The freight market took a hard right turn this week. National tender rejection rates are essentially flat, only moving down 8 bps over the past seven days. With many of the larger markets at or near annual lows capacity appears to be plentiful outside of some small areas in New England and Pacific Northwest as Christmas tree season winds down.

Historically speaking, the spot market cools off for a few weeks after heating up around Thanksgiving. Another heated period typically occurs in the week preceding Christmas. In other words, we should be close to the bottom of the market in December with next week being the last full week of shipping prior to the holiday.

Service becomes more of an issue the closer we get to the end of the year as shippers and carriers alike attempt to capture as much revenue and clear as many docks as they can. This year will be a little different as an extended container shipping season filled warehouses close to capacity in reaction to tariff concerns. A lot of the freight moved earlier in the year leaving less need for last minute shipping, but also less space in warehouses for inventory.

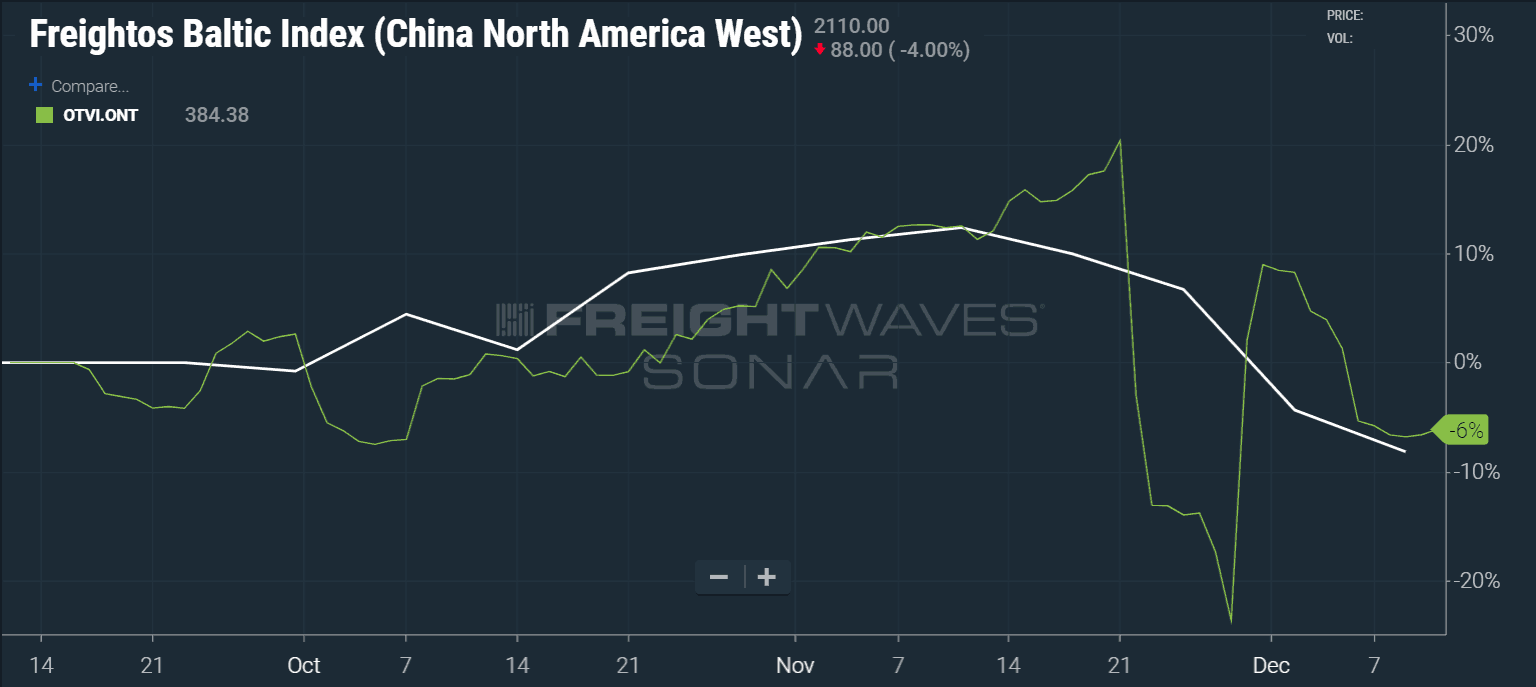

Freight volume dropped sharply over the past week—the national outbound tender volume index fell 4.3%. The southern California markets of L.A. and Ontario lead the charge by dropping 18% and 11% respectively. The Freightos Baltic Index rates dropped for the fourth consecutive week to the West Coast from China this week, indicating declining inbound container volume to the ports of Long Beach and L.A. There has been a lagging correlation between inbound container rates and outbound volume from the L.A. markets this fall. Shipping rates lead outbound volume by a week or so starting in September.

With the one market that has been fuel any larger capacity disruptions cooling down, there should be a muted impact this holiday season, meaning the peak of this year’s freight season is probably behind us. Most of the volume has been front loaded this year.

Heavily wooded Maine and eastern Oregon have been two of the main areas of the country showing any significant issues locating capacity in recent weeks. This is a seasonal occurrence and is typical for this time of year.Carriers typically avoid these areas so when fall harvests or Christmas trees start moving with significant volume, there are not enough trucks in the area to fill the short term demand. Outbound tender rejections in Maine (OTRI.ME) have jumped 10.02% in the past seven days. Outbound rejection rates in Pendleton, OR (OTRI.PDT) are lower than they were a week ago (-590 bps) but remain elevated well above the average for the past six months.

Expect capacity to gradually fall away later this week for longer haul lanes. Drivers will need to be in a position for home time and will not want to be too far away. Regional moves should have little to no trouble finding coverage in the interim.