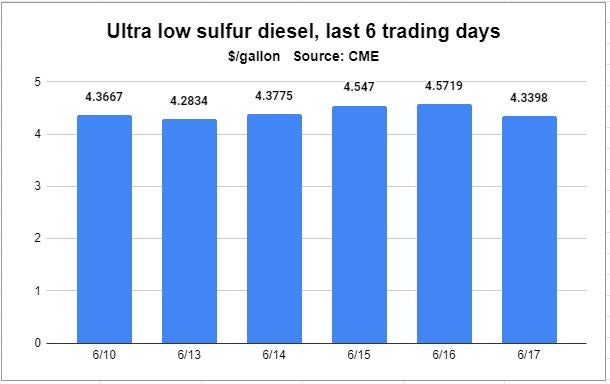

Ultra low sulfur diesel prices on the CME commodity exchange closed out the week with an enormous drop, but it wasn’t big enough to take levels down to a weekly decline.

And the big drop came after a day in which one of the world’s most important forecasting reports, the monthly outlook of the International Energy Agency, gave an overview of the future for the “middle of the barrel” from which diesel comes. And that overview doesn’t have much of a forecast for price relief.

The settlement Friday of $4.3398 per gallon represented a decline of 23.15 cents per gallon on the day, down 5.08%. Trading Friday across the petroleum sector was bearish, with West Texas Intermediate crude down 6.57% from Thursday and RBOB gasoline, an unfinished gasoline blendstock that is traded as a proxy for gasoline, declining 4.11%.

There was no apparent reason for the significant drop, as it was not dragged down by falling equity markets, which at the time of the CME close were up for the day. The most significant bearish news in the market came out of Russia, where news reports said Deputy Prime Minister Alexander Novak told reporters that by finding alternate buyers to the Western countries and companies that have shunned Russian oil, the country’s output was close to the 10.2 million barrels per day level from February, prior to the invasion of Ukraine.

But the day’s results kept up a trend that has been a market feature for months: diesel outperforming crude, whether the overall market is rising or falling. It has tended to outperform gasoline as well, but did not do so Friday.

And with crude supplies becoming less of a concern, the issue gets back to refining capacity and the world’s ability to take that crude and turn it into refined products like diesel.

In a subsection of its monthly report, the IEA gets right to the point in its section headline: “Few signs of tight diesel and kerosene markets easing.”

Diesel and kerosene — the building block for producing jet fuel — come out of the middle of the barrel, along with products such as heating oil.

The IEA notes that gasoline prices and refining margins are “breaking new records,” but it is that middle part of the barrel that continues “to experience unprecedented shortages and prices.”

While there are far more complex models to measure refinery profitability, anybody with access to the daily settlements of crude and ultra low sulfur diesel on the CME can produce a basic indicator of refining margins. A simple comparison of the price of ULSD and Brent crude on CME, normalized to a per barrel price, produced a number this week that broke the $70 per barrel mark. While that spread has been higher, the days where it exceeded $70 were a feature of a short-term squeeze on ULSD near the expiration of the May contract, which closed out at the end of April.

Historic spread between diesel and crude

At the start of the year, the spread was about $20. In 2019, the last full pre-pandemic year, it was less than $20. In April 2020, when refiners were switching as much of their (reduced) output away from gasoline and toward diesel, given that gasoline consumption had fallen much further than diesel, the spread at times was less than $10 per barrel.

The IEA report notes that the combined global demand for diesel and jet kerosene was 36.7 million barrels per day in the fourth quarter of 2018, and has not yet recovered. But that is a function of weaker jet demand, which continues to suffer from a lack of significant international travel.

“Diesel demand, taken on its own, has seen a particularly strong post-COVID recovery,” the IEA wrote. Fourth-quarter 2021 demand globally was 29 million barrels per day, a record level.

One reason for that surge in consumption was because of the high price of natural gas, particularly in markets outside the U.S., the IEA said. That led to some applications switching out of natural gas and into diesel.

But the IEA also puts into print a point of discussion gaining significant traction: IMO 2020, an environmental regulation governing the sulfur levels of marine fuels, is finally having an impact on diesel markets.

The return of IMO2020 to impacting the diesel market

An upward push from IMO 2020 was long predicted in the run-up to the rule going into effect at the start of 2020 under the guidance of the International Maritime Organization. Models leading up to the implementation of the rule all projected that a portion of the intermediate products needed to make diesel would likely be diverted into the marine fuel “pool,” resulting in a tighter market for diesel. There were movements in the spreads between crude and diesel in the fall of 2019 that suggested the strengthening of diesel relative to the rest of the barrel was occurring.

But the pandemic gave the world such a glut of everything petroleum that the models didn’t get a test. That is now over, according to the IEA. “As global diesel demand surpassed pre-pandemic levels, the low-sulfur distillate molecule deficit became more apparent,” the IEA report said. “While not entirely a diesel product, the large share of distillate-range molecules in 0.5% sulfur marine fuel sets its price at or near diesel levels.”

The ability to squeeze more of those distillate molecules out of crude to make both diesel and the new demand from the marine fuels market can be challenging, the IEA said. Distillate demand is about 34% of world demand, but in some areas, it’s closer to 55%. Europe is an example of that, having aggressively incentivized for many years the purchase of passenger cars powered by diesel engines. That’s why Europe needs to be a significant net importer of diesel, according to the report.

That 55% contrasts sharply with what the IEA said is something of a natural barrier. “It is practically impossible to achieve more than 45% to 50% yields for middle distillates,” the IEA wrote.

Those distillate markets were “comfortably supplied” between 2015 and 2010, the report said. But distillate yields began falling in 2018-19, the IEA said, as refineries became more complex and could produce greater percentages of gasoline, a more favored product in most cases.

This problem is now structural witn no easy fix. The IEA said its outlook for global middle distillate supplies is that refining capacity “is not sufficient to fully meet middle distillates demand in 2022 or in 2023.”

The undersupply might not be as wide as it was in 2021, but the gap last year was filled by inventory drawdowns. Given how much lower global distillate inventories are now — they drew 300,000 barrels per day in the first quarter — that draw to fill the gap created by refining shortfalls will be done against a smaller stock base, the IEA said. And market prices are very aware when that happens; it doesn’t occur in secret.

“As such, inventories’ cushioning effect is limited now, contributing to the extraordinary levels of middle distillates prices,” the IEA said of the stock drawdown that appears to be inevitable.

More articles by John Kingston

As diesel prices soar past crude, refining squeeze challenges oil markets

Diesel once again racing higher than prices for crude oil, gasoline

East Coast diesel inventories tighter again; other numbers offer buyers hope

.

Chloe

well said!!! megan has caused this turmoil!! she married into the family. has absolutely used harry and the royal family. she is ungracious !! also pushing american attitude on the naturally reserved british! harry needs to be home here >>> https://desalary.com/