Truck parking survey highlights public awareness challenges

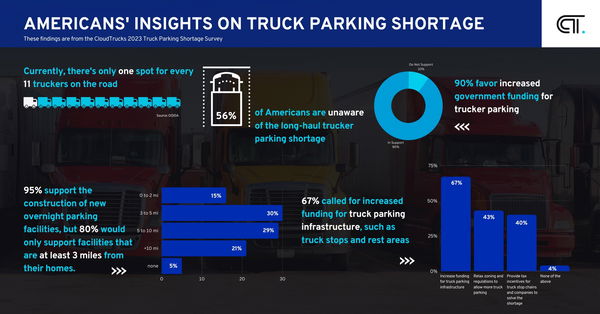

Last month, CloudTrucks surveyed 1,000 U.S. adults about general perceptions of truck drivers and if they have heard of the truck parking shortage. The results, published in CloudTrucks’ 2023 Truck Parking Shortage Survey, highlight that while Americans generally have a positive view of truck drivers, most respondents didn’t know that the parking shortage had a major impact on their quality of life.

One major challenge is that while respondents support additional truck parking, they just don’t want that parking near them. The report said: “When asked, ‘How close to your home would you support the construction of new overnight parking facilities for long-haul truckers?’ the majority (80%) only support facilities that are at least three miles from their homes, and 5% said they did not support new construction at all. Only 15% said they are comfortable with facilities being within 2 miles of their homes.”

NIMBYISM plagues many forms of property development and truck parking is not exempt. But there is some cause for hope. FreightWaves’ Mark Solomon wrote, “Despite the ‘not-in-my-backyard’ feedback, the survey’s findings gave CloudTrucks executives optimism that the public at least understands the problem. Tobenna Arodiogbu, co-founder and CEO of CloudTrucks, said it’s important to ensure the ‘resources provided to truck drivers are proportional to how much we value their service to our economy.’”

Understanding chassis usage with Karl Fillhouer

On Tuesday, FreightWaves interviewed Karl Fillhouer, vice president of sales and operations at Circle Logistics, about chassis usage and what it means for ocean carriers and trucking companies. Fillhouer outlined the history of how steamship lines originally controlled their own chassis and how large truckload carriers provide and utilize chassis in their operations.

One major challenge for chassis remains the lingering impact of pandemic-related production delays. Fillhouer noted the current wait time for a new chassis is around 18 months. Another challenge is related to access, with smaller carriers resorting to using leased chassis due to lack of access.

The leasing and renting of chassis is a lucrative business. Fillhouer noted private equity has taken particular interest in recent years with Apollo Global Management’s purchase of Direct ChassisLink Inc. (DCLI) in March 2019 for $2.5 billion.

FreightWaves’ John Paul Hampstead wrote about the purchase, pointing out “the shortage of intermodal chassis equipment in North America and its impact on port congestion has been widely covered in transportation media and should be considered a positive backdrop for DCLI’s core business, but note that intermodal volumes in the United States are heavily exposed to international trade.”

The episode also included the use of ChatGPT to create a monologue about the importance of chassis for container ships and trucking. The text was then converted via additional AI to mimic the host’s voice on air. The only deficiency was the AI’s inability to pronounce chassis correctly.

You can view the entire episode here.

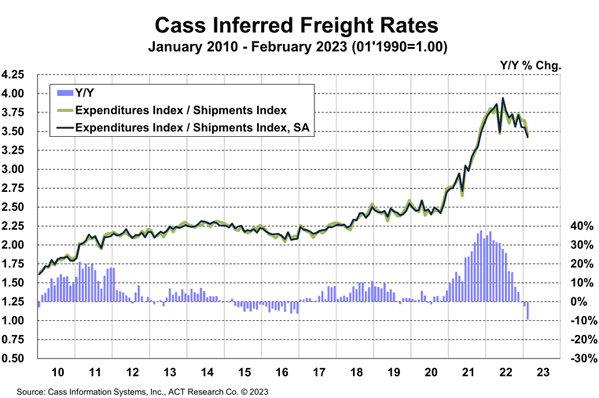

Market update: Cass February data shows freight rate slide

Data released Tuesday by payment processor Cass Information Systems suggests that while shipments rose, freight rates continued their downward trend in February.

Cass Inferred Freight Rate data, a calculation of the index’s expenditures divided by shipments, declined 9.4% year over year in February, after declining 2.4% in January. February month-over-month (m/m) freight rates were down 5.5% after remaining unchanged in January. The report estimated about 1% was due to lower fuel costs from diesel price declines, with three-month trailing diesel price declines lowering freight bills paid by around 6%.

The Cass Freight Index Shipments component rose 3.8% m/m in February after a 3.2% m/m decline in January. The report noted that soft retail sales, ongoing destocking and sharp import declines are the expected shipment environment for the coming months.

“At the risk of stating the obvious, the fundamental reason truckload spot rates are still falling is there are too many drivers chasing too little freight,” said ACT Research’s Tim Denoyer. “But the freight market is constantly dynamic, and we expect current loose conditions to first rebalance and then tighten over the course of the next year or so.”

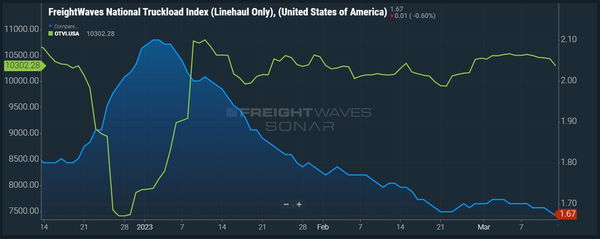

FreightWaves SONAR spotlight: Spot market linehaul rates continue gradual decline

Summary: Spot linehaul rates continue their gradual decline in spite of relatively stable outbound tender volumes. The National Truckload Index (Linehaul Only), or NTIL, is a seven-day moving average of daily spot rates less the cost of fuel. Fuel costs are based on the average retail price of diesel fuel and estimate the fuel efficiency at 6.5 miles per gallon.

Linehaul rates less fuel are a useful indicator of spot market activity, as many carriers that negotiate off the spot market with freight brokers are unable to negotiate a fuel surcharge. The falling spot rates continue to indicate excess truckload capacity relative to flattish truckload demand.

One concern for both carriers and brokers that utilize committed contracted freight is the tendency for shippers to tender fewer contracted loads and instead post them on the spot market for greater transportation cost savings. While tender rejection rates are a good indicator for truckload pricing power, it can be difficult for carriers and brokers to tell if a customer’s change in load volumes is due to fewer products to ship or if that freight is instead ending up on internal bid boards or spot market load boards.

The Routing Guide: Links from around the web

FMCSA proposes 9% cut in trucker registration fees for 2024 (FreightWaves)

3 red flags that could signal a double-brokerage scheme (Transport Dive)

Food giants cash in on ‘pet parents’ buying gourmet meals for ‘fur babies’ (FreightWaves)

Highway safety group calls for speed limiters on trucks, rolling back 2020 HOS changes, more (OverDrive)

Knight-Swift trailers keep aging as equipment market remains tight (Transport Dive)

Slowdown in E-Commerce Hitting Logistics Companies’ Payrolls, Experts Say (The Wall Street Journal)