Significant retail restocking is likely to continue for the first three quarters of 2021 as retailers will likely want to pull forward inventory ahead of the 2021 peak season in the second half of the year, a Hub Group (NASDAQ: HUBG) executive said during the company’s fourth-quarter earnings call late Thursday.

However, market activity for intermodal will “probably be more stable and less spiky than what we saw last year,” said Hub Group Chief Commercial Officer Phil Yeager on the call.

Although a “strong freight environment” helped overall revenue grow by 6% in the fourth quarter, the intermodal marketing company still experienced lower fourth-quarter net income on higher transportation costs.

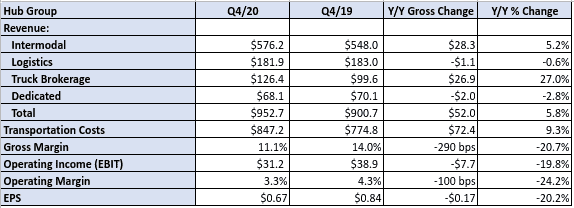

Fourth-quarter 2020 net profit for the Oak Brook, Illinois-based company was $22.4 million, or 67 cents per diluted share, compared with nearly $28 million, or 84 cents per diluted share, in the fourth quarter of 2019.

Total fourth-quarter revenue grew 6% to $952.7 million year-over-year amid a 5% increase in intermodal revenue and a 27% increase in truck brokerage revenue.

Indeed, intermodal volumes rose 9% in the fourth quarter, Hub Group said.

Company costs and expenses were $74.4 million, compared with nearly $87 million in the fourth quarter of 2019. A decline in salaries and benefit expenses, as well as lower travel expenses, were among the factors that led to the year-over-year decrease.

But fourth-quarter transportation costs grew by 9% to $847.2 million year-over-year.

Hub Group said it expects 2021 capital expenditures to range from $150 million to $170 million, consisting primarily of investments to support growth in the business, including containers and tractors, as well as investments in technology.

Hub Group plans to “add approximately 2,500 containers, which will result in net growth of approximately 2,000 after retirements of containers that have reached end of life. We are also planning to add approximately 750 tractors, 500 of which are for replacements of older units and 250 of which will support growth in our drayage and dedicated fleets,” it said.

The company is also seeing “a good opportunity to grow across all our service lines” in 2021, according to Phil Yeager. Among the opportunities are anticipated mid-high-single-digit pricing for intermodal and double-digit revenue growth for its brokerage service, he said during the earnings call.

Another opportunity will be exploring additional synergies resulting from its December acquisition of NonstopDelivery (NSD), a last-mile logistics provider for the home-delivery sector. That service is a non-asset-based model and so it provides more flexibility, executives said.

“The acquisition of NSD expanded our service offering into the fast-growing last-mile delivery space, and we anticipate significant cross-sell opportunities with our customer base,” Hub Group CEO Dave Yeager said in a release.

The company will also be looking to improve productivity among its drivers and improve the balance of its network, executives said during the call.

Subscribe to FreightWaves’ e-newsletters and get the latest insights on freight right in your inbox.

Click here for more FreightWaves articles by Joanna Marsh.

Related articles:

Hub Group’s $95M acquisition is path to being a last-mile market leader