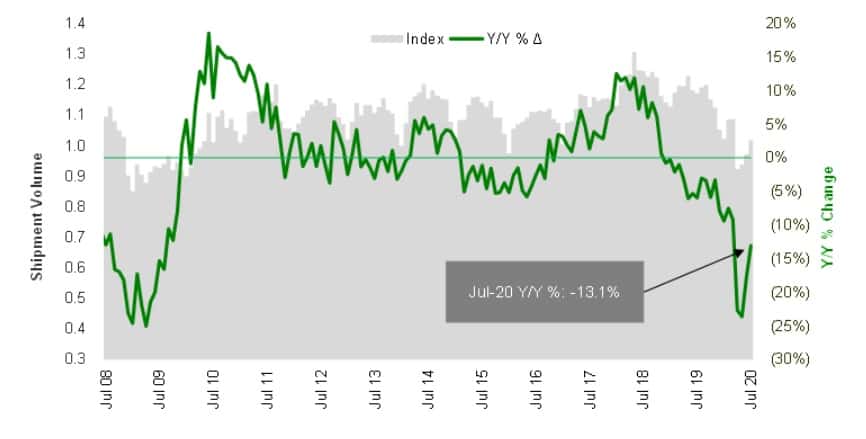

Freight data provided by Cass Information Systems for July continues to lag other market indicators. While the freight index displayed a 4.8% sequential monthly improvement in shipments from June to July, with expenditures increasing 2.8%, the dataset is still a long way off of prior-year levels, posting a 13.1% year-over-year decline in shipments, with expenditures falling 14.3%.

The report’s author, Stifel Financial (NYSE: SF) equity research analyst David Ross, pointed to headwinds like consumer confidence, the economy not being fully open and uncertainty on future stimulus payments as reasons for the shipments index remaining 6.3% below March’s reading.

The index measures freight shipments for all modes of transportation in North American but is 75% weighted to truckload (TL) and less-than-truckload (LTL), which makes the data a bit of an outlier compared to other anecdotes and datasets.

To the contrary, commentary from most publicly traded TL carriers indicated a continuation of strong volumes in July. Schneider National’s (NYSE: SNDR) second-quarter earnings call was in part marked by management’s assertion that year-over-year volume growth is likely in the third quarter.

Werner Enterprises (NASDAQ: WERN) reported year-over-year improvement in results during July in its one-way segment, which is exposed to spot market freight unlike its dedicated unit where stickier contracts are in place. Management didn’t specifically guide to which metrics improved during the period but the initial indications for the carrier’s July appear well ahead of Cass’ low-teen percentage declines in shipments and rates. Werner reported a modest 2.2% year-over-year decline in revenue per tractor per week in one-way for the second quarter, up 3.9% in dedicated.

USA Truck (NASDAQ: USAK) reported load rejections were 80% higher than the level typical for July and revenue per loaded mile was up 5% sequentially from the second quarter, which was down 5.7% year-over-year. Improved fundamentals are allowing the carrier to go back and reprice the bottom 10% of its customer book.

Most of these carriers have large exposure to retail consumables, food and beverage deemed essential during the pandemic and at times in short supply, explaining the favorable trends.

However the LTLs, which are much more reliant on the sluggish industrial economy and reported revenue declines in excess of 20% during the downturn, reported smaller year-over-year declines in July. ArcBest Corp. (NASDAQ: ARCB) reported a 7% revenue decline in its asset-based segment for the month, with Old Dominion Freight Line (NASDAQ: ODFL) seeing revenue only 3% lower.

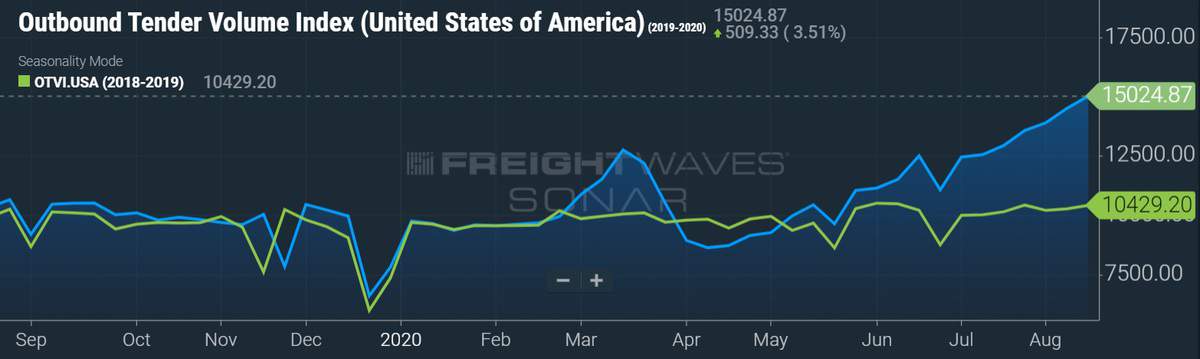

The positive July commentary was reported from other carriers as well during the second-quarter earnings season. These anecdotes are closer to inline with the Outbound Tender Volume Index (SONAR: OTVI.USA), which has remained positive on a year-over-year comparison since inflecting so in mid-May.

Ross said he expects “the trend to be higher through year-end” given the performance seen in other “freight volume indicators.”

Cass reported its truckload linehaul index declined 5.7% year-over-year in July, up 0.1% from June. The index is made up of mostly contract rates, which continue to lag the rate inflation seen in the spot market. Ross said supply is “only going one way,” referring to the several capacity-curbing catalysts facing the industry — spiking insurance costs, increased regulation and an eventual end to the government’s stimulus spending.

“For when we look at spot rates posted in July (and into August here), the pricing picture painted is bullish for upcoming carrier negotiations with shippers,” Ross stated. He expects contract rates to move higher in the fourth quarter.

The intermodal price index fell 18.3% year-over-year, down 0.8% sequentially in July, a new 10-year low. The index includes total intermodal costs inclusive of fuel surcharges, which are roughly 20% lower compared to 2019. Ross approximates the decline in fuel is accounting for “roughly 5% of the difference.”

“Intermodal volumes are improving, but after listening to second-quarter earnings calls of some of the intermodal carriers, it appears contract pricing was down y/y in 1H20 negotiations, lagging truckload, but that will likely start to turn in the fall,” Ross said.