“Peak season” is a term in maritime that really has lost all meaning. Since the pandemic began, the ports have been processing record volumes of containers. Inventories were wiped out when the consumer went on a gluttonous buying binge. Now the bulk buying has stopped along with purchases of furniture and appliances since consumers purchased what they needed.

While the buying behavior of consumers has changed, companies are continuing to find ways to manage their inventory.

“We are seeing 40% more product on the secondary market as consumers have pulled back,” Brett Rose, CEO of United National Consumer Suppliers, told American Shipper. “There is no more stimulus money and people are spending money on travel. Retailers could have never forecasted such a huge cliff in consumer spending.”

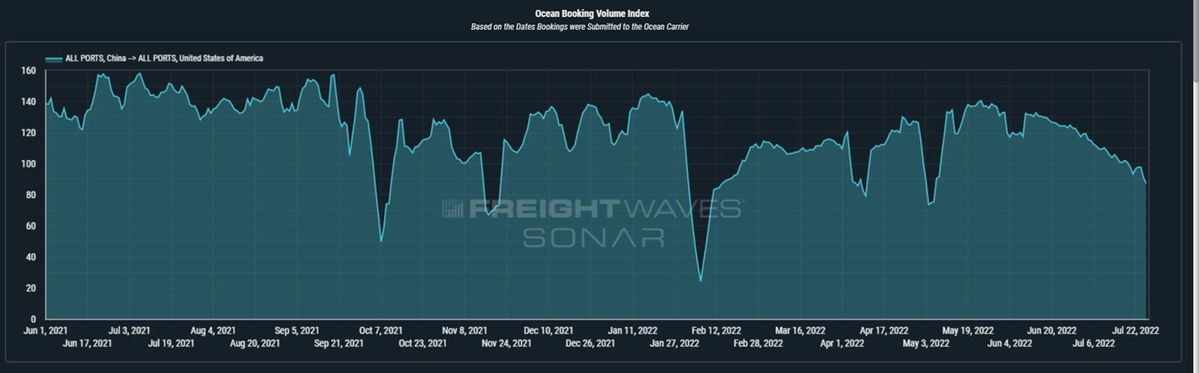

The waterway superhighway is still filled with historic volumes of cargo, but based on the flow of trade, there are signals showing a decrease in volume. Future ocean bookings tracked by FreightWaves show the total container volume from all ports in China to all ports in the U.S. is decreasing. This reflects the consumer expectations of retailers.

In this chart, you can also see the massive hit in trade as a result of China’s COVID lockdowns or slowdowns.

Now it’s important to note the decrease in orders is still above 2019 levels. The U.S. economy is not in a free fall. This is a leading indicator of how inflation is taking a chunk of consumers’ wallets and they are being more selective in their purchases.

But unfortunately, another trade indicator is signaling more inflation — and there is nothing the Federal Reserve can do about it.

Congestion at the U.S. ports and what I like to call “the hot mess” at the German and Netherlands ports have put a stop to the fall in spot rate prices. The China to East Coast route is steadily flirting around $10,000.

The Europe to North America East Coast is up 2% over $8,400.

While these prices are not the nosebleed $25,000 we saw at the height of the container logjam, this trend is showing the inflationary pressures on the U.S. supply chain will continue. That means the U.S. consumer will continue to foot the bill.

The problem is that congestion at the ports in these key trade lanes is growing, meaning containers will be tied up, creating a false “shortage” of available containers to be used.

The CNBC Supply Chain Heat Map for the U.S. is forecasting additional congestion.

“On the U.S. East Coast, congestion at the Port of Savannah continues to be very high with average waiting times climbing to 7.5 days, up 123% compared to the previous quarter,” according to Everstream Analytics. “Vessel counts increased from last week to 18 on average. The Port of New York and New Jersey saw waiting times decrease slightly to 1.8 days on average with 10 vessels waiting at anchor.” The port is using sweeper vessels to move out the excess empty containers.

“The Port of New York and New Jersey is facing record import volumes yet historically low loaded exports, leading to empty containers accumulating in and around the port complex that are now affecting the regional supply chain that is already under stress from various sources across the country,” said Bethann Rooney, director of the Port Department, the Port Authority of New York and New Jersey. “To mitigate this industrywide issue, the Port Authority has worked with its port partners to repurpose select port properties to establish three additional ‘pop-up’ container yards in the last two months that have the capacity for approximately 15,000 containers. We emphatically encourage ocean carriers to step up their efforts to evacuate empty containers more aggressively to free up much needed capacity for arriving imports and keep commerce moving through the Port of New York and New Jersey.”

Savannah, Georgia, has become a port of West Coast congestion refuge. Savannah has publicly stated that trade to its port has been boosted by West Coast labor talks and delayed access to rail at West Coast ports, prompting a significant shift in vessel calls. Even the container trade from Charleston, South Carolina, is making its way to Savannah.

“[Georgia Ports Authority] is currently handling the highest volume of ad hoc and new service vessels the Port of Savannah has experienced to date,” it said in a release. “Uncertainty around the labor talks, unprecedented and unplanned vessel calls, record cargo volume, and vessel diversions to Savannah have contributed to a higher than normal number of vessels waiting at anchor.”

The Port of Oakland is packed with containers as a result of the recent protests by truckers of California’s AB5 independent contractor law. Dwell times for imports nearly tripled in one week to almost 27 days.

“The recent protest disruptions at the Oakland Seaport which halted operations for several days are having an impact. It could take weeks to sort everything out. This will likely cause further cargo delays,” said Bryan Brandes, maritime director at the Port of Oakland.

Across the pond in Europe, another strike is set to send the flow of trade into disarray, but it’s not Germany (for now). It’s Great Britain. Numerous port labor strikes and rail disruptions in Europe have bogged down the movement of containers at German ports, and that contagion is moving into the U.K. The congestion created by the labor slowdowns and strikes have constricted Hamburg, Germany’s, container availability, and the CNBC Supply Chain Heat Map for Europe has flipped from yellow to red.

All of these hairballs of trade have ocean carriers deploying their Drano Max — blank sailings. The Shanghai route has seen 12% of its available sailings canceled for August. Ningbo, Xiamen, Shenzhen and Qingdao are also seeing a number of cancellations. Unfortunately, as the congestion grows, so do the expectations for additional canceled sailings.

“The mounting delays at U.S. ports facing carriers is leading to vessels returning to Asia out of position to fill their next scheduled inbound sailing,” said Alan Baer, CEO of OL USA. “This will lead to a reduction of available capacity due to increased blank sailings, and ultimately higher transportation costs. Reduced volume may initially help to mute the upward price pressure, however, if we see volume increase, the availability of space will tighten quickly.”

Both canceled sailings and congestion will keep a floor in ocean pricing. Until all the congestion is cleared out, the inflationary pressures will continue to be passed on to the consumer. Unfortunately, the pipes of trade are obstructed.

The CNBC Supply Chain Heat Map data providers are global freight booking platform Freightos, creator of the Freightos Baltic Dry Index; logistics provider OL USA; supply chain intelligence platform FreightWaves; supply chain platform Blume Global; third-party logistics provider Orient Star Group; marine analytics firm MarineTraffic; maritime visibility data company Project44; maritime transport data company MDS Transmodal UK; ocean and air freight benchmarking an analytics firm Xeneta; leading provider of research and analysis Sea-Intelligence ApS; Crane Worldwide Logistics, air and freight logistics provider SEKO Logistics, and artificial intelligence and predictive analytics company Everstream Analytics.