New operating results from four Asian shipping lines were released Friday, pointing to steep performance declines in the fourth quarter and ongoing market erosion in the first month of this year.

Orient Overseas Container Line (OOCL), the Hong Kong-listed subsidiary of China’s Cosco Group, disclosed revenue and volume data for Q4 2022. Taiwan’s Evergreen, Yang Ming and Wan Hai released monthly operating stats for January.

OOCL

OOCL reported revenue of $3.18 billion for Q4 2022, down 35% year on year. Volume was down 2.7% and revenue per forty-foot equivalent unit fell 31% versus Q4 2021.

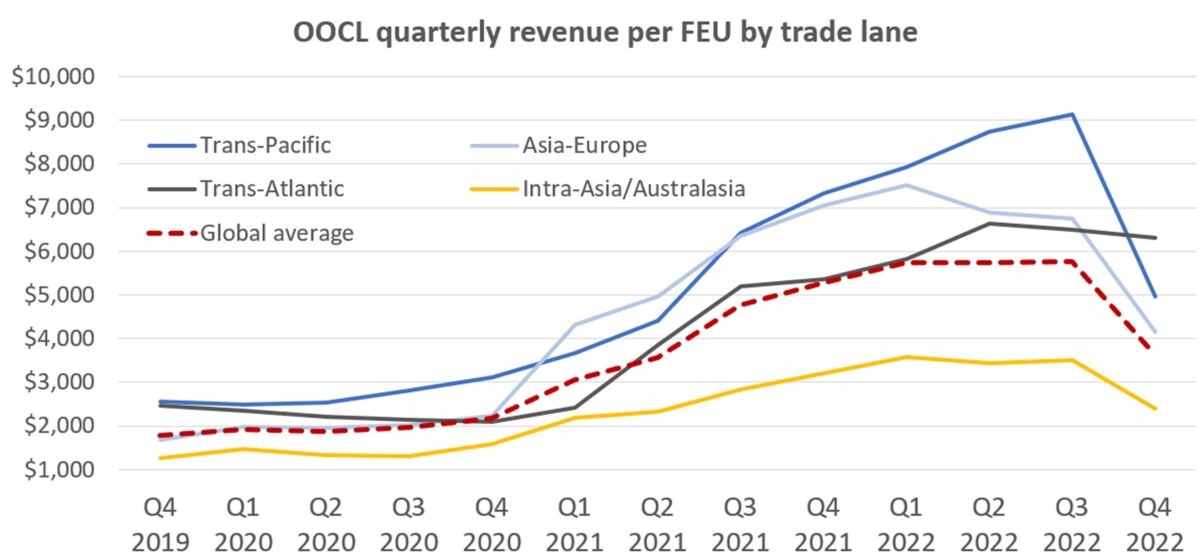

Looking at OOCL’s revenue per FEU by trade lane over time reveals how the container shipping boom peaked and how quickly business is now falling off.

OOCL’s global average revenue per FEU (including both contract and spot) peaked in Q3 2022 at $5,771. In the fourth quarter, the global average plummeted sequentially by 37% versus the third, to $3,645 per FEU.

The drivers of the quarter-on-quarter plunge: OOCL’s trans-Pacific revenues per FEU fell 46% in Q4 2022 versus Q3 2022, to $4,959; Asia-Europe declined 39% to $4,150 per FEU; and intra-Asia — OOCL’s highest-volume trade — fell 32% to $2,400 per FEU.

Bucking the trend, trans-Atlantic revenues per FEU were down only 3% quarter on quarter to a still very high $6,308, although this is OOCL’s smallest-volume market by far, limiting the benefit.

On a more positive note, the company’s Q4 2022 revenues per FEU were still double to triple levels in Q4 2019, pre-COVID.

Its global average was up 104% versus the same period three years prior, with trans-Pacific revenue per FEU up 94%, Asia-Europe 148%, trans-Atlantic 156% and intra-Asia up 91%.

Despite the fall in spot rates in the second half of last year, companies like OOCL continue to enjoy higher-than-usual revenues due annual contracts negotiated at peak levels.

Evergreen, Yang Ming, Wan Hai

The Taiwan-listed carriers offer an early glimpse of what’s happening in Q1 2023 due to the requirement that they disclose monthly operating revenues.

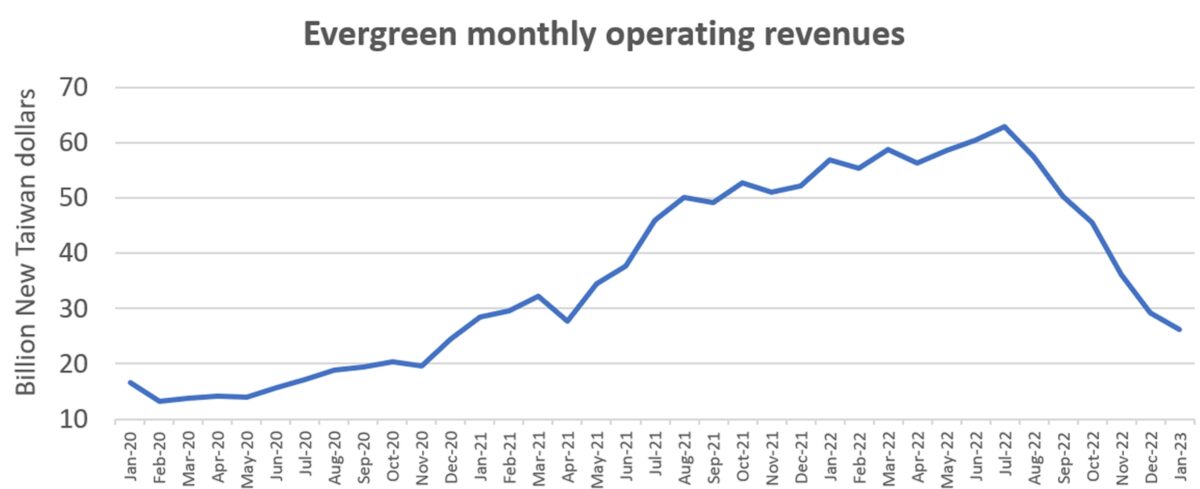

Evergreen, the world’s sixth-largest shipping line, reported operating revenues of 26.4 billion New Taiwan dollars (TWD) or $875 million in January, down 10% from December and less than half the all-time high of 62.8 billion TWD in July.

Evergreen’s revenues were still up 58% last month versus January 2020, pre-COVID. But that’s not as positive as it looks, because the carrier has increased its fleet size by 30% since then, according to data from Alphaliner.

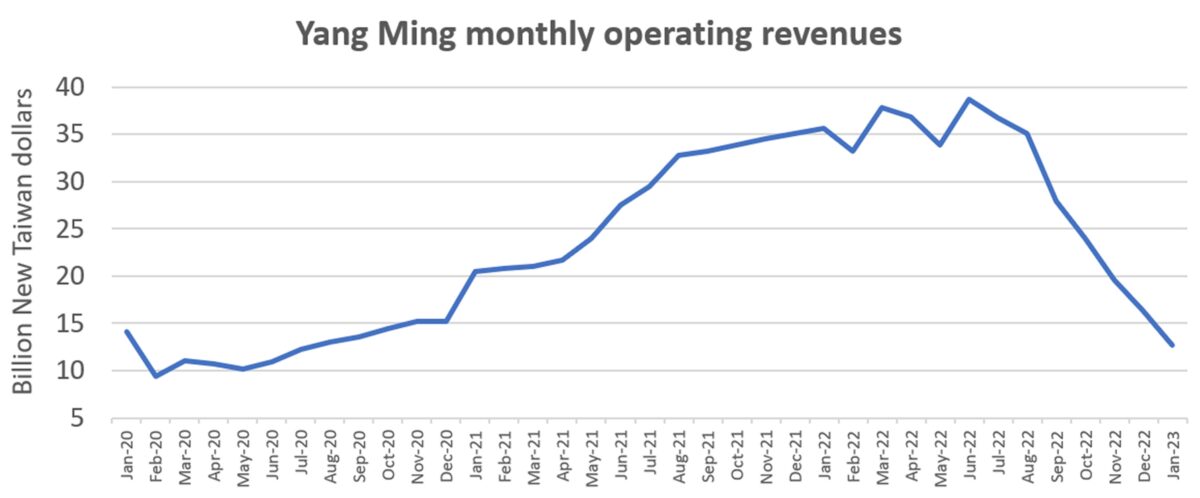

Yang Ming, the world’s ninth-largest carrier, reported operating revenues of 12.7 billion TWD in January — a steep 22% drop from December. January revenues were less than a third of the 38.7 billion TWD in revenues recorded in June.

Yang Ming’s revenues last month were actually 10% below those in January 2020, pre-pandemic, despite the fact that the company has increased its fleet capacity by 9% since then.

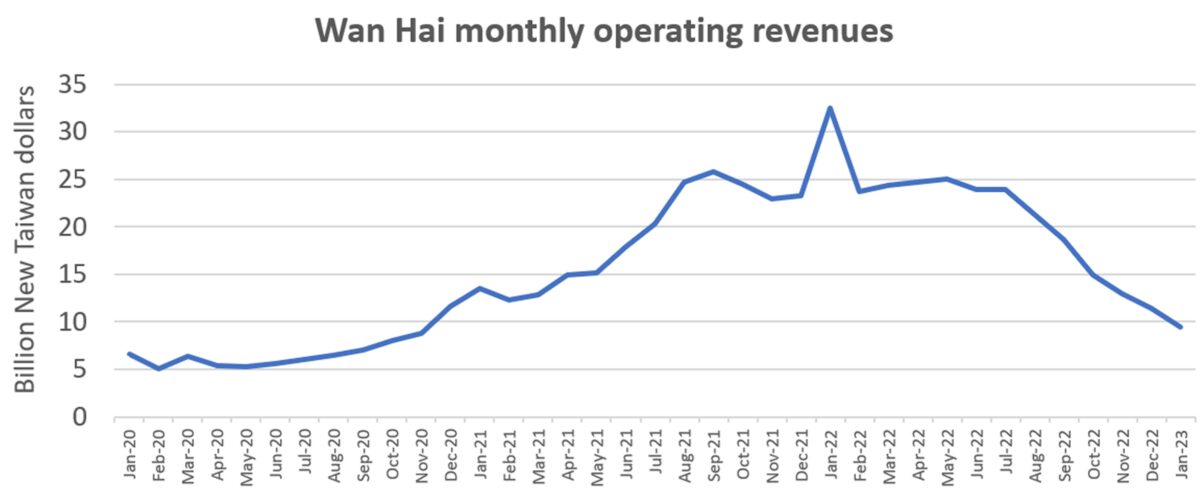

Wan Hai, the world’s 11th-largest ocean carrier, reported operating revenues of 9.5 billion TWD in January, down a hefty 17% from December, to less than a third of its all-time monthly high.

Revenues last month were still up 44% from those in January 2020, but this may be entirely due to fleet growth. Wan Hai’s fleet capacity has increased 59% over the same period.

Click for more articles by Greg Miller

Related articles:

- Maersk: Container shipping contract rates will sink to spot levels

- Lag effect: Why liner profits stay high much longer than spot rates

- Top 10 container lines: How did rankings change during boom?

- Here’s how container shipping lines can escape a crash in 2023

- ‘Surge finally over,’ US imports back near pre-pandemic levels

- Container shipping’s ‘big unwind’: Spot rates near pre-COVID levels