Goldman calls for one more spot rate peak in Q4; issues new price targets

This morning a team of Goldman Sachs (NYSE: GS) analysts—Matt Reustle, Nick Fahmie, and Siwei Bian—released an insightful research report on American trucking called “Big Wheels Keep on Turnin’?” Reustle and his team sought to provide an answer to what they said was the most common transportation investor concern they hear: “how long the pricing cycle will last and whether or not we have hit peak.”

Goldman calls for one more peak in spot rates during the fourth quarter of this year, followed by a gradual decline as the driver shortage is slowly mitigated by accelerated hiring. Although “sticky wage increases are attracting labor,” Reustle wrote, the investment bank does not see a significant threat to the freight demand side of the equation on the horizon.

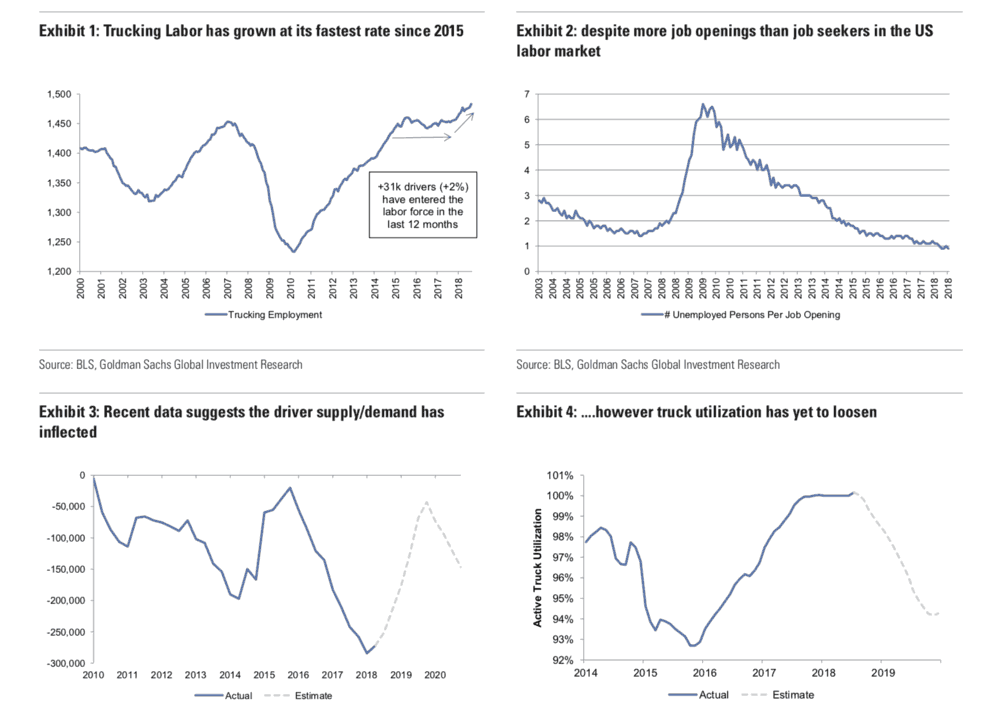

Reustle rightfully points out that the ‘driver shortage’ needs to be taken into context: since the early 1990s, 77% of the time the trucking industry has experienced a ‘driver shortage’. What matters isn’t the fact of the shortage itself, it’s the depth of the shortage—how bad it is. In the past year, more than 31K drivers have entered the workforce, the fastest rate of growth in three years. The only way to explain that accelerated hiring in a low unemployment environment is to look at the significant wage increases (+12% since June 2017) that carriers have resorted to in order to hang on to drivers.

While Goldman believes the driver shortage has found its bottom and is starting to turn around, there is no reason to believe that spot rates have already reached their peak. Carriers’ asset utilization has not loosened at all, remaining at 100% since 2H 2017. The fall/holiday peak shipping season will bring another peak in spot rates before capacity increases to the point of equilibrium and rates soften over the course of 2019.

What’s fascinating, though, is that Goldman recognizes the entire trucking industry is going through a step-change in cost. Although 2019 will be soften, Reustle thinks that rates will remain 12% above the 2014-7 range. One of the factors keeping rates high is inflationary driver pay, which represents about 40% of the cost of transportation.

But what to do about trucking stocks? Investors have been skittish toward the sector since Werner Enterprise’s (NASDAQ: WERN) extremely strong second quarter earnings, which prompted a counter-intuitive sell-off that has taken stocks like Knight-Swift (NYSE: KNX) down 20% year-to-date. Wall Street apparently thought that it can’t get any better that this, that trucking hit its peak, so it was time to take profits and wait out the inevitable decline. It hasn’t worked out like that, though: it turns out the constraints on truckload capacity are structural, and old age is not going to kill an economic expansion with strong fundamentals like oil & gas, industrial production, housing starts up more than 9% year over year, and plenty of liquidity in the economy looking for a home.

Which companies are best poised to take advantage of the remaining fall season upside and keep doing well in a relatively capacity-rich environment next year? Goldman has two recommendations: Landstar System (NASDAQ: LSTR) and XPO Logistics (NYSE: XPO).

Goldman thinks that XPO’s LTL business should be less cyclically volatile than truckload, so that portion of their revenues are somewhat protected from a turn in the trucking market (and XPO itself is calling for modest margin improvements in LTL as the company unleashes its new salesforce in the fourth quarter). XPO calls for mid- to high-teens growth in EBITDA for 2019. Goldman lowered its 12 month price target for XPO to $127 from $129, which is still a 12.4% upside from today’s trading price.

Landstar, Reustle admitted, is technically the company most exposed to truckload spot rates of all the companies covered by Goldman, but its business model of independent BCOs (Business Capacity Operators), shields the company from the effects of rate changes.

“Because of this model, for every 1% change in rates, we estimate this only has a ~0.9% effect on LSTR’s EPS. Further, given the strong demand environment, LSTR can look to offset any potential rate declines by going after volumes,” Goldman wrote. The bank dropped its 12 month price target for Landstar to $142 from $143, still a 16.9% upside from where LSTR is trading today.

The biggest price target change in Reustle’s report was Knight-Swift: Goldman revised KNX downward to $42 from $47, still a 19% upside from where KNX is trading at today, $35.26. The lowered price target was not due to pessimism about Knight-Swift’s earnings per share, which estimates Goldman actually increased, but because the bank has recognized that KNX has historically traded at a 17.2x multiple (weighted between an historical Knight multiple of 20x and a Swift multiple of 15x). Previously, perhaps anticipating greater synergies between the two very different trucking companies, Goldman thought KNX should trade at a multiple of 18.6x.