More shipowners have come to Wall Street than have left over the past half decade. Yet most of the new arrivals have been micro-cap stocks and some of the recent departures have been big names.

On Monday, liquefied natural gas (LNG) shipping giant GasLog Ltd. (NYSE: GLOG) announced plans to go private.

The delisting of GasLog follows on the heels of January’s definitive agreement to fold Navios Containers (NYSE: NMCI) into Navios Partners (NMM), December’s “take private” announcement by Seacor (NYSE: CKH), the delisting of Teekay Offshore’s common (but not preferred) units in January 2020 after the takeover by Brookfield Business Partners, and the privatization of DryShips in October 2019.

GasLog’s founder, shipping magnate Peter Livanos, said the new deal would allow “for access to growth capital currently absent in the public equity markets.”

That’s definitely not a vote of confidence in the value of a shipping listing.

GasLog is selling 45% of its outstanding shares to BlackRock (NYSE: BLK) for $248 million. If shareholders approve the deal, BlackRock’s Global Energy & Power Infrastructure division would pay $5.80 per share, a 17% premium to Friday’s close, and the stock would be delisted.

Livanos and the Onassis Foundation would retain their 55% stake and GasLog Ltd.’s sister company, GasLog Partners (NYSE: GLOP), would remain public.

Share price jumps

GasLog Ltd.’s share price jumped 19% on Monday on the BlackRock news.

“This is a surprising development but nonetheless underscores the long-term positive outlook for the LNG sector given this new investment on the part of BlackRock,” said Clarksons Platou Securities analyst Omar Nokta in a research note.

According to Fearnleys Securities, “The backdrop here is, in our view, a financing gap with $315 million in senior unsecured [debt] due next year and limited scope to bridge this with cash flow from the spot vessels. This is probably the best thing GasLog shareholders could have hoped for.”

Stifel shipping analyst Ben Nolan said in a client note that he does not expect a competing bid to up the price. “BlackRock is buying a minority stake and will not have control. If a new candidate were to materialize, they would have to be financial — not strategic — as we believe giving up control [for a strategic buyer] is out of the cards. However, most financial [investors] are not interested in minority control.”

Public versus private?

Do five delistings or proposed delistings over 15 months point to a trend or are they just a confluence of company-specific decisions?

Jefferies shipping analyst Randy Giveans told American Shipper, “There has always been this tug-of-war between the costs and benefits of being a publicly traded company. There are certainly pros and cons to it, but the vast majority of shipowners who are public want to stay public.

“That said, for companies that habitually trade at a discount to NAV [net asset value] or at a substantial discount to peers, it certainly makes sense to unlock value through a take-private/merger/roll-up transaction,” said Giveans.

An analyst speaking to American Shipper on condition of anonymity highlighted Livanos’ statement on lack of growth capital access.

“The fact that they viewed publicly equity markets as closed for new capital speaks volumes about the decision as well as the place for shipping in those markets,” he maintained.

The analyst also pointed out that an infrastructure fund did the GasLog deal, as was the case with Teekay Offshore. “There is a lot of private equity money in infrastructure looking for a home, and a less volatile end market with long-term contracts could meet a lot of their parameters,” he said, noting that “spot-exposed tanker, dry bulk, container names are much less likely to be targets.”

Different rationales for different deals

The DryShips take-private deal was a “different animal,” the analyst noted. DryShips founder George Economou bought back the outstanding shares. The transaction followed a period when a series of dilutive offerings heavily impacted the share value. Being public was complicated for Economou; he was the target of multiple shareholder suits during DryShips’ history.

In the case of Navios Containers, the sale to Navios Partners — which owns dry bulk ships as well as container ships — is expected to close in the first half of this year.

Aristides Pittas, CEO of container-ship lessor Euroseas (NASDAQ: ESEA) and dry bulk owner Eurodry ((NASDAQ: EDRY), commented on the Navios deal during a Capital Link virtual forum in January.

He opined that the Navios Containers delisting “was initiated when the dry bulk market was lousy” and “containers were doing extremely well and they decided to merge them in order to help the mother company [dry bulk-centric Navios Partners].” Now that dry bulk is healthier, Pittas wondered whether “they might regret that decision.”

“I am convinced the market does not want to have mixed fleets,” said Pittas. He said the combined market cap of Euroseas and Eurodry was 50% higher versus when container ships and bulkers were both under the Euroseas banner.

LNG carrier earnings roundup

The BlackRock deal overshadowed the earnings news, but both GasLog Ltd. and GasLog Partners published quarterly results on Monday.

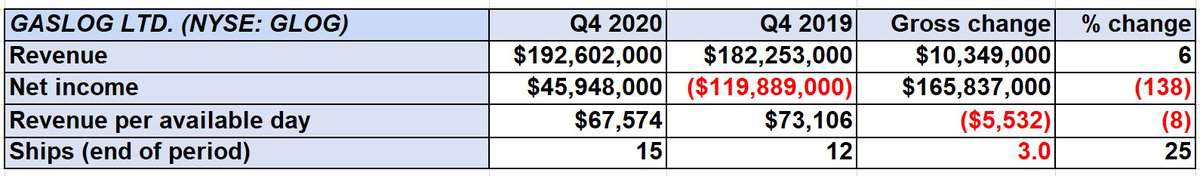

GasLog Ltd. reported net income of $45.9 million for Q4 2020 compared to a net loss of $119.9 million in Q4 2019. Adjusted Q4 2020 earnings per share of 24 cents came in just above the analyst forecast for 23 cents.

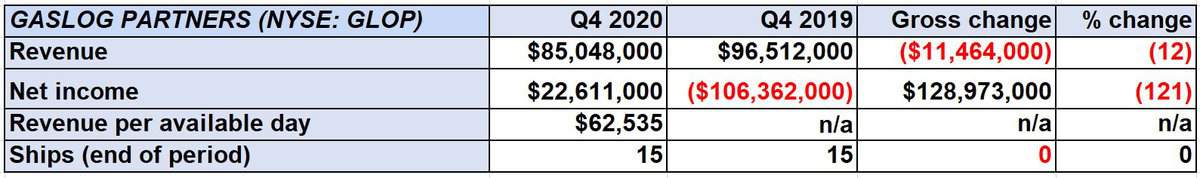

GasLog Partners posted net income of $22.6 million for Q4 2020 compared to a net loss of $106.4 million in the same period the prior year. Adjusted earnings per unit of 38 cents topped the consensus forecast of 31 cents.

During the conference call, Paul Wogan, CEO of both GasLog Ltd. and GasLog Partners, said he saw potential for LNG shipping spot rates to improve this year.

In 2020, coronavirus fallout curtailed U.S. LNG exports to Asia in Q2 and Q3. “Should the global economy continue to recover, we expect LNG carrier spot rates to improve in 2021 relative to 2020 as many fewer U.S. cargoes would be shut in during the summer months,” said Wogan. Click for more FreightWaves/American Shipper articles by Greg Miller

MORE ON LNG SHIPPING: New world record set for shipping rates: $350,000 per day: see story here. Shipping titan Peter Livanos lays out his vision of LNG’s future: see story here. John Fredriksen-backed Flex LNG makes Spotify-style NYSE debut: see story here.