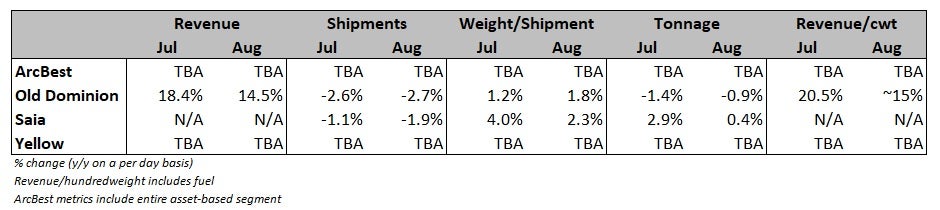

A couple of less-than-truckload carriers reported moderating trends Wednesday. Third-quarter updates from both Old Dominion Freight Line and Saia Inc. showed that the robust year-over-year (y/y) growth rates recorded over the last few quarters are continuing to slow.

Old Dominion (NASDAQ: ODFL) reported revenue was up 14.5% y/y in August, a growth rate that was 390 basis points (bps) lower than it recorded in July. Tonnage during the month was down 0.9% y/y following a 1.4% decline in July. Lower shipment counts were only partially offset by higher weight per shipment.

The August tonnage dip was worse than expected as some analysts were calling for a slight gain to as much as a mid-single-digit increase during the month. Part of the positive expectation was due to a perceived easier comp to 2021. Old Dominion’s tonnage was up just 10.9% y/y in August 2021, which was a slowdown from increases of 30% to high-teen percentages recorded from April to July 2021.

Higher revenue per hundredweight, or yield, drove the revenue increase for the carrier. Through the first two months of the quarter, Old Dominion’s yield was up 18.1% and 7.3% (excluding fuel surcharges) compared to the same period of 2021.

The industry’s yield metrics and margins continue to benefit from elevated fuel prices. However, on-highway diesel prices are down 5% on average sequentially in the third quarter and off 12% from the late June high of $5.81 per gallon. Old Dominion’s revenue per hundredweight was up 22.6% y/y (plus-9.3% excluding fuel) during the second quarter.

“Old Dominion produced solid revenue growth for the first two months of the third quarter,” Greg Gantt, president and CEO, stated in a news release. “While our volumes decreased on a year-over-year basis, we continued to improve our yield through the consistent execution of our yield management initiatives.”

While the y/y revenue and tonnage trends slowed from the second quarter — up 26.4% and 2.8%, respectively — Old Dominion has seen revenue increase at an industry-leading pace. Compared to 2020, revenue in July was 55.1% higher with August revenue up 43.6%.

Industrial-related freight accounts for roughly two-thirds of total tonnage for most LTL carriers. The Manufacturing Purchasing Managers’ Index remained unchanged at 52.8 in August. A reading above 50% indicates growth in the U.S. manufacturing sector. The latest reading marked 27 consecutive months of expansion but the lowest level of growth recorded since June 2020.

The Thursday Institute for Supply Management report showed new orders returned to growth mode, up 3.3 percentage points at 51.3. Overall, inventories (53.1) grew at a slower pace with customers’ inventories (38.9) remaining “too low.” The order backlog (53) remained in expansion territory.

Saia (NASDAQ: SAIA) also reported a moderation in y/y trends Wednesday. The carrier’s final results for July were in line with preliminary expectations as shipments were down 1.1% y/y with a 4% increase in weight per shipment pushing tonnage 2.9% higher in the month. August shipments were off 1.9% y/y with tonnage up just 0.4%.

Saia’s August result also trailed expectations from a couple of analysts, which ranged from up 2% to as much as up 6% y/y. By comparison, Saia’s tonnage during the second quarter was 2.8% higher y/y.

Saia does not provide revenue metrics in its intraquarter updates.

LTL stocks reacted negatively to the updates with ArcBest (NASDAQ: ARCB) leading the way, off 5.3% in midday trading Wednesday. Shares of SAIA were down 3.7%, Yellow Corp. (NASDAQ: YELL) was down 3.2% and Old Dominion was off 2%, compared to the S&P 500, which was up 0.9%.

ArcBest and Yellow are expected to release third-quarter updates this week.

More FreightWaves articles by Todd Maiden

- Transportation, logistics M&A not slowing down

- Transportation market loosens again in August

- Lineage Logistics grows distribution footprint in Europe

Dale Harp

How is YRC FREIGHT,S STOCK LOOKING?