National outbound freight volumes have gone faster than they came. The coronavirus giveth a freight frenzy, and the coronavirus taketh said frenzy. The outbound tender volume index (OTVI) is now below where we would expect it to be during “normal times.” The index is below its March 2018 starting point of 10,000, currently sitting at 9,417.07. Since the peak of the freight frenzy 17 days ago, OTVI has fallen 26%. It took 31 days for national freight volumes to rise from normal levels to their peak on March 24th.

National truckload freight volumes are now at the same point they were on February 17th. There is no end to the volume deceleration in sight. At the time of writing, 94% of Americans are still under shelter-in-place orders. Even if consumers weren’t under orders to stay home, the businesses in their communities are still shut down. The U.S. Chamber of Commerce released a survey of small businesses that stated within two weeks more than 50% of small businesses would be completely shut down. Small businesses move a significant amount of truckload freight. National freight volumes will continue to underperform as long as small businesses are not open. Carriers need to prepare for a time when trucks are sitting idle.

Just one of the 15 major freight markets FreightWaves tracks was positive on a week-over-week basis. The ratio of positive markets has plummeted compared to recent weeks and the absolute weekly percentage decreases are accelerating. The market with a gain in OTVI.USA was Laredo, Texas (3.57%). On the downside, this week saw a decline in Indianapolis (-21.86%), Miami (-21.35%) and Savannah, Georgia (-21.25%).

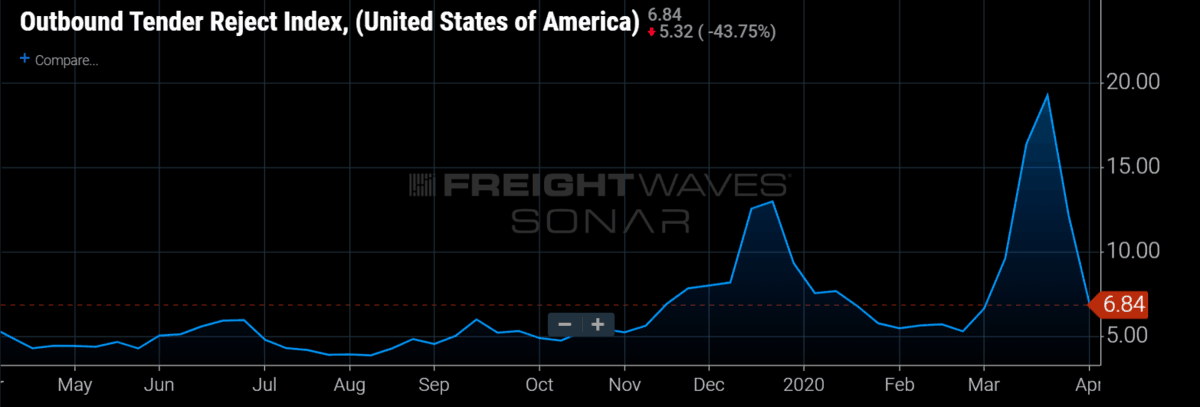

Tender rejections plunge this week

Much like OTVI, the outbound tender rejection index (OTRI) has also fallen back to “normal levels.” In the 11 days since peak tender rejections, OTRI has fallen 65% – from 19.25% to 6.84%. Just as with volumes, capacity is loosening faster than it tightened. In the 11 days prior to peak OTRI, the index increased 43%. This was a drastic but short-lived tightening of capacity. Due to the steep decline in volumes, capacity has now returned to what we would expect in a normal spring environment.

Capacity will continue to loosen as freight dries up throughout April. With a vast majority of the country on lockdown and many industries at near cancellation, there simply isn’t enough freight to keep capacity tight.

For more information on the FreightWaves Freight Intel Group, please contact Kevin Hill at [email protected], Seth Holm at [email protected] or Andrew Cox at [email protected].

Check out the newest episode of the Freight Intel Group’s podcast here.

Noble1

For you chart reading enthusiasts(analysts) who are well read in sophisticated chart reading “principles”(wink) , there is one particular chart I would like to bring to your attention on COVID-19 total cases in a province in Canada . Prince Edward Island . It jumped out to me very clearly for I recognized it within the wink of an eye once I saw it .

They appear to have only 25 cases up to date . If you go to Canada DOT ca on Coronavirus disease (COVID-19): Outbreak update , you’ll arrive at a page where you can hover across the country’s map with your mouse .

Once you arrive over Price Edward Island’s COVID-19 Cases chart , look at that crystal clear pattern !

Notice the very clear pauses within the pattern , as I referred to could occur in a prior comment of mine in regards to the COVI-19 infected cases curve on another thread on Freightwaves .

Now isn’t that interesting ? It sure is !

This definitely points out that there is a natural structure to what may appear to many as random and chaotic in the COVID-19 curve(s) of infected cases ! In other words we can use this accurate model/principle to “predict” the high probability as to where pauses ,flattening , and a reversal should occur within the curve .

In my humble opinion …………..

Colonel

I have an eight year old nephew who’s smarter than noble 1.

As for writer Seth Holm he’s an embarrassment t to the UGA School of Journalism. To be a hack at such a young age, branded for life as a stupid faceless writer, is sad.

UGA should get its degree back.

Noble1

Quote : “Seth Holm is a Senior Research Analyst for the Freight Intel Group at Freightwaves .Seth is a graduate of the University of Georgia with a major in Finance. ” , not a major in journalism . Seth is an “analyst” with a major in Finance, not a writer .

Was that too difficult for your big brain to comprehend ?

What was that you were saying about not being smart ? LOL !

Now why don’t you attempt to entertain us with a useful contribution for Freighwave readers rather than defecate from your mouth in the comment section .

In my humble opinion ………..

Noble1

Here’s a comment just for the pea brain Colonel aka colon breath . Next time keep your face sphincter shut , LOL !

Quote :

April 16 2020

Looming US Real Estate Crisis – Freddie Mac Warns of Housing Market Uncertainty, Homebuilder sentiment Drops 58%

“U.S. real estate agents and lenders are bracing for the biggest housing crash in over a decade. Since the coronavirus spread and the American government shut down the nation’s economy, Freddie Mac’s quarterly real estate report is grim and says the U.S. housing market faces considerable challenges “amid economic uncertainty.” Further, the NHB Wells Fargo Housing Index otherwise known as the Homebuilders sentiment has seen the largest drop since 2012.”

(wink)

Noble1

From my perspective ,

Unfortunately many typically get caught with their pants down in bear market rallies(proregressive bounce) , rather than use them to position themselves to participate, in this case, in a continuation of the prior decline .

The recent decline before this market proregressive bounce was only the first leg down in North America . In regards to COVID-19, it’s far from over as well . It’s only in its first wave .

In regards to trucking ,statements such as ,quote; “There is no end to the volume deceleration in sight. “, at this juncture is what I like to see . Markets don’t reverse with a glimmer of hope , they reverse when social mood and the herd is most negative .

A bullish Wave 1 reversal takes many by surprise , then Wave 2’s correction brings them back to believe Wave 1 was a hoax and the herd tends to feel even more pessimistic than at the wave 1 low believing the sky is falling near the low of wave 2’s correction . Then wave 3 wakes them up .

Keep in mind , transportation is one of the first sectors to reverse at the beginning of an early market recovery in the business cycle , and it does so when the world(economy) appears to be gravely falling apart and demand is weak . Just like it is the first to reverse in the late stage of an expansion when everything appears to be delightful and demand is at its strongest . You should remember this , for the latter has occurred not so long ago . We don’t call it a market barometer for nothing .

So keep a very close eye on Transportation and Financials , and put your emotions aside !

In my humble opinion ……….

Dave

Back in March Many FW articles said the record high volumes would just go back to “normal”.

How wrong you were.

Just wait til May and June.

The DEPRESSION is here but nobody is talking about it. Everyone just talks about how great the stock market is doing (pumped up by magical record debt fed money). Mark my words… DEPRESSION DEPRESSION DEPRESSION.

Get your house in order.

CM Evans

It’s amazing how many other wise intelligent people don’t see what’s coming.

Mike

I cannot believe I missed this phony pandemic myself. I am totally embarrassed…

Noble1

Mike if you’re the one who I had suggested to hedge your position back in December with a “house insurance analogy” and buying time through the use of derivatives , and then I came back to point out the January barometer had been confirmed , you have no excuse !

If my memory doesn’t fail me and you are the “Mike” I replied to on what I pointed out above , you had stated that you played in the futures market in the past .

If you lost money , then shame on you . If you didn’t lose money but missed out on an occasion to make some , then no big deal . There will always be another opportunity .

The worse thing that you can do to yourself is to live with regret . THIS IS A GAME ! Nothing more and nothing less . There will always be another occasion , always . Your life however, is priceless . So remain vigilant and stay healthy and be prepared for the next occasion while learning from this one .

Wishing you nothing less than the very best !

In my humble opinion …………

Mike

I begged you for that lone Noble, you laughed at me… Rather hard to open a brokerage account with no cash…

Noble1

Wait Mike , consumers haven’t seen anything yet in my opinion .

Watch when the next shoe drops they’ll be emotionally devastated . The next shoe will hit real estate value . We should be on the edge of that commencing occurrence . First signal is rising unemployment leading into real estate value disintegration . Social mood is going to get a heck of a lot darker . Pessimism is only at its commencement at this point .

While real estate takes a hit , we’ll want to keep an eye on small caps .

Stay tuned !

In my humble opinion …………

Noble1

CM , when the market was nearing its peak and some of us were calling it , we “intelligent” one’s were interpreted as nuts . Then the market collapsed .

Same in the transportation(trucking) sector in 2018 . When we “intelligent” one’s were calling its peak , we were interpreted as nuts since demand and rates were off the charts .

Same with oil/crude , ad nauseam . We’re not perfect , but damn well near to being so , LOL !

When I stated to my close one’s that we would see x gasoline price at the pump , they didn’t want to believe it but knowing me knew that its probable occurrence was very likely . I also stated that when x gasoline price would occur at the pump the economy and market would be in a dire circumstance . X gasoline price at the pump has occurred recently . When I was calling this gasoline price at the pump to hit in the near future , COVID-19 wasn’t in existence .

Same in regards to calling Crude to drop below 2016’s low while this site was calling diesel to fly to the sky based on IMO 2020 , LOL ! That being said , I wouldn’t knock this site(Freightwaves) , for none are perfect and we all make mistakes . That being said , it’s fun to taunt some of their reporters from time to time (wink)

In my humble opinion ………….