The growing congestion in Europe is a leading indicator of empty-container constriction. Logistics officials tell American Shipper there are two-thirds more containers waiting in Europe than on the East Coast.

The strikes in Germany have slowed the processing of containers at the port, which has led to a pileup on the rails. The strike on the rails did not help the situation either. As a result, a snarled hairball of congestion slowed access to empty containers in the hinterland.

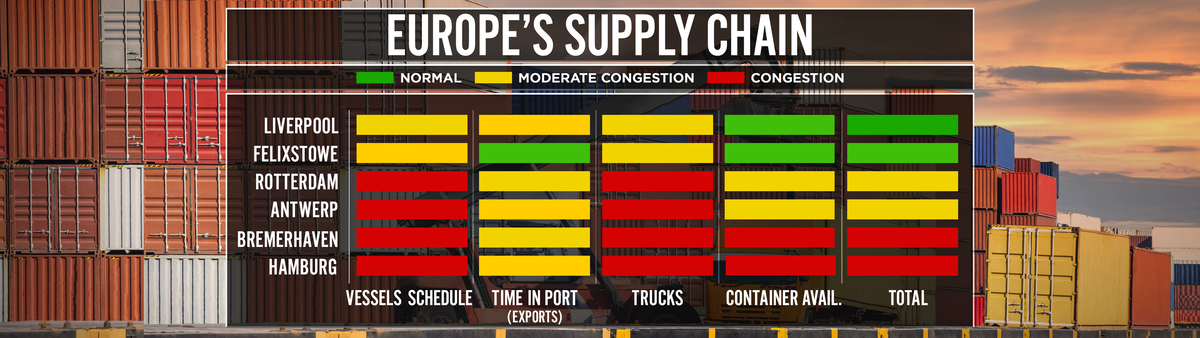

The CNBC Supply Chain Heat Map shows the sea of red. The congestion has created a two-and-a-half-month backup to the U.S. It has also hit the Europe-Asia trade route.

“The stressed situation for vessels waiting for berth and discharge is resulting in the lack of empty equipment availability in the hinterland, which will put further pressure on the equipment situation in Asia due to low backhaul activities,” said Andreas Braun, EMEA ocean product director for Crane Worldwide Logistics.

Alex Charvalias, supply chain in-transit visibility lead at MarineTraffic, said conditions in Hamburg, Germany, need to be monitored closely.

“A worsening situation in Hamburg with close to 200K TEU [twenty-foot equivalent units] waiting for a berth indicates that waiting times will get higher in the coming weeks,” he said.

For the past several months, I have been warning about the availability of containers and how the congestion can only create a false container shortage. We have been here before.

This may not be a dislocation of containers, but the fact these containers are not moving easily is not good over the long term. While prices of containers may not go soaring, $20,000 plus the price of containers will not continue to drop as the supply of empties is landlocked in Europe. Blank sailings in Europe will only add to the capacity constriction.

A recent report on ocean freight spot prices from Shifl stated, “Landside congestion and container dwell in port continues to haunt U.S. customers, halting the decline in spot rates.”

All the pipes of trade are connected. If one pipe starts to have empty-container constriction, container prices will be influenced across the board. The congestion is building exponentially on the East Coast in the U.S.

A whopping $1.2 million in trade is now anchored off Savannah, Georgia.

“You have 36 container vessels waiting outside Savannah carrying a total combined volume of 311,300 TEUs,” Charvalias said. “That’s over half a month’s volume of what Savanah handles.”

Rerouting ships to the neighboring Port of Charleston in South Carolina may not solve the problem because the congestion will also build up there.

“It just creates a pingpong congestion effect that further disrupts the already strained landside operations. It may take months to clear the backlog,” he said.

While manufacturing orders are down 20% to 30% in select categories, it is not down across the board. The demand for empties still exists. The situation in Europe is only getting worse with another kink in the system: the heat wave impacting water levels.

“Inland waterways are being impacted the most,” Braun said. “This impacts bulk shipping more, but we have also seen some container barge operators, especially on the Rhine, have to cut down on their max capacity of payloads.”

Braun said grains like wheat, as well as fertilizer, coal and animal food products, move by bulk vessels. Just when you thought the spot rates would continue to fall, the congestion contagion is constricting container availability once more.

The CNBC Supply Chain Heat Map data providers are artificial intelligence and predictive analytics company Everstream Analytics; global freight booking platform Freightos, creator of the Freightos Baltic Dry Index; logistics provider OL USA; supply chain intelligence platform FreightWaves; supply chain platform Blume Global; third-party logistics provider Orient Star Group; marine analytics firm MarineTraffic; maritime visibility data company Project44; maritime transport data company MDS Transmodal UK; ocean and air freight benchmarking analytics firm Xeneta; leading provider of research and analysis Sea-Intelligence ApS; Crane Worldwide Logistics; and air, DHL Global Forwarding, and freight logistics provider Seko Logistics.