On its earnings call, Lisle, Illinois-based truck manufacturer Navistar (NYSE: NAV) walked through its earnings outperformance and provided some highlights on the business and its increased guidance.

The medium- and heavy-duty truck manufacturer reported that adjusted net income increased 57 percent year-over-year to $105 million in its fiscal second quarter 2019 compared to $67 million in the prior year comparable period.

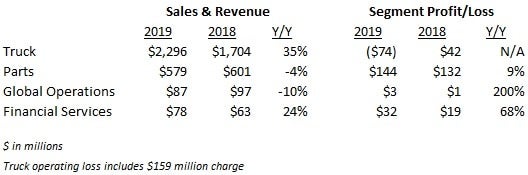

NAV’s adjusted results exclude the company’s $159 million class action settlement. On May 30, 2019, NAV agreed to settle class action complaints over defective MaxxForce engines and recorded a $159 million charge against second quarter earnings for settlement payouts as well as pending lawsuits not included in the settlement agreement.

NAV raised its earnings guidance for fiscal 2019. Management said that the guidance raise is based on strong industry conditions. Management now expects 2019 full-year retail deliveries of Class 6-8 trucks and buses in the U.S. and Canada to be 425,000 to 445,000 units. The company is calling for Class 8 retail deliveries in the 290,000 to 310,000 range, which is in-line with ACT Research’s 2019 forecast for 306,000 units.

NAV raised its fiscal 2019 revenue guidance range to $11.25 billion to $11.75 billion ($0.5 billion higher on each end of the range) and adjusted EBITDA expectation to $875 million to $925 million ($25 million higher on each end of the range). Management said that higher gross margins will lead to improved EBITDA margins in the second half of 2019 compared to the first half.

Management said that its new guidance does not include the potential impact from tariffs that may be implemented on goods crossing the Mexican border. Mexico represents approximately two-thirds of NAV’s total truck manufacturing capacity. Further, management said that they expect 2020 to be another good year, but again excluded potential tariffs on Mexico from this assessment.

On the call, management provided additional color on its new guidance. Management said that orders are down more than 60 percent and that its total backlog is down more than 22 percent, but that the company is taking market share in new orders placed. They said that they are still seeing large fleets buying equipment. Even those fleets that purchased heavily in the second half of 2018’s record freight demand environment are inquiring about production plans in the back-half of 2019.

Further, management said that they are taking market share in new orders without sacrificing price. Pricing is up 1 to 2 percent across all vehicle types and they believe that future pricing increases will continue to outpace materials costs for the rest of the year. Additionally, they said that day sales inventory on-hand, which measures total inventory throughout Navistar and its dealers, is 84 days, which is at the low-end of its historical range of 80 to 120 days.

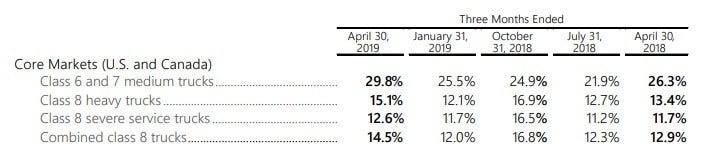

NAV reported increased market share across all vehicle types. Additionally, they said that the feedback on its newest line of trucks has been positive. Management said that on-board recorded data, as well as data from its dealers, on more than 400,000 trucks shows that the new line is performing well.

“In the second half, we believe our growth in market share will translate to improved revenues and gross margins that will generate higher adjusted EBITDA margins than in the first half. Our marketplace progress, which has delivered our strongest backlog this decade, provides confidence that both 2019 and 2020 will be good years for Navistar,” said Navistar’s Chairman, President and Chief Executive Officer Troy A. Clarke.

NAV reported a 24 percent increase in revenue to $3 billion in the period, with higher Class 6-8 trucks and bus sales in the United States and Canada being the primary driver. Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) increased 23 percent to $224 million.

NAV has recently been mentioned in the news as a potential acquisition target of Volkswagen AG (U.S. OTC: VLKAF). On June 3, 2019 Volkswagen announced that the company plans to move forward with the initial public offering of its heavy-truck division, TRATON SE, as part of its effort to restructure assets and raise capital. TRATON owns 16.8 percent of Navistar.

Shares of NAV were up as much as 9 percent on the earnings report.