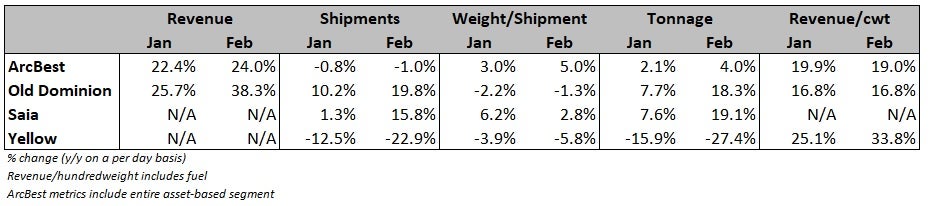

Less-than-truckload carrier Yellow Corp. reported Wednesday that tonnage fell 27.4% year-over-year in February, following a 15.9% drop in January.

The declines, part of Yellow’s yield enhancement initiatives, were far worse than the improving comps announced by other carriers. In recent days, several publicly traded carriers reported a surge in year-over-year tonnage growth rates in February when compared to January. Severe winter storms during February 2021 created an easy comp for the recent month.

Old Dominion Freight Line (NASDAQ: ODFL) saw tonnage increase 18% year-over-year in February (+8% in January), with Saia (NASDAQ: SAIA) logging a 19% jump in the month following an 8% increase in January.

Weather was a year-over-year tailwind for most but not for Yellow (NASDAQ: YELL). The carrier also said COVID outbreaks presented an obstacle to start the year.

“Financial results for the first two months of the quarter are improved compared to a year ago even though terminal operations were impacted from Covid-19 cases and weather during January and February,” CEO Darren Hawkins stated in a press release.

In its 2021 first-quarter update, the carrier blamed a February tonnage reversal on winter-related service disruptions at 215 of the 327 freight terminals it had operating at the time, seemingly providing an easy comp for February 2022.

Yellow has been focused on a restructuring, which has combined all of its operating companies into a seamless network on one tech platform. Like other LTL carriers, it has also used a favorable supply-demand backdrop to push yields higher and improve profitability even if it means losing customers.

Similar to the tonnage results, Yellow’s daily shipments were off in the first two months, with the rate of decline almost doubling in February. Weight per shipment was down by mid-single-digit percentages in each month as well.

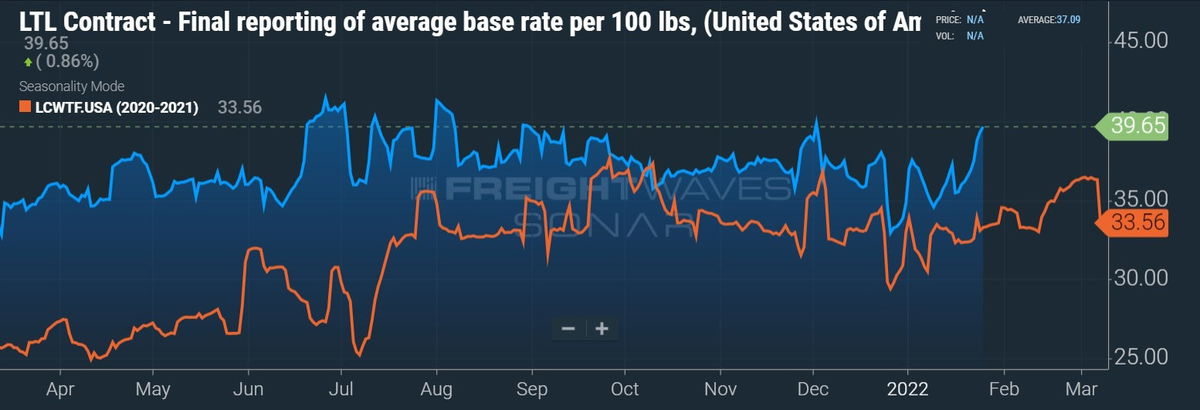

However, yields, or revenue per hundredweight, increased at a faster rate than at any other carrier issuing an intraquarter update, up 25.1% year-over-year in January and 33.8% in February. Higher fuel prices are inflating yield metrics for LTL carriers but core contractual rate increases have increased by roughly 10% throughout the industry.

In late 2021, the industry implemented general rate increases on base rates earlier and higher than in recent years. Yellow was one of the first, implementing a 5.9% average increase Nov. 1.

Even with the volume declines, Yellow likely saw revenue per day increase by a high-single-digit percentage in January and by mid-single digits in February. By comparison, ArcBest (NASDAQ: ARCB) and Old Dominion posted 20%-plus growth rates in each month.

The fallout from a network overhaul, service embargoes and yield-raising efforts are weighing on volumes at Yellow even as the industrial complex continues to log steady growth (Manufacturing Purchasing Managers’ Index has been in expansion territory for 21 straight months) and expanding e-commerce platforms remain a tailwind to LTL demand.

“Our goal to complete the transformation to One Yellow in 2022 remains on schedule,” Hawkins continued. “We are nearing completion of the design and modeling phase of the linehaul network integration to support both regional and long-haul service as well as streamline local pickup and delivery to eliminate duplication. When completed we will operate a fully integrated network with the speed, efficiency and consistency of a super-regional carrier.”

Click for more FreightWaves articles by Todd Maiden.

- AFS Logistics acquires DTA Services, combines freight auditing platforms

- ArcBest sees record Q4 fundamentals carry into Q1

- Hot LTL market carries into 2022