It is not guaranteed that container lines will withdraw more sailings to boost Asia-to-Europe container spot freight rates around the turn of the year. But if they fail to do so, annual contract negotiations with shippers in December will be difficult.

“The trend in 2019 has been awful for lines,” said Patrik Berglund, CEO of Xeneta, an Oslo-based ocean freight rate benchmarking and market analytics platform.

“Carriers definitely have a weaker starting point when compared to 2018-19.

“My expectation is carriers will see that their best hope of reversing this trend is to take capacity out, probably heading into Chinese New Year when they will be settling long-term contracts.”

Around 50% of the Asia-Europe container shipping trade is currently managed under long-term contracts usually signed by carriers and shippers in December and January. This compares to around 75% of the trans-Pacific market, where contracts are agreed to in May and June.

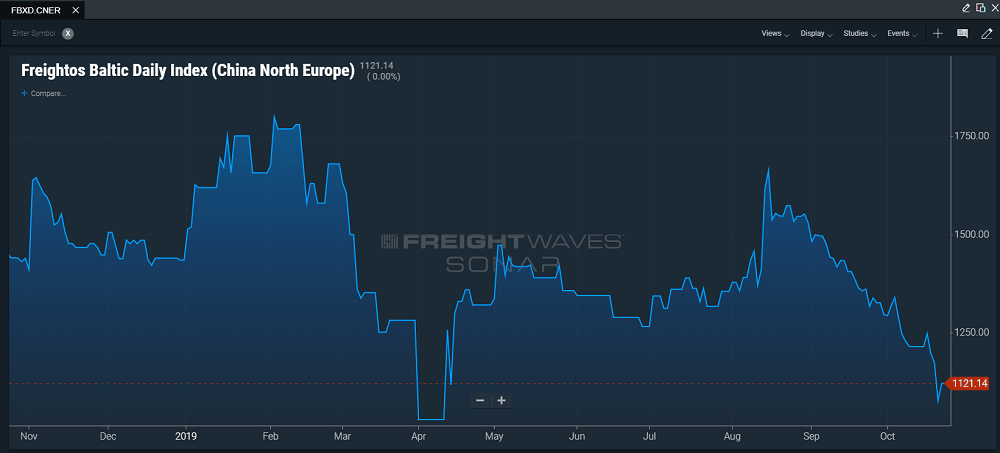

With annual Asia-Europe contract negotiations fast approaching, lines are clearly in a pickle. Both short-term and long-term container shipping contract spreads have trended downward through most of 2019 (see chart below), while spot freight rates on the Shanghai-to-Rotterdam trade are currently around 16% lower than a year earlier, according to Drewry.

Both short- and long-term container shipping contract rates have been trending downward for most of 2019. Source: Xeneta

The joker: IMO 2020

Withdrawing more capacity in a bid to boost spot rates ahead of talks with shippers is one of the few cards left for carriers to play. The strategy might be aided by the phased introduction of low-sulfur fuels that become mandatory under International Maritime Organization rules on Jan. 1.

“Carriers have some opportunity to restrict supply in the crucial run-up to annual contract negotiations as it is also the run-up to the IMO 2020 fuel regulations,” a Freightos representative told FreightWaves.

“Some vessels will be taken out of the running while they’re retrofitted with scrubbers (to avoid using IMO 2020 low-sulfur fuel).

“The short-term hit by taking ships out of commission for longer than necessary may pay off if prices rise.”

Shippers wary

Certainly shippers have been vocal about how lines might use the introduction of IMO 2020 fuels to boost earnings. However, Berglund noted, “Even if we get a $100-200 per FEU ‘IMO 2020 effect’ as more expensive low-sulfur fuels are introduced, it wouldn’t take us back to ’18/’19 rate levels, which again makes a strong argument that liner operating costs including fuel do not determine rates, as I’ve previously argued.”

The Asia-Europe market has been a disappointment for carriers in 2019, with healthy demand growth failing to be reflected in spot rate gains. Flexport reported earlier this week that Asia-Europe space is currently “tight.” Even so, according to Freightos’ daily index, spot rates from China-East Asia to North Europe were $1,121 per FEU on Oct. 22, down from $1,441 a year earlier.

Drewry believes rate cutting has been responsible for the failure of lines to benefit from relatively strong European demand this year.

“The disconnect between supply and demand fundamentals and freight rates is indicative of a return to predatory pricing on the part of some carriers within the trade, undermining the positive demand story,” Drewry reported.

“Unless lines match pricing discipline to that shown for capacity it will be for nothing.”

Demand downturn ahead?

The bad news for lines is that the positive European demand story through most of 2019 is now turning tepid.

“The eurozone economy remained close to stagnation at the start of the fourth quarter, according to the latest flash PMI (Purchasing Managers’ Index) data, with demand for goods and services falling for a second successive month,” noted IHS Markit in its latest flash IHS Markit Eurozone Composite PMI report.

“New orders for goods and services fell for a second month in a row, the rate of decline easing slightly but nevertheless adding to the worst picture of demand since mid-2013 in recent months.”

Short-term respite for carriers might come from the upcoming Lunar holidays, which fall early in 2020. “An earlier Chinese New Year, beginning 25 January, might offer some assistance to contract negotiations by boosting activity in December,” noted Drewry.

More articles by Mike