Volume declines continued for less-than-truckload carrier Yellow Corp. in May. After the market closed Thursday, the company reported a 17.2% year-over-year decline in tonnage during the month, which followed a similar drop in April. The declines are part of a plan to cull unwanted freight from the network and drive yields and margins higher.

On Yellow’s (NASDAQ: YELL) first-quarter earnings call, management said the tonnage declines had peaked in February, which saw a 27% year-over-year drop. March was down 18% and a preliminary assessment of April called for a decline of 14% to 15%. April ultimately came in worse than expected, but it appears that the freight drops have stabilized, albeit at still sizable declines.

“The quarter-to-date operating metrics for the second quarter are consistent with our expectations as we work to ensure the optimal level of freight is moving through the network,” said CEO Darren Hawkins in a press release. “With continued steady demand for LTL capacity and a consistent favorable pricing environment, our financial results for the first two months of the quarter have outperformed our historical sequential improvement from Q1.”

The company is consolidating and closing terminals in its Western network, with two additional phases planned by the end of the year. Yellow has already consolidated its four LTL operating companies and its logistics unit under the same roof.

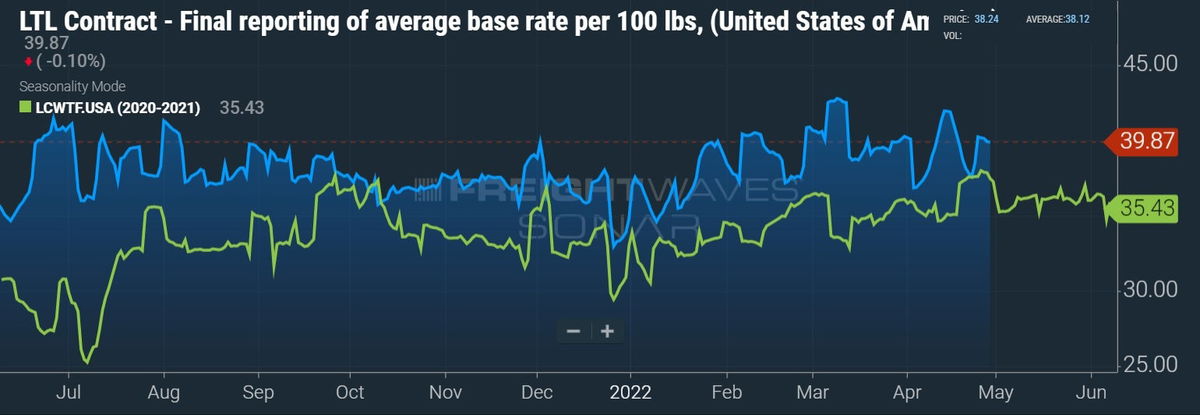

So far in the second quarter, shipments have fallen 15.3% compared to the year-ago period and weight per shipment is off by 2.2%. However, revenue per hundredweight, or yield, is up nearly 30%. Higher fuel surcharges — up 70% year-over-year so far in the second quarter and 27% higher on average than in the first quarter — have provided a big tailwind to yields.

“Our plan is to grow the business and we are confident that our transformation to One Yellow positions us for long-term tonnage growth,” Hawkins continued. “We expect the One Yellow network transformation to enhance customer service, lead to greater efficiencies and cost savings and add capacity to the network.”

All in all, revenue for Yellow was likely up by low double-digit percentages in April and May compared to last year. That’s modest compared to other carriers that have seen revenue growth exceed 20% — a combination of tonnage gains moderating to the low- to mid-single digits and yields up roughly 20% — over the same time.

Old Dominion (NASDAQ: ODFL) reported Monday that revenue per day was up 26% year-over-year in May, following a 29.1% increase in April. ArcBest (NASDAQ: ARCB) saw revenue increase by 24% in each month.

Asset-light LTL provider Forward Air (NASDAQ: FWRD) said Wednesday that revenue per shipment increased 40.7% in the first two months of the quarter compared to the same period in 2021. The increase was largely tied to higher yields and a 15.4% increase in weight per shipment. The company has been actively removing lighter, lower-margin freight from its network in favor of heavier, higher-valued shipments.

The disclosed metrics from the company imply revenue in April and May was up in the mid-20% range year-over-year.

“We remain focused on the selection of higher-quality freight in our network,” said Tom Schmitt, chairman, president and CEO, in a press release. “Second quarter of the prior year was the peak period for unpalletized, loose freight. We cleansed our network of inefficient freight to ensure that we keep our commitment to customers for their most sensitive freight, to the point where we now have the same tonnage as last year at much higher-quality levels.”

Schmitt said he expects Forward Air to exceed its second-quarter earnings-per-share guidance range of $1.59 to $1.63.