The highlights from Wednesday’s SONAR reports are below. For more information on SONAR — the fastest freight-forecasting platform in the industry — or to request a demo, click here. Also, be sure to check out the latest SONAR update, TRAC — the freshest spot rate data in the industry.

Market watch

Elizabeth, New Jersey

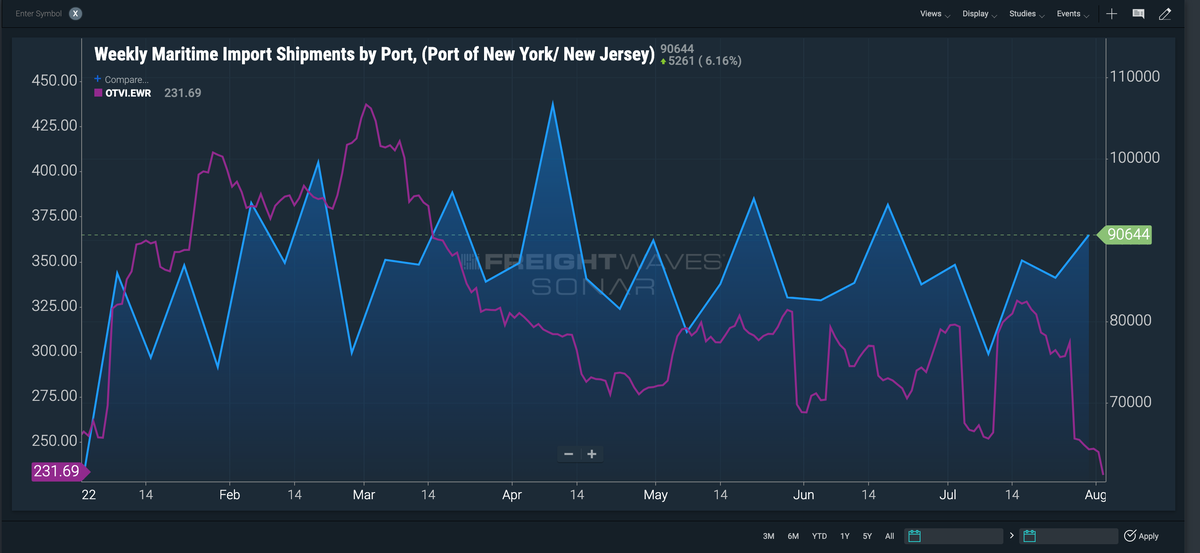

Outbound tender volumes in Elizabeth have fallen dramatically in the last couple of weeks, as the Port of New York and New Jersey faces record import volumes.

Containerized imports to the port have risen 18% in recent weeks, but outbound truckload volumes in Elizabeth have fallen 23%.

This has created excess trucking capacity in Elizabeth as the outbound tender rejection rate has fallen 175 basis points since July 21 and now sits at 5.2%.

Philadelphia

A traditional backhaul market, Philadelphia’s headhaul index has remained positive for almost all of 2022. Inbound tender volumes have been running slightly higher than outbound tender volumes, which is a positive sign.

Both inbound and outbound loads have begun a free fall in the past few days. Outbound tender volumes are down 7.5% since Monday, while inbound tender volumes are down 9.1%. Two days does not make a trend, but be careful about committing to loads in or out of Philadelphia as the market could continue falling over the near term.

Columbia, South Carolina

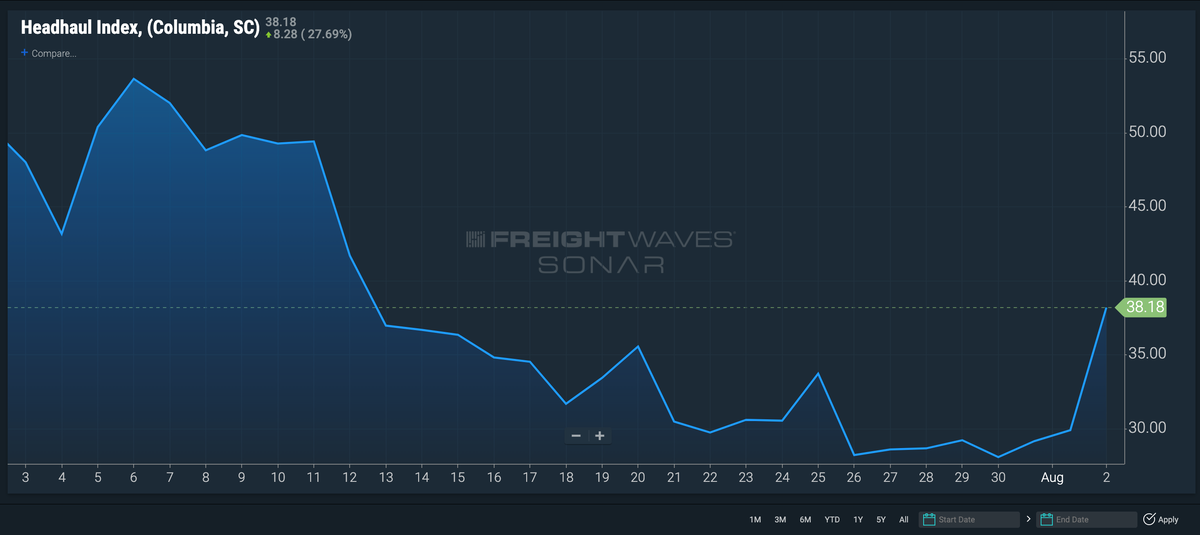

On the southern end of the East Coast, Columbia is seeing its freight market come back to life.

Outbound volumes in Columbia are up 14.3% since July 26, while inbound tender volumes remain flat. The difference now between outbound and inbound tender volumes has pushed Columbia’s Headhaul Index upward 9.9% to 38.18, its highest level since mid-July but still well below its year-to-date high of 69.06 on March 8.

While Columbia’s headhaul score has increased, like most markets in 2022, imbalances in outbound and inbound tenders are not moving tender rejections, which remain steady at 4.54% but well below the national average.

NTI as a point of reference

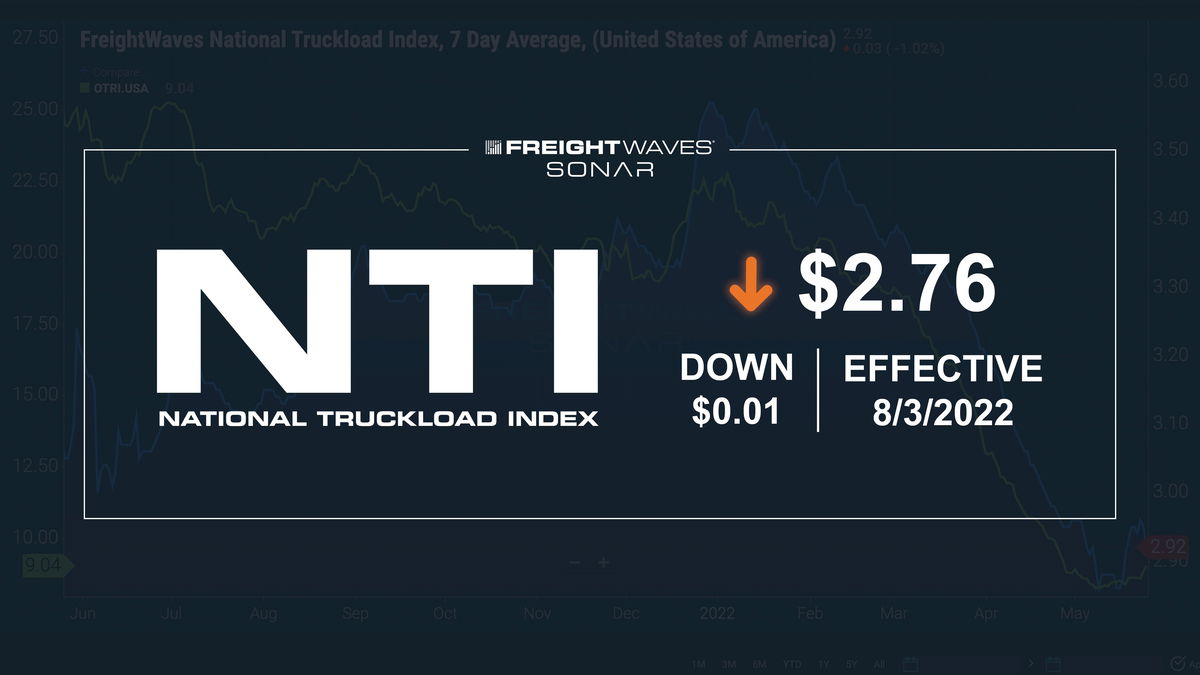

The National Truckload Index is a daily look at how spot rates in specific lanes hold up in comparison to the national average, giving carriers and brokers an idea of which lanes to gravitate toward or avoid.

Lane to watch: Cincinnati to Columbia

Cincinnati has seen a 5% increase in outbound volumes so far in the first few days of August, and spot market rates out of the Ohio city and into Columbia have remained consistently above the national average of $2.76.

FreightWaves’ TRAC Market Dashboard gives this lane a confidence score of 3, so there is some room for volatility within these rates, but they have remained consistent for the last three months.

Also, given the uptick in outbound volume in Columbia, there is a good chance of booking a load afterward. And since this is only a recent increase in volume, rates have not yet begun to receive downward pressure, allowing carriers to receive the same rate but with better outcomes.

Sarah Elizabeth

I earned $15000 last month by working online just for 5 to 8 hours on my laptop and this was so easy that i myself could not believe before working on this site. If You too want to earn such a big money then come and join us..