Less-than-truckload carrier Saia (NASDAQ: SAIA) looks to expand its terminal network in 2021 and take yields and margins higher.

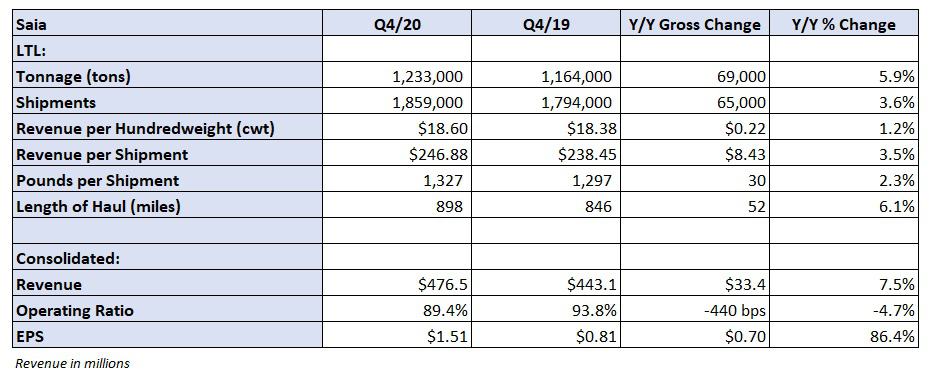

The Johns Creek, Georgia-based carrier reported fourth-quarter earnings per share of $1.51 on Monday, outpacing the consensus estimate of $1.30 and last year’s result of 81 cents. The fourth-quarter result benefited by 9 cents due to a lower tax rate.

Terminal expansion plans

Saia plans to open at least one terminal during the first quarter and management is hopeful that it can add four to six in total during the year. On the Monday call with analysts, management said those plans include a large facility in northeast Atlanta as well as building out a market where they are not well represented, Wilmington, Delaware.

The goal is to plant a flag in new markets and expand the footprint in existing markets to improve the company’s overall freight mix. Terminals closer to customers are expected to reduce turn times and improve network efficiency.

The company opened one new terminal in 2020 and replaced five facilities, including the expansion of a cross-dock terminal in Memphis, Tennessee. Total capacity at that facility grew by more than 60% to 200 doors. Saia’s total door count grew by 4% in 2020, a level that is expected to be exceeded in 2021.

Saia has grown its presence significantly in the Northeast. The company began opening new terminals in 2017 and accelerated those efforts when New England Motor Freight filed for bankruptcy. Saia has roughly 20 terminals in the region currently.

Net capital expenditures are expected to be $275 million in 2021, up from $219 million in 2020. Acknowledging that cash flow generation will likely exceed capex this year, management said they want to keep dry powder for current and future real estate opportunities, which include buying raw land, greenfield developments and expansion projects.

The 2021 cash outlay will also include the purchase of new equipment, trailers specifically as more of its customers are requesting drop-and-hook service.

The company ended the year with $46 million in net debt, down 67% year-over-year. Saia’s net debt-to-capital ratio of 4.5% was down from 14.3% a year ago.

Freight mix and yields the key to operating ratio improvement

Saia posted an 89.4% operating ratio, 440 basis points better than the 2019 fourth quarter. Of note, revenue was 8% higher year-over-year but operating income grew by 85%. The company posted the best full-year OR in its history at 90.1%.

Incremental margins of almost 70% were driven by improved pricing/yields as well as a 2% increase in weight per shipment and a 6% increase in length of haul.

Management referred to the pricing environment as “stable” throughout the pandemic. Contract renewals the last two quarters have exceeded 6% and the company implemented a general rate increase of 5.9% on its general tariff freight on Jan. 18. Other carriers have installed similar increases recently. Saia has seen only a modest drag on shipments as a result of the price bump.

In the quarter, yield metrics excluding fuel moved higher. Revenue per hundredweight increased 4.1% year-over-year with revenue per shipment up by 6.5%. When asked why the lag in revenue per shipment compared to peers, even as the company’s service has improved and terminals have been added, management said they are focused on “getting paid for the service we are providing.”

Some cost headwinds to OR improvement on horizon

Overall cost inflation is usually 3% to 4% year-over-year. However, management expects yields to improve to a level high enough to absorb cost increases and drive margins higher.

During the quarter, purchased transportation increased 230 basis points as a percentage of revenue as the company was forced to increase usage to meet customer expectations.

Additionally, the company struggled to procure lower-cost rail capacity, compared to truck, in the period. Higher-priced truck service usually accounts for half of Saia’s out-of-network transportation; this quarter it was two-thirds.

Declines in fuel and salaries, wages and benefits as a percentage of revenue drove the OR improvement.

Management expects the first-quarter OR to be flat with the fourth quarter but sees full-year results coming in better than long-term guidance of 100 to 150 basis points of annual improvement. Saia implemented a 3.5% wage increase across the workforce in January, which is earlier than normal and management indicated it could take further actions to make sure they have drivers and workers needed.

Demand is proving to be a tailwind. Tonnage was 6% higher year-over-year in the fourth quarter and up 5.6% in January, which was up against a tough comparison. The comps get easier moving forward as the pandemic took a toll on freight demand for a few months during 2020 beginning in March.

On the chances of getting ORs closer to the competition, management said they see “no impediment” to reaching a level “solidly into the 80s.” Pricing and freight mix will be the determinants.

Shares of SAIA were up more than 4% in midday trading compared to the S&P 500, which was up 0.25%.