The relationship between gross revenue and gross margins for freight brokerages is inversely related across much of the freight cycle. As spot market rates rise faster than paper (contract) rates, margins compress on higher load volumes. The opposite is also true: As spot rates fall faster than paper rates are rebid down, gross margins expand on flat and/or lower load volumes.

It is all part of the cyclical nature of supply and demand in trucking.

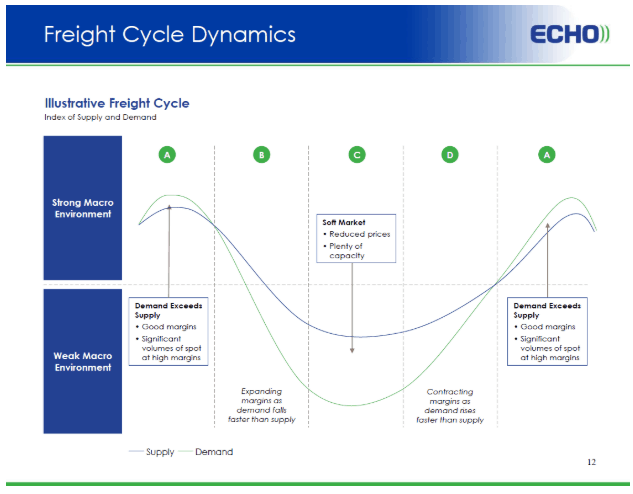

In our October white paper “Freight Broker Performance Across the Cycle,” we examined this topic in detail. Part of our reference material was an excellent chart produced by Echo Global Logistics summarizing supply and demand in each part of the freight cycle.

According to Echo’s chart of freight cycles, we believe freight brokerages are in Stage C. This stage is the trough of the cycle, in which load volumes are flat or declining, spot rates have already fallen to their lows, and paper rates are being rebid down by shippers to reflect the new macro environment for the freight market.

While no one can predict when the freight market will enter Stage D, we can identify its markers. The transition to the next stage should include spot rates rising as shippers continue to either rebid current paper rates and/or move more loads into the spot market to take advantage of lower rates in the spot market.

This movement of loads into the spot market will increase demand and spot rates as paper rates find a bottom. This movement of paper vs. spot rates will continue to compress gross margins until demand and supply are relatively even again.

Gross margins — theory vs. practice

The stages of the freight cycle from Echo are great in theory, but how well do they describe the real world?

Below is a chart of gross revenues and gross margins as measured by the top five publicly traded freight brokers: C.H. Robinson (CHRW), J.B. Hunt (JBHT), Echo Global Logistics (ECHO), Landstar (LSTR) and XPO Logistics (XPO). As we can see, gross revenues peaked in the second quarter of 2018. During this time, gross margins were contracting as spot rates rose much faster than paper rates could be rebid higher by freight brokerages. This is consistent with Stage A in the Echo model, when demand outstrips supply. Margins contract on higher gross revenue and load volumes.

In the second half of 2018, gross revenues fell along with spot rates and load volumes. During this time, though, gross margins expanded as spot rates began to fall even as paper rates were still being rebid higher to reflect the volatility in rates seen in the first half of 2018. That environment correlates quite nicely with Echo’s Stage B in the freight cycle.

The first half of 2019 has been stuck in Stage C of the freight cycle. Gross revenue and gross margin, as well as load volumes, have been on the decline. Spot rates have declined and are still holding flat, while paper rates have been under rebidding pressure by shippers that are actively clawing back rate increases given up at the height of the 2018 capacity crunch.

The next stage in the cycle should see more shippers moving loads into the spot market to capture lower spot rates as they continue to rebid paper rates lower. This will move freight brokerages into the most difficult part of the cycle in which gross revenues and gross margins contract as spot rates begin to climb while paper rates continue to be rebid down. On the bright side, load volumes should increase as another cycle begins in the freight market.

This article is based on the latest Freight Intel Group white paper, “2019 Freight Broker Outlook: Where are we in the freight broker cycle?”

As is the case with other reports and white papers from the FreightWaves Freight Intel Group, the entire report that this article is based on can be found on the FreightWaves SONAR site for SONAR subscribers.

For more information on the FreightWaves Freight Intel Group, please contact Kevin Hill at [email protected], Seth Holm at [email protected] or Andrew Cox at [email protected].