers operate in a relatively concentrated marketplace that, in recent years, has made their services somewhat less resistant to downward rate pressures. In addition, LTL shippers typically value service over price and are willing to accept higher rates for service quality and reliability. LTL carriers have forecast contract rate renewals of 10% or more, levels that are nearly unheard of in the sector.

Hand-wringing over higher prices tends to obscure the reality that transport services represent only 2% to 6% of the cost of goods sold, depending on the value of the product being shipped, according to Satish Jindel, CEO of Ship Matrix, a consultancy. Miller said that his data corroborates that figure. What makes this cycle different is that higher freight costs are eating into manufacturers’ gross margins at the same time that materials costs are also rising significantly.

Keith Roth

I noticed in the article, air freight and domestic freight were discussed, but no mention of ocean cargo freight rates. A 40 foot container from China port to Atlanta Georgia door, cost about $3800 USD pre-covid, and that same freight cost went up to about $24,000 USD last fall, and has now softened to about $14500 recently. In my calculations that is a cost increase factor of 6.3 at peak, and now only 3.82 times more expensive than it was 2 years ago. Given that ocean cargo represents a much larger freight volume than air, I think the impact of this increase should also be included in this conversation. It should also be mentioned that many truck repair components, for example brake shoes and brake drums, are very heavy, and the ocean freight impact on these components if sourced from Asia, represents total product cost content increases in the range of 60% for the value of the component. These types of increases are also having a significant impact on the cost to operate a fleet in today’s world.

Montee Bailey ZippLine Express LLC

There’s a lot of supporting facts and numbers to support this article, but one thing that has yet to be addressed is the going problem of the brokers for the big companies pocketing the extra money. Freight prices are going up due to fuel, lack of driver’s and driver’s not wanting to be over the road long periods of times. But!! Small business owners and owner operators are not seeing the money that has incurred from these the price inflation, the brokers are pocketing the money with in return makes it difficult for the owner operators and Small business owners to continue to operate at healthy capacity. Essentially these price increases are only benefiting rhe big companies like Uber Freight, TQL, Nolan, JB Hunt but are not allocated to the actual carrier.

Blake Scallan

Solid thought, but do you think these big brokers were able to get these direct shippers to increase rates over 30 percent and then pocket all of it? I run a brokerage, have my own fleet, and a very strong understanding as I play both the spot market and direct business. Most companies have no updated their budgets to include these down stream costs. Shippers have to lead the way with a push from brokers, and a realization by trucking companies. If not, the capacity problems will be exacerbated and then you will really see price hikes like we have never seen.

Truckguy

Freight rates have gone up due to demand for hauling outpacing supply of trucks, not fuel prices. Any fuel surcharge is a separate issue.

Blake

Truck rates are set to decline? Did this article completely ignore all of the rising costs in diesel, parts, tractors, trailers, insurance ect? Did the writer consider the almost exact increase of 30 percent for diesel and 30 percent towards the cost of living. Trucking rates are extremely low considering the cost of doing business. Rates will do exactly the opposite of what this article suggest if supply and demand have anything to say about it. Or will this government send more regulations??