Not Federal Reserve Chairman Jerome Powell’s early trading session policy comments and not China’s retaliatory tariffs announced just hours before could move U.S. equity markets meaningfully. It was the President’s tweets.

In a series of tweets, President Trump ordered U.S. companies to “immediately start looking for an alternative to China,” urging domestic companies to bring manufacturing back to the U.S. Specifically, he called out FedEx (NYSE: FDX), United Parcel Service (NYSE: UPS), Amazon.com (NASDAQ: AMZN) and the United States Postal Service to “search for and refuse all deliveries of Fentanyl from China (or anywhere else!).”

China’s announcement moved the Dow Jones Industrial Average modestly, down about 150 points. However, this move was recouped with Chairman Powell’s “act as appropriate to sustain the expansion” commentary, which left investors somewhat appeased, but still searching for meaning.

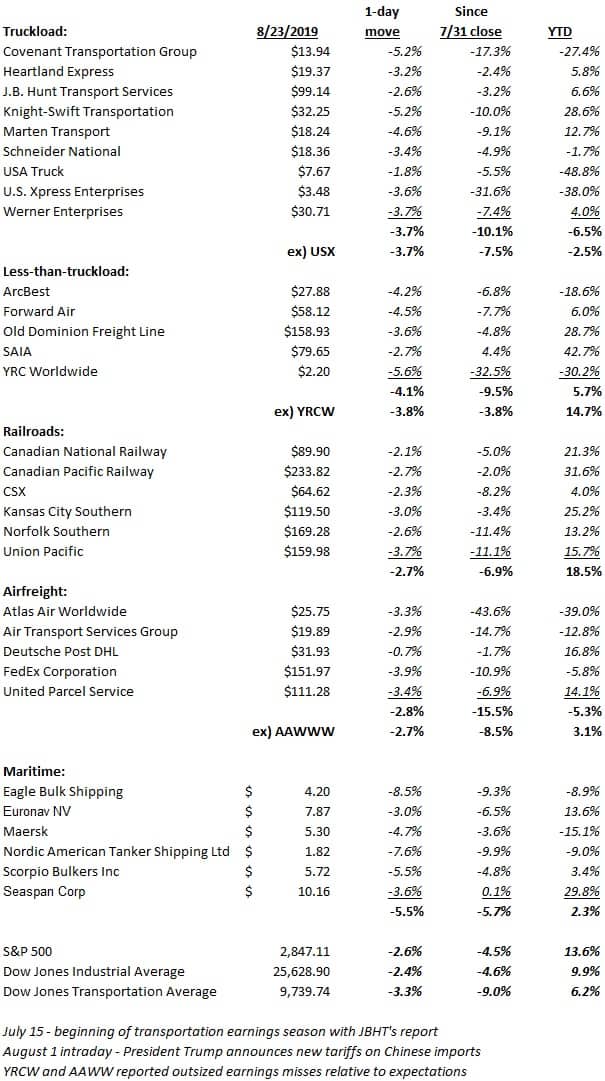

Then the President tweets. The transportation stocks, along with the broader markets, had a visceral reaction to the comments. Both the Dow Jones Transportation and Industrial averages immediately dropped 2 percent, with the transportation average closing off more than 3 percent on the day.

The declines were seen across all modes of transportation (see stock table below).

The carnage may continue on Monday, August 26 as the President announced an increase to tariffs in response to China’s actions. The U.S. will now increase Chinese tariffs on $250 billion of goods to 30 percent (from 25 percent) on October 1 and to 15 percent (from 10 percent) on another $300 billion, which take effect on September 1.

The lead up to the selloff

Before the trading session began, China’s State Council announced that it will impose additional tariffs of $75 billion on U.S. imports. The 5 percent to 10 percent tariffs will take effect on September 1 and December 15, respectively.

Fed Chairman Powell’s comments were fairly opaque, leaving both hawks and doves something to cling to. The main takeaway was, “act as appropriate,” but not specifically signaling future changes to interest rates. Other notable comments from the Kansas City Federal Reserve’s annual symposium in Jackson Hole, Wyoming were the acknowledgment from the chairman that global growth was deteriorating, but that the domestic economy was performing well overall. He suggested that trade tensions were weighing on global growth, business investment and the manufacturing segments and that there was “no rulebook” for the current trade war. He stated that the Fed was close on its initiatives to manage unemployment and reiterated the 2 percent inflation target.

At its July meeting, the Federal Open Market Committee announced a 25 basis point rate cut, lowering the benchmark rate to a range of 2 percent to 2.25 percent. This was the first rate cut since the Great Recession of 2008.

Transportation stocks

U.S. equity markets have been fairly resilient through recent trade rhetoric. Resilient, but laden with volatility. The transportation stocks have been whipsawed a bit more than broader markets, given their increased exposure to changes in trade policy. What gets lost in the noise around the markets is that fundamentals may be firming. Contracted truckload volumes (OTVI.USA) are 7 percent higher year-over-year and the comparisons get easier over the next few weeks.

However, this likely won’t matter to the stocks in the interim. As the rhetoric ramps, we can be somewhat certain that more uncertainty and volatility will likely ensue.