Marten Transport rode strong results in its Dedicated and Brokerage divisions to post net income for the fourth quarter of 2019 that was stable for the period, but operating income for the quarter was down 3.8%.

For the full year, Marten (NASDAQ: MRTN) reported a 7.1% increase in operating revenue and a gain of 8.7% in operating income. That led to record results in both those categories. Net income was up 11% for the year.

Net income for the fourth quarters of 2018 and 2019 was essentially flat on either side of $15.74 million.

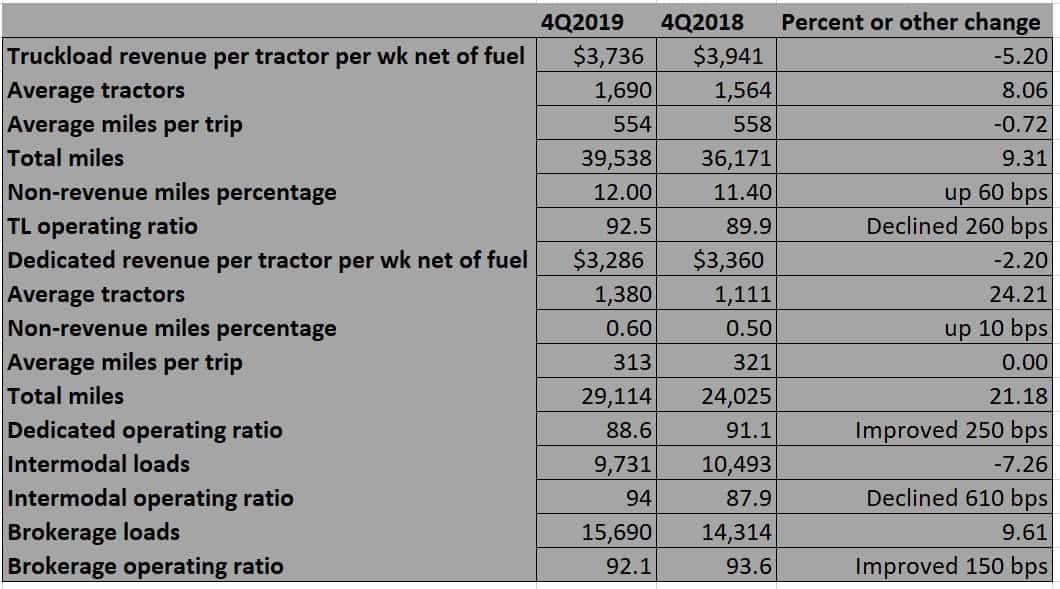

The differences in the performance of the Truckload and Dedicated divisions were stark even with relatively minor differences in some benchmark numbers. Marten’s truckload revenue per tractor per week, net of fuel, was up 5.2% to $3,736 compared to the fourth quarter of 2018. The same category for Dedicated showed that group’s per-truck revenue up just 2.2%, to $3,286 from $3,360.

But the Dedicated operating ratio improved to 88.6% from 91.1% while the OR in Truckload worsened to 92.5% from 89.9% in the corresponding quarter of 2018.

Nonrevenue miles percentage for Truckload was 12%, up from 11.4% a year earlier. Dedicated nonrevenue miles percentage, which is usually low, rose slightly to 0.6% from 0.5%.

Truckload revenue for the quarter rose just 2.4%, up $1.97 million to $82.99 million, net of fuel surcharges. But Truckload operating income dropped to $7.11 million from $9.54 million in 4Q 2018, a decline of 25.4%.

Dedicated’s operating income in the quarter jumped to $8.11 million, up from $5.268 million, a rise of 53.9%. Its OR improved to 88.6% from 91.1%.

Dedicated revenue took a big jump, up 21.5%, $10.52 million, rising to $59.57 million, net of fuel.

Volume in Marten’s intermodal service, which has been a tough business for all operators, declined 7.26% to 9,731 loads. And its OR dropped 610 basis points to 94% from 87.9%.

Brokerage loads were up 9.61% to 15,690. Its OR improved to 92.1% from 93.6%.

Among other notable numbers in the report, Marten’s cash on hand declined to $31.46 million from $40.8 million in the third quarter and $56.7 million at the close of 2018. Salaries, wages and benefits rose to $72.7 million from $65.9 million a year ago.

The full-year OR results showed many of the same trends that were present in the fourth quarter. The Truckload division saw its OR weaken to 92.2% from 90.7% while Intermodal widened to 92.7% from 89.1%. Meanwhile, the Dedicated division’s OR improved 240 basis points to 88.3% while Brokerage’s OR improved 180 basis points to 91.8%.

The end result for the year was an overall strong performance. Presumably helped by contract rates that held more firm than spot rates for the year, Truckload revenue managed to post a gain of 2.2%, net of fuel. The Dedicated division posted a revenue gain of 19.7%, net of fuel. Net of fuel, Intermodal had a 9.1% drop in operating revenue while brokerage revenue climbed 26.1%.

The Wisconsin-based Marten does not do a conference call with analysts. In the company’s earnings release, Chairman and CEO Randolph Marten, noting the record operating revenue and operating income for the full year, said it had topped the 2018 records in that category by 7.1% and 8.7%, respectively.

Marten’s stock over the past 52 weeks has eked out a slight gain, up 0.88%, according to Barchart. That is less than some of its peers: Werner (NASDAQ: WERN), up 17.56%; Heartland (NASDAQ: HTLD), up 2.53%; Schneider (NASDAQ: SNDR), up 12%.