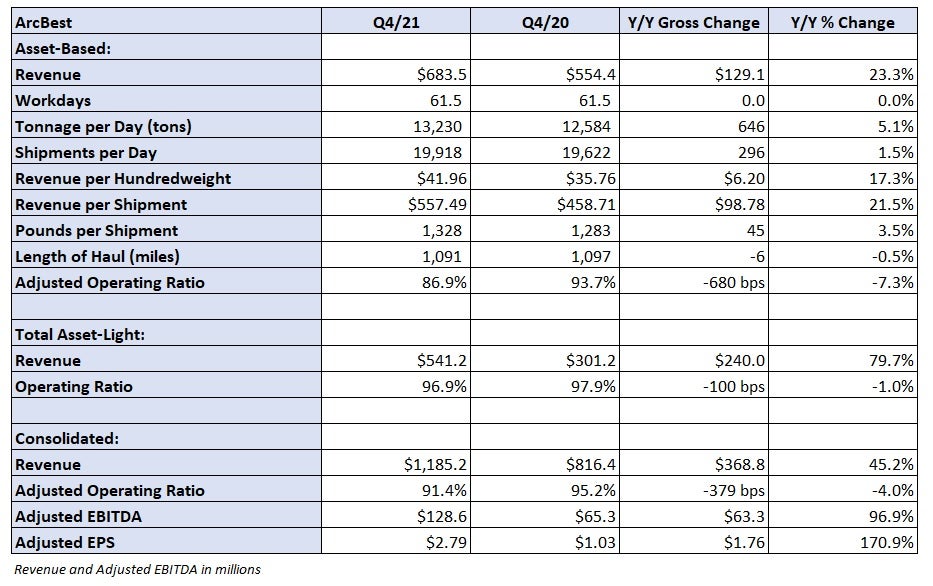

ArcBest reported fourth-quarter adjusted earnings per share of $2.79 Tuesday before the market opened. The result was 52 cents ahead of consensus expectations and nearly three times higher than the year-ago level.

“2021 was a year of immense challenges — from the ongoing pandemic to extreme supply chain pressures — but our team stayed focused on our strategic initiatives and consistently exceeded expectations,” stated Judy McReynolds, chairman, president and CEO, in a press release. “We are making smart investments across our business to advance our strategic vision and adapt to the rapidly evolving market environment, all while being true advisers to our customers.”

The company’s asset-based unit, which includes less-than-truckload operations, reported another mid-80s operating ratio.

Click for full article – “ArcBest raises long-term financial targets, expects revenue to double by 2025”

Revenue increased 23.3% year-over-year to $684 million as tonnage per day was up 5.1% with revenue per hundredweight, or yield, surging 17.3%. LTL yields increased by a double-digit percentage excluding fuel. Weight per shipment was up 3.5% (+1.1% on LTL shipments).

ArcBest’s (NASDAQ: ARCB) asset-light segment recorded a 79.7% year-over-year increase in revenue to $541 million. The increase included $120 million in new revenue from the acquisition of truckload brokerage MoLo Solutions, which closed at the beginning of November.

The company will host a call at 9:30 a.m. Tuesday with analysts to discuss results. Stay tuned to FreightWaves for more earnings coverage of ArcBest.

Click for full article – “ArcBest raises long-term financial targets, expects revenue to double by 2025”

The FREIGHTWAVES TOP 500 For-Hire Carriers list includes ArcBest (No. 26).

Click for more FreightWaves articles by Todd Maiden.

- J.B. Hunt acquires furniture hauler from Bassett in $87M deal

- Another quarter, another record at Landstar

- Knight-Swift sees big Q4, expects hypergrowth to moderate in 2022