What will the daily savings be for a ship that has a scrubber installed, given the fuel spread on any particular day? That potentially multi-million-dollar question just got a lot easier to answer.

The IMO 2020 regulation, which goes into effect Jan. 1, will require all ships not equipped with exhaust-gas scrubbers to burn fuel with a sulfur content of 0.5% or less. Ships with scrubbers can continue to use cheaper 3.5% sulfur high-sulfur fuel oil (HSFO).

On Nov. 1, S&P Global Platts unveiled parallel dry bulk indices measuring rates that allow for daily comparisons of scrubber versus non-scrubber ship earnings.

The latest move follows the Oct. 1 introduction of the Platts Cape T4 Index, a weighted average of time-charter equivalent (TCE) assessments of four roundtrip voyages by so-called Capesize vessels (bulkers with a capacity of around 180,000 deadweight tons).

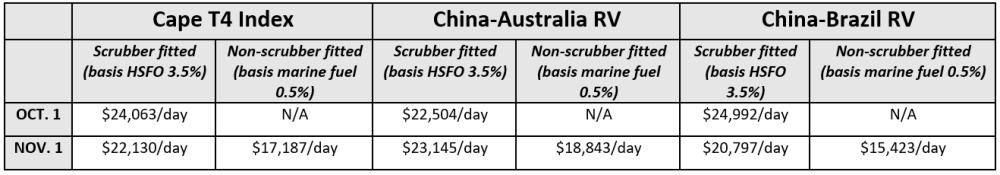

In response to a query from FreightWaves, Platts provided its inaugural scrubber versus non-scrubber assessments for the Platts Cape T4 Index as well as the two most important roundtrip voyages that comprise that index (China-Australia and China-Brazil).

What’s the spread?

Given the current price differential between 3.5% and 0.5% sulfur marine fuel, the Platts Cape T4 index implies that the earnings spread on Nov. 1 is $4,943 per day to the advantage of scrubber-equipped Capesizes. The spread is $4,302 on the China-Australia dual indices and $5,374 on the China-Brazil indices.

The current futures prices on ICE imply that these spreads should significantly widen. As of market close on Oct. 31, the spread between HSFO and 0.5% sulfur fuel – known as very low sulfur fuel oil (VLSFO) – was $202/ton in Amsterdam/Rotterdam/Antwerp (ARA) and $185/ton in Singapore.

The futures pricing implies the spread in the first quarter of 2020 will be up 28% in ARA and 38% in Singapore versus Oct. 31; and for full-year 2020, it will be up 15% in ARA and 24% in Singapore compared with Oct. 31.

Some prognosticators have argued that the futures spread is inaccurate because the post-IMO 2020 price of HSFO will be much higher than expected, given that operators of scrubber ships will have no choice but to buy this fuel type, regardless of price. The much more commonly held belief is that there will be far too much excess HSFO supply in the world and competition will cause prices to plummet, widening the spread.

One derivatives trader who declined to be identified told FreightWaves that if those making the low-spread argument are correct, “then the whole energy market participating in futures, including oil majors, must be idiots.” He added that those who believe the futures market is wrong “should be mortgaging their house and shorting this spread with everything they have – they would make a killing and could retire to a Greek island.”

Different methodologies

The undisputed champion in the world of dry bulk indices is London’s storied Baltic Exchange. By far the most famous shipping index in the world is the Baltic Dry Index. The Baltic Exchange has previously said that it would consider the creation of a scrubber index for bulkers, but it has yet to announce firm plans.

Platts’ Cape T4 Index is viewed as a direct competitor to the Baltic Exchange’s Capesize 5TC Index. The methodology used by the Baltic Exchange for its time-charter indices is very different than the methodology used by Platts.

In both cases, the measurement is time-charter equivalent or TCE. In a time-charter (TC) contract, the charterer pays for fuel and voyage expenses, and the contract is in dollars per day. In a spot voyage deal, the contract is in dollars per ton of cargo, and the vessel interest pays for fuel. To convert a spot contract to a TCE rate, various assumptions are made and the cost of fuel and other voyage expenses are added into the equation before it is converted to dollars per day.

The Baltic Exchange methodology starts with broker rate assessments of time charters, and when those are not available, extrapolates the TCE from spot rates. Platts comes at it from the opposite direction. It always uses the spot rate and converts to TCE.

How Platts’ parallel indices are derived

Given that IMO 2020 rules are not yet in force and the use of LSFO is not yet required, how is Platts already estimating the different rates for scrubber versus non-scrubber Capesizes? And how will it do so after January 1?

FreightWaves asked Platts whether its price reporting of spot rates takes into account whether a cargo is carried on a scrubber ship or a non-scrubber ship.

“The answer to your question is ‘no,’” responded Alex Younevitch, managing editor of freight markets at S&P Global Platts. “Both scrubber and non-scrubber TCE indexes are fed by the same dollars-per-ton freight rates, on respective routes, which we assess daily.”

Younevitch added, “So, the dollar per ton rate for a specific route would feed both scrubber and non-scrubber TCE rates for the same trade. The difference between scrubber and non-scrubber TCE indexes will mostly depend on the difference between VLSFO and 3.5% bunker prices,” he continued.

This methodology implies that the dollars-per-day spread between the scrubber and non-scrubber Platts TCE indices will generally move in parallel with the dollars-per-ton spread between HSFO and VLSFO. But numerous industry executives have stated that in the real-world TC market, a ship owner with a scrubber will not recoup all of the price advantage of being able to burn HSFO versus VLSO. Rather, some of the fuel savings would be shared with the charterer.

According to Younevitch, “The spread between traded TC rates in the real world does not really matter as far as the use of the [Platts] TCE benchmark goes. The point of a benchmark is to represent a line in the sand, which is as close as possible to the general market situation, [and to] be transparent and standardize the underlying trade.”

He further explained, “If counterparties agree to use a scrubber TCE benchmark as a basis for a freight contract, they can apply a premium or discount to it, depending on their view on where the spread between TC rates should be, specific circumstances – like specs of the vessel in each particular case – and, most importantly, respective negotiating power.”

Even if the Platts spread might not represent the real-world TC spread, Younevitch maintained that “it’s as close as standardized benchmarks can do, based on specific, transparent assumptions. It is then up to market participants to use the benchmarks themselves or spread between them, depending on their view of the market and specific circumstances.” More FreightWaves/American Shipper articles by Greg Miller