Less-than-truckload carrier Saia (NASDAQ: SAIA) reported a reversal in trends during February as severe winter storms forced closures across the carrier’s network of terminals. February tonnage fell 2.3% year-over-year after climbing 5.4% in January.

At the peak of the storms, Saia had as many as 70 of its facilities fully or partially offline, in some cases for several days. The carrier has a strong presence in Texas, 20 terminals, which bore the brunt of the storms as some areas of the state went without power for more than a week.

“February trends reflect a negative impact related to severe winter weather that affected much of the central U.S., with the largest impact on business occurring in Texas,” a Wednesday press release stated.

Saia’s January LTL shipments increased 1.4%, with weight per shipment up 3.9%. February’s shipments declined 6.7%, with weight per shipment up 4.7%.

KeyBanc (NYSE: KEY) equity research analyst Todd Fowler said in a Wednesday note to clients that the weather impact could limit Saia’s margin improvement efforts in the first quarter. He noted March tonnage would have to increase in the high-teen percentage range for the carrier to meet his volume estimate for the period.

Saia previously issued expectations of more than 150 basis points in operating ratio improvement during 2021.

Other LTL networks see weather-related falloff in February

ArcBest Corp. (NASDAQ: ARCB) reported a roughly 7% year-over-year decline in tonnage in its asset-based segment, which includes LTL operations, during February. Volumes were up by a similar percentage in January. Revenue in the segment was up 7% year-over-year through late February with favorable pricing trends, revenue per hundredweight, accounting for the increase.

Old Dominion Freight Line (NASDAQ: ODFL) said bad weather limited its operations for roughly one week during February. After posting an 11.9% year-over-year increase in tonnage in January (revenue +14.6%), tonnage was only 5.9% higher in February (revenue +9.2%).

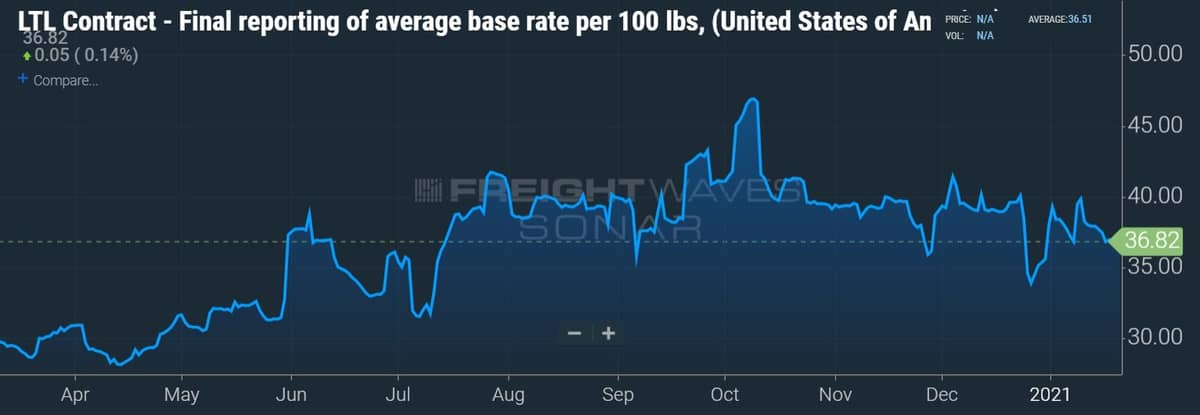

Old Dominion also reported favorable yields, excluding fuel, up 3.8% year-over-year through the first two months. Most carriers issued general rate increases on noncontractual freight earlier this year.

Weather appears to be a one-off as industrial economy rallies

A February survey of manufacturing supply executives, the Purchasing Managers’ Index, came in 2.1 percentage points higher at 60.8% on Monday. It was the ninth consecutive month the index was in growth territory, a reading above 50%. New orders were up 3.7 points from January to 64.8% and customers’ inventories remained at an all-time low of 32.5%.

Industrial production was up for the fourth time in a row in January, climbing 0.9% sequentially, with manufacturing output climbing 1%. The dataset is still 1.8% lower year-over-year, but the declines are getting smaller.

Manufacturing can represent more than 80% of tonnage for some LTL carriers. LTL volumes historically lag the PMI index by roughly three months.

“Absent the February severe weather period, business trends were consistent with those seen in January,” Saia’s press release concluded.

Shares of SAIA are up nearly 3% in midday trading compared to the S&P 500, which is off 0.5%.