Layoffs get the headlines but a surprising number of electrification startups are adding employees even as they try to raise more money. Volvo is using two dealerships and a five new charging points to create a corridor in California. And the Diesel Technology Forum graphically shows once again that fossil fuels are still king in commercial transportation.

Was this newsletter forwarded to you? Click here to get Truck Tech delivered by email on Fridays.

Electrification startups are hiring

Record-high inflation, tighter lending restrictions and unrelenting supply chain problems. Is it any wonder that some electrification startups are laying off workers? Xos Trucks is cutting 8% of its workforce even as it makes strategic hires. Rivian is considering releasing 700 workers, or 5% of its workforce, according to Bloomberg.

Electric Last Mile Solutions announced bankruptcy liquidation of its last-mile electric delivery van startup. Some companies, like battery pack maker Romeo Power, didn’t respond to an inquiry.

But in checking with other startups this week, the jobs picture looks rosier and more in line with the nation’s 50-year low in unemployment. Far from subtracting, these companies are desperate to add workers.

Consider Lion Electric Co., the SPAC-sponsored Canadian electric bus and truck maker that went public 14 months ago.

‘Everything available’

“We have everything available — production, administrative, engineering,” Lion’s marketing lead Patrick Gervais told me this week. That includes a battery manufacturing facility in Mirabel, Quebec, about 40 minutes north of Montreal. Lion is getting closer to opening its 900,000-square-foot brownfield plant in Joliet, Illinois.

Lion received $490 million in proceeds in May 2021 from its business combination with blank check company Northern Genesis Acquisition Corp. Northern Genesis raised money as a shell company intending to merge with a startup and bring it public.

With most of that money gone, Lion in June set up a $125 million offering to sell new shares at market price in the U.S. and Canada.

Lion is not alone in tapping equity to scale the business. More on that strategy below.

Creative financing

Nikola Corp. is pleading with shareholders for the final proxy votes it needs to increase its pool of authorized shares to 800 million from 600 million. As of Thursday, it needed the proxies for fewer than 1% of outstanding shares to secure the source of future financial flexibility.

Meanwhile, the electric truck maker and hydrogen fuel developer continues increasing headcount, adding 77 new employees in June, 40 so far in July and nearly 400 since the beginning of the year, a spokesperson said.

Watching Nikola’s moves foreshadows what other transportation startups may do. Nikola aligned with a special purpose acquisition company in March 2020 before the height of the SPAC frenzy. The $700 million it received in SPAC proceeds is long gone.

Nikola opened two $300 million equity lines of credit (ELOCs). It sells shares at a 3% discount in exchange for tapping the lines ATM-style when it needs cash. Those ELOCs are nearly tapped. Nikola recently used uncommitted shares from its current 600 million authorization to sell senior debt. Less than 70 million shares remain uncommitted.

Adding 200 million additional authorized shares would provide financial flexibility to keep growing. However, borrowing against equity is expensive.

Xos and Lordstown Motors are among those that established shares-for-cash ELOCs.

Just hire, baby

Lordstown Motors Corp. sweated survival until Taiwan’s Foxconn effectively bought the business and the massive former General Motors plant in northeast Ohio. The electronics giant that makes Apple iPhones is building a contract manufacturing business starting with LMC’s electric pickup truck aptly named Endurance.

Lordstown Motors has a new owner — and zero layoffs. (Photo: Lordstown Motors)

“Other than LMC employees who transferred in connection with our recently completed transaction with Foxconn, we have had zero layoffs,” Daniel Ninivaggi, Lordstown chairman, said in an email. “In fact, we are aggressively hiring for key positions throughout the company, particularly in engineering.”

With 18 years in business, electric bus and battery manufacturer and infrastructure developer Proterra Inc. defies the startup label. But it gets lumped with them because it took the SPAC path to public ownership. Despite its challenges, Proterra is “actively recruiting and hiring across our business” and has more than 150 open positions, a spokesperson said.

Electric truck chassis maker Atlis Motor Vehicles, which sells shares via crowdfunding, added 27 new employees since the start of the quarter.

On a grander scale, Panasonic Energy Co., one of the Big Four global battery makers, plans to create up to 4,000 new jobs as part of a $4 billion investment in DeSoto, Kansas. Panasonic touts the plant as the world’s largest electric vehicle battery plant. It will be a center of innovation, manufacturing and supplying lithium-ion batteries for electric car manufacturers.

Charging corridors

The Pilot Co. and General Motors plan for locating 2,000 public high-speed electric charging stations coast to coast got the attention this week. But it was not alone.

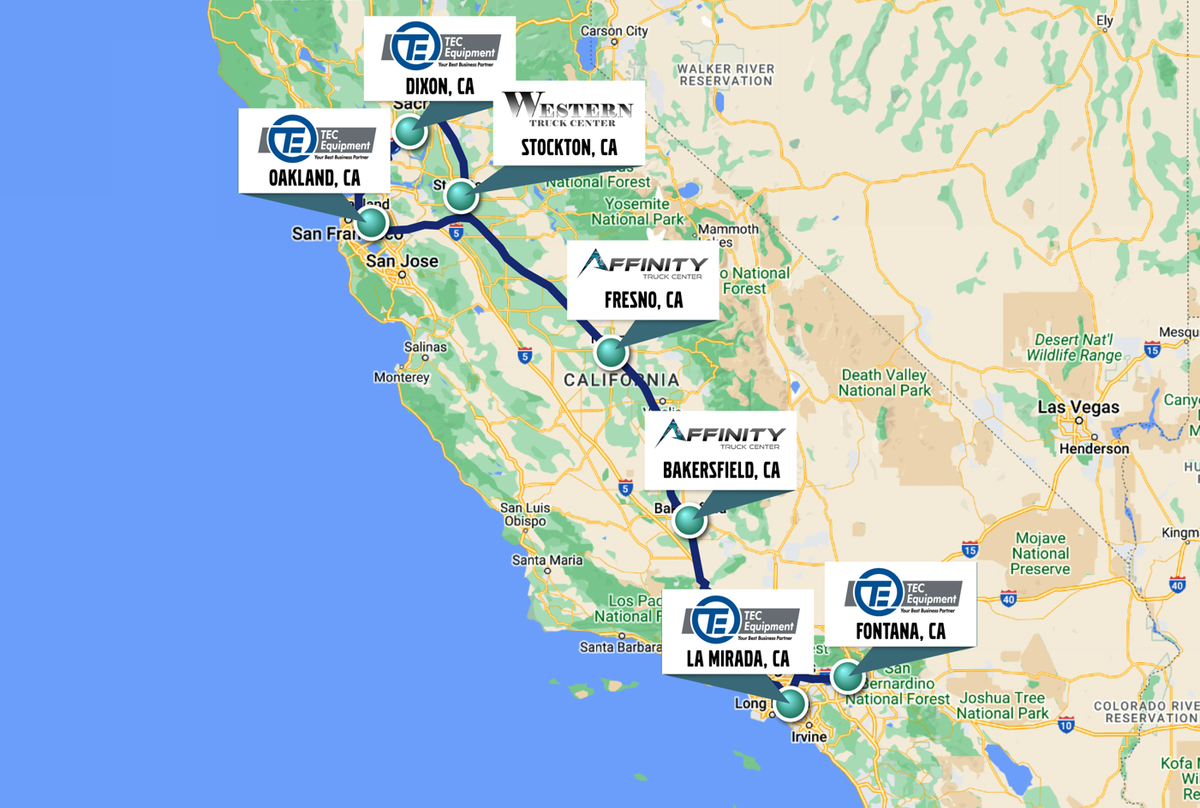

Volvo Truck North America is establishing an electric corridor connecting several of California’s largest metro areas.

The Electrified Charging Corridor Project received a $2 million grant from the California Energy Commission. The CEC and the powerful Air Resources Board help fund a lot of electric truck and infrastructure efforts in a mission to reduce smog from emissions.

Over the next 18 months, the project will deploy high-powered chargers at several existing Volvo Trucks dealership locations in Central and Northern California, including TEC Equipment Oakland, TEC Equipment Dixon, Western Truck Center in Stockton and Affinity Truck Centers in Fresno and Bakersfield. They will join chargers already available at TEC Fontana and TEC La Mirada in Southern California.

Increasing usefulness

Spreading out charging begins to make battery-electric trucks useful beyond the typical 150 to 200 miles they can travel on a single charge. Long charging times remain an issue, but having chargers available is key to greater adoption of electric trucks.

“This project will open the door to a truly electrified freight future in which zero-tailpipe emission medium- and heavy-duty trucks are no longer limited to short-mileage, return-to-base operations and can reach far and wide across the state,” Peter Voorhoeve, VTNA president, said in a press release.

The project begins this year with all five Northern California locations expected to be online by the end of 2023.

Truck payments

WattEV picked up $3 million from the Southern California Association of Governments and the South Coast Air Quality Management District to help pay for the leases on 20 of the 50 Volvo VNR Electric Class 8 trucks it will use as the ponies in its Pony Express truck-as-a-service startup.

The trucks will be available for individual drivers or small fleets in 2023 as part of a full package service that includes use of the truck, charging and maintenance. The WattEV app lets drivers plan the day ahead, receive best route directions and manage the battery’s state of charge.

WattEV is developing high-speed charging sites in Bakersfield, San Bernardino, Long Beach and Gardenia.

King Diesel

Fighting for attention against a torrent of electric trucking news the Diesel Technology Forum deserves credit for creatively finding ways to make its point about the supremacy of diesel and ongoing emissions reduction technology in commercial trucking.

This picture really is worth 1,000 words. Or maybe more.

That’s it for this week. Thanks for reading.

Alan

Charlie Fafard

I work with a large gas/electric utility in south central Wisconsin. EV trucking is just coming to our service territory, and we’re trying to get details on the technical requirements for charging class 8 EV trucks. Can someone suggest where we can get this information? Specifically KW requirements per charger and the number of chargers anticipated per station. What is the typical range for today’s EV trucks? Does Alan Adler have any videos that would include this information?

Thanks!