This will be a carriers’ market as rates set for more rises

Containership markets are tightening deep in the third quarter as ocean freight rates are set for more increases in September. Market watchers say the service reduction cuts from the container lines are paying off as shipper demand moves into its seasonal peak.

The Freightos Global container index, a composite of container rates across global sailings, is near a 19-month of $1,672 per forty foot equivalent (ffe), a gain of 16% over the same rate last year.

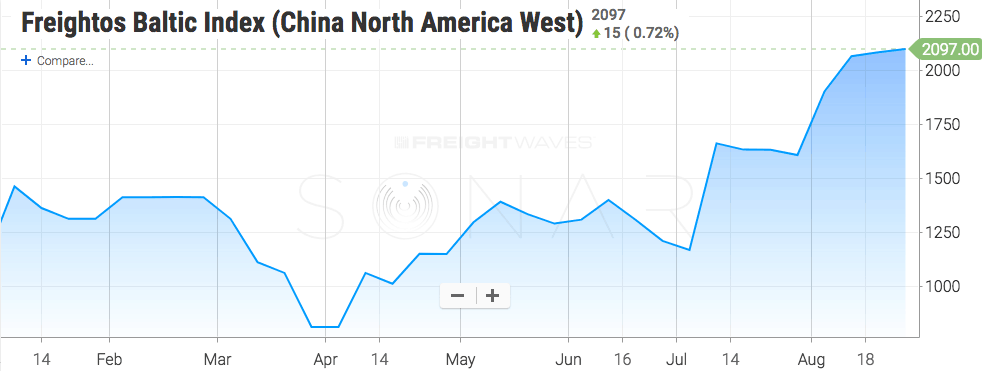

Drilling down into specific sailings, China/Asia-to-U.S. routes are leading much of those gains. Rates to the U.S. West Coast, available on SONAR under ticker FBX.CNAW, are up 30% year-on-year to $2,097 per ffe. The voyage to the U.S. East Coast, under ticker FBX.CNAE, shows a 32% gain year-on-year to $3,319 per ffe.

Those rates are likely to head higher, says Simon Heaney, senior manager of container research at maritime consultancy Drewry.

“With Asia-to-U.S. West Coast currently experiencing some capacity tightness – a combination of a tariff induced cargo rush, bad weather in Asia and earlier service suspensions – it is likely that spot rates will continue to rise while the situation lasts,” Heaney said.

As reported previously, supply and demand issues are buffeting shippers like few periods before. Retail sales in a strong U.S. economy are providing a tailwind, resulting in strong import activity to the U.S. But tighter shipping capacity and the worries over tariff threats are headwinds not seen in the market in a while.

A chief operating officer with a California-based freight forwarder, who spoke on background, says cargo owners and shippers he’s worked with started their peak season shipping earlier this year than in seasons past due to concerns about tariffs and worry that transportation capacity will not be available later in the third quarter.

“It might be related to front-loading as a result of tariffs, or some institutional memory from last year when peak pricing was sky high. There are also just a lot of product launches and e-commerce is taking up a lot of capacity, specifically in air,” the forwarder said.

He too echoes view that space is tighter especially on the busy trans-Pacific market.

The Ocean Alliance, which includes China’s Cosco and France’s CMA CGM, and THE Alliance, which includes Hapag-Lloyd, Japan’s Ocean Network Express, and Yang Ming, reduced sailings and are using smaller ships in that trade lane.

Those cuts amount to 6% of available capacity on the trans-Pacific, the COO said. That means a similar percentage of container shipments are being deferred to sailings a week or more after they were originally scheduled.

“We even hear of double rolls now, so 2 weeks later. We know for a fact that all ships are sailing 100% capacity on the trans-Pacific,” the COO said.

Joshua Brogan, vice president specializing in logistics at management consulting firm AT Kearney, estimates that shippers are facing 2% to 5% of containers being deferred to sailings a week or more later due to the tighter capacity.

Those deferrals are not causing too much pain in retail supply chains yet. But shippers may not have expected capacity to tighten so much after multiple quarters of oversupply in the container market.

Container rolling “is not something that shippers are too concerned about, but it’s definitely worse than it’s been in a while and it will probably get worse,” Brogan said. “I wouldn’t be surprised if we see more more rolling of containers as the peak season progresses.”

Brogan says ocean-based supply chains are getting more scrutiny after the West Coast port strikes of 2015 and the 2016 Hanjin bankruptcy upset container shipping. Now, BCOs and forwarders are spreading shipments across different carriers and ports so as to be less exposed to any one potential upset.

The strong growth in U.S. East Coast ports reflects that with double-digit growth seen along the Atlantic seaboard. He says shippers with less time-sensitive, lower value freight are opting for the Northeast and Southeast ports rather than the West Coast, which is a more expensive but faster option to reach U.S. markets.

A container from China might take three to four weeks to reach the U.S. Midwest through a west coast port. An east coast port transit, though, might take four to five weeks. But the shipping cost through Savannah to Atlanta or through New Jersey to Pennsylvania would be 25% less than through a west coast transit.

With more capacity available to the U.S. East coast, “it’s sort of a no brainer to start moving stuff through there,” Brogan said. “The trade off is that the transit time is not as good. In general, it can add a week or a week and half.”

For high turnover goods such as fast-fashion apparel, “the extra week is something to think about.”

Shippers have been changing their routing in an effort to speed up their imports to avoid a tariff. A New York-based manager for an Asian logistics provider says shippers are nominating U.S. West Coast discharge to bring in goods ahead of tariffs. Their reason being that intermodal transportation costs would be less than the tariff.

“I have heard of a couple of shippers that, instead of say, going to the U.S. East Coast or Houston, they are going to the West Coast and trying to figure it out from there,” the manager said. “They are definitely trying to front load shipments.”

Forwarders and shippers that reserve slots for later resale on container ships, the non-vessel operating common carrier (NVOCC), may be feeling the brunt of the tightness. The COO says many NVOCCs relied on excess capacity in the industry to sell container slots to customers on a spot basis, But ocean carriers are now bumping them in favor of contract customers with larger and regular container volumes.

“Many NVOCCs have played games with the carriers for many years, banking on excess supply,” the COO said. “They could double book, cancel, it was a free for all, boosting their profits and lowering returns for the carriers. That game is over.”

The New York-based manager also says the tightness expands to the land as shippers also face the problem of finding adequate truck capacity.

“It’s a perfect storm for shippers,” the manager said. “Front-end loading of containers, the drayage capacity crisis. All these companies are going to run into problems getting their container to a consignee.”