The highlights from Thursday’s SONAR reports are below. For more information on SONAR — the fastest freight-forecasting platform in the industry — or to request a demo, click here. Also, be sure to check out the latest SONAR update, TRAC — the freshest spot rate data in the industry.

Market watch

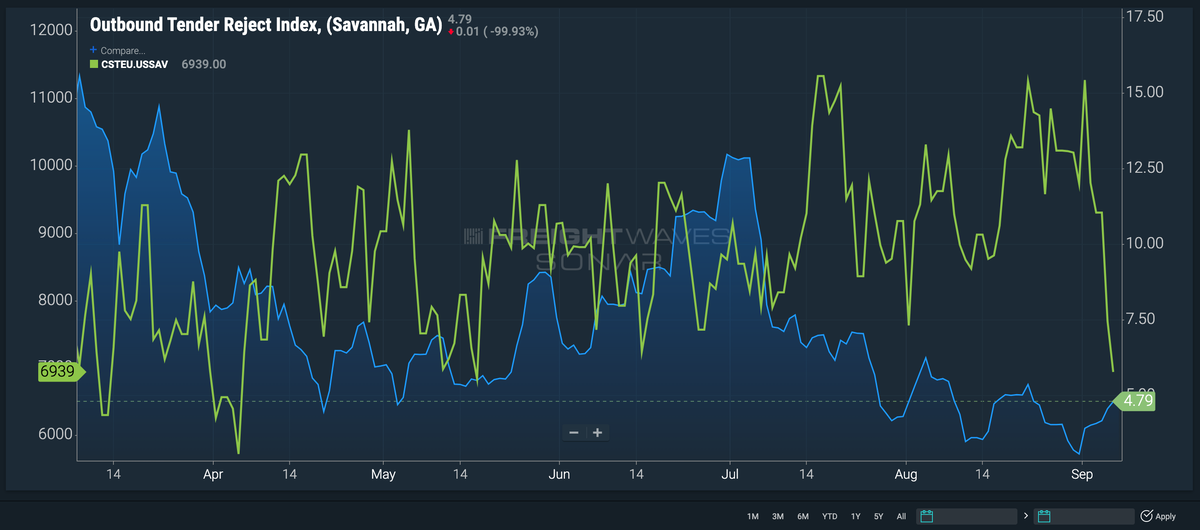

Savannah, Georgia

Outbound tender rejections in Savannah are bouncing back to start September but are still low in comparison to where they were through the summer.

Since Sept. 1, the Outbound Tender Reject Index in Savannah is up 179 basis points (bps) and leveling out to 4.7%.

Import volumes to Savannah continued to trend higher into September, but the holiday limited the amount cleared through customs. The increased number in rejections implies that capacity in Savannah has been able to handle the increasing amount of volume for now, but it will be an ongoing concern so long as imports remain elevated.

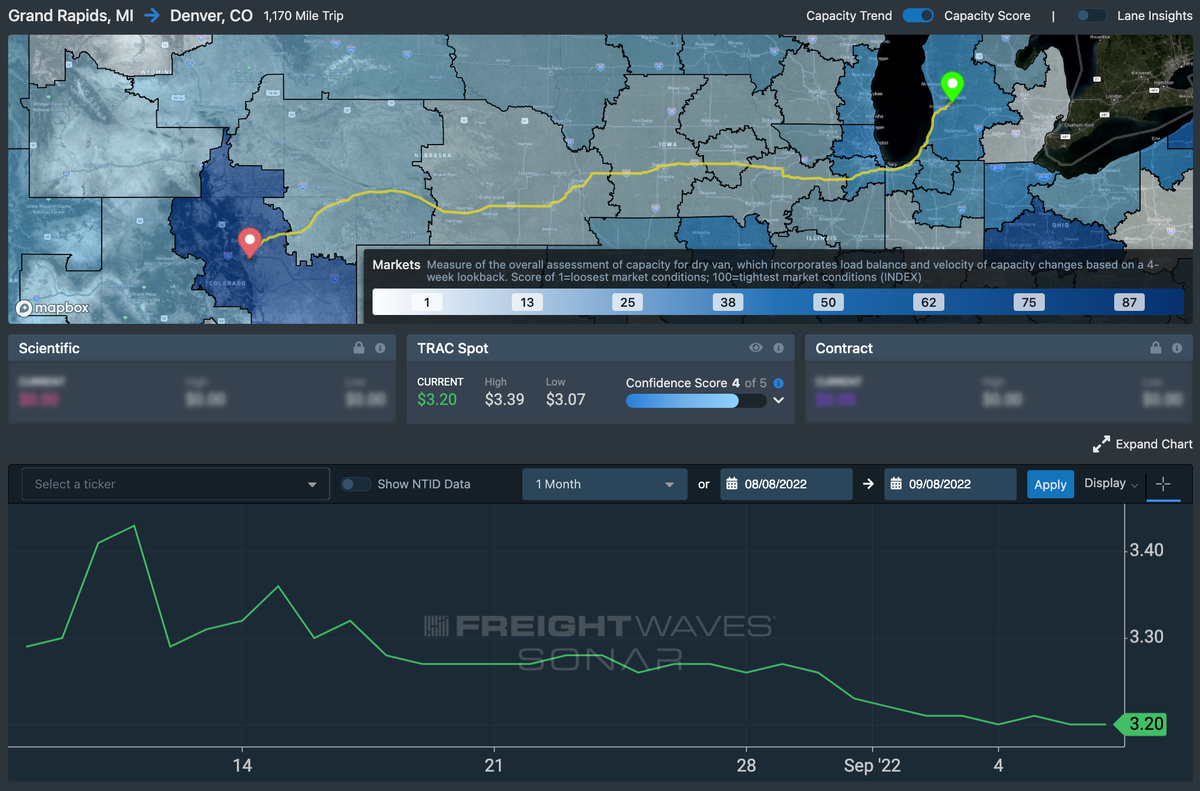

Grand Rapids, Michigan

In the north, rejection rates are dropping like fall temperatures on Lake Michigan.

Outbound tender rejections were at a 90-day high at the start of September but are down 360 bps to 12.4%. The sharp decline in rejection rates indicates a recovery from Labor Day, but these rejection rates still remain well above the national average of 5.5%.

“As far as rates go, they have been continuously coming down in response to the overall market loosening,” said Alex Riemersma, truckload pricing manager at Ally Logistics. “Decreasing fuel prices have removed upward pressure on spot rates, and this could be partially responsible for the decrease in tender rejections as carriers operate with lowered expenses.”

A lane in particular to analyze this downward trend is Grand Rapids to Denver. With a confidence score of 4, indicating that there is a good amount of certainty in rates being offered, spot market rates in this lane are down 2 cents since the start of the month to $3.20 a mile — 52 cents above the national average. It is important to note that long-haul spot rates this far above the national average can be very difficult to cover.

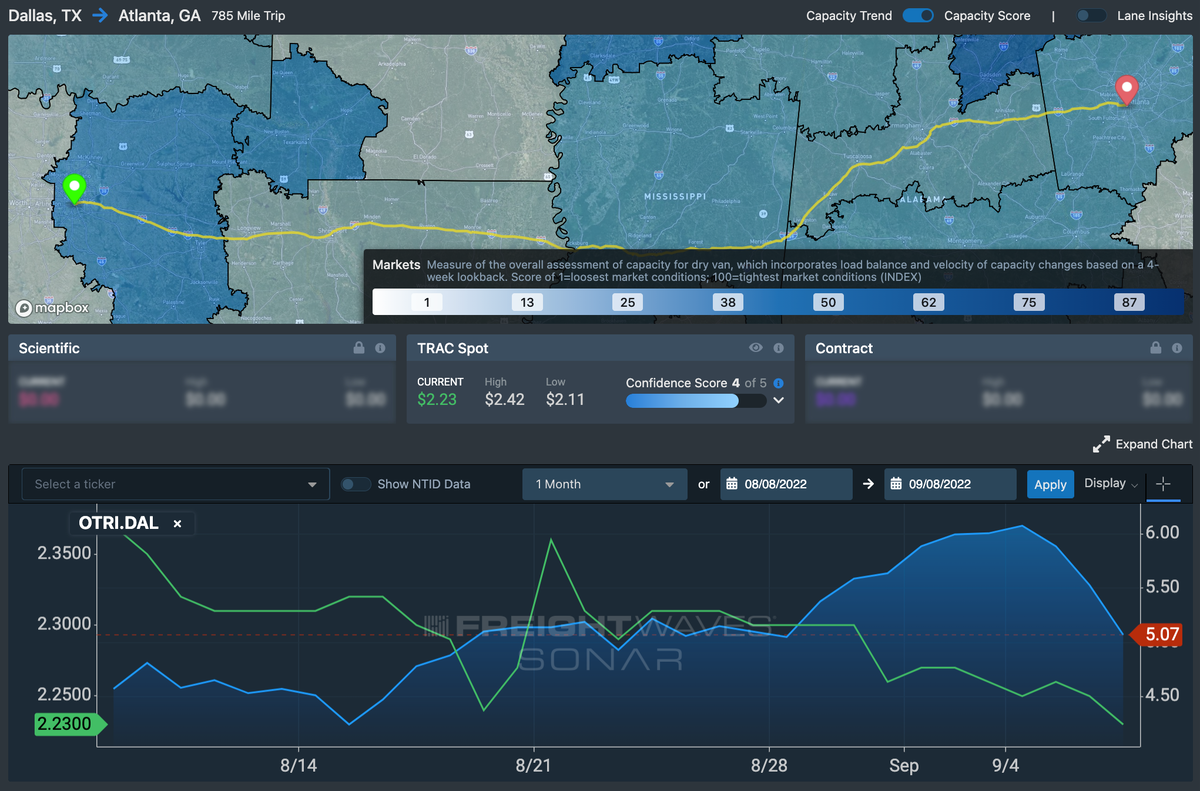

Dallas

The spot market in Dallas is softening as rejections are down significantly for a market of its size since the start of the week.

The Outbound Tender Reject Index is down 100 bps since Monday to 5%, taking spot rates down with them. Dallas to Atlanta is a lane that is run frequently and has a confidence score of 4, but the average rates are down to their lowest value of the year. Rates have dropped 4 cents since the start of the month to $2.23 a mile — 45 cents below the national average.

NTI as a point of reference

The National Truckload Index is a daily look at how spot rates in specific lanes hold up in comparison to the national average, giving carriers and brokers an idea of which lanes to gravitate toward or avoid.