February saw a decline from January in overall retail sales, but non-store retail, which includes e-commerce, continues to outpace overall sales, rising 25.9% from February 2020 and 1.8% from January, according to monthly data released Tuesday from the U.S. Census Bureau. However, some experts are predicting boom times ahead.

Retail and food service sales dropped 3% in February from January in the final report before the latest round of stimulus payments hit consumers’ bank accounts. February’s sales remained 6.3% above February 2020, the last month before COVID-19-related lockdowns began. Food services and drinking places saw a 17% decline in February year-over-year.

For the three-month period ending Feb. 28, retail sales are up 6% from the year-ago period.

The Census Bureau also revised January’s sales upward to 7.6%, which followed the $600 stimulus checks sent out in the beginning of the month. Among the winners in January were department stores, up 23.5%; home furnishings, up 14.7%; and electronics, up 12%. In February, though, many of those subcategories saw month-over-month declines, including department stores falling 8.4%, sporting goods stores 7.5% and furniture and home furnishing stores 3.8%.

January’s increase followed three consecutive months of declines in retail sales.

In a note to clients, Bankrate.com senior industry analyst Ted Rossman said the figures “indicate the continued fragility of our economic recovery.” However, with the new round of $1,400 stimulus checks now reaching Americans, the economy could be poised for growth.

“We predict the results from February may be a precursor of an upcoming boom in sales,” Naveen Jaggi, president of retail advisory services for JLL, said. “Between the winter storm which left many consumers homebound this February and the majority of previous stimulus checks already spent, it wasn’t surprising to see a decline.”

Read: $1,400 COVID relief checks to trigger surge in e-commerce shipments

The $1,400 stimulus checks suggest another bump in retail sales could occur when the March data is released. Following the first round of $1,200 payments as part of the CARES Act enacted on March 27, 2020, parcel volumes increased 16% during the week of April 5, 30% the week of April 12 and 55% during the week of April 19, according to data compiled for FreightWaves by Pittsburgh-based ShipMatrix Inc., which helps companies manage their parcel transport spending.

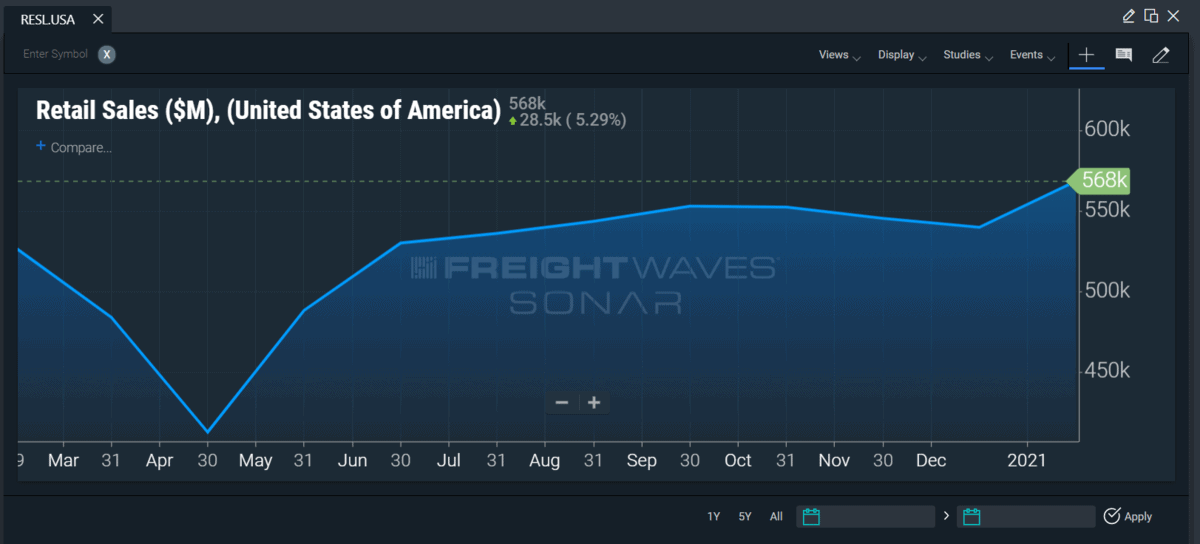

SONAR data on retail sales (SONAR: RESL.USA) over the past year shows spikes in sales beginning at the end of April 2020 and again in January 2021, immediately following the distribution of stimulus payments.

“The last time stimulus came out, the e-commerce orders doubled in days. People may use this money to buy something for themselves,” Rick Lee, SEKO Logistics’ chief operating officer for North America, said during a briefing with reporters in February. “And then it was a smaller stimulus. Now with a large potential stimulus coming, our orders will surge within days.”

Non-store sales (SONAR: RESL.NSTR), including e-commerce, show this trend, with spikes following both previous stimulus checks.

Jaggi said additional external impacts will also help build retail momentum.

“Consumer habits are expected to take a positive turn as the spring season approaches,” Jaggi said. “The vaccine rollout will continue to gain momentum and in turn push dining, entertainment, apparel and tourism. Additionally, the first batch of stimulus payments in the American Rescue Plan were distributed on March 12 and as a result we are expecting an increase in sales next month.”

Jaggi also noted that food services and drinking establishments are poised for a rebound.

“Food services and drinking places were down 17% from this time last year, but we believe sales will only go up from here. As cities begin to reopen indoor dining and lift more and more COVID-19 restrictions, we anticipate retail and food services will have a Roaring ’20s effect in 2021 and retail sales will reap the benefits,” Jaggi said.

Kiplinger, in its latest economic outlook, is predicting gross domestic product growth of 6.2% or more in 2021 because of the additional stimulus checks passed by Congress.

“As the pandemic recedes, consumers’ savings could be used to splurge on services that they have been skipping, setting up a possible boom in the service sector beginning midyear,” Kiplinger said. “The consumer savings rate was 13.7% in December, well above its normal level of 7.5%. Consumers saved 16.3% of their disposable income in 2020 and thus will have plenty of cash to boost spending on travel, dining out and other services after the pandemic is brought under control.”

The company predicted the economy could reach its pre-pandemic level in March.

Click for more Modern Shipper articles by Brian Straight.

You may also like:

Social Auto Transport raises $1.5M in seed funding to expand gig economy auto-moving business

Bringg’s collaboration with Uber opens new doors for e-commerce