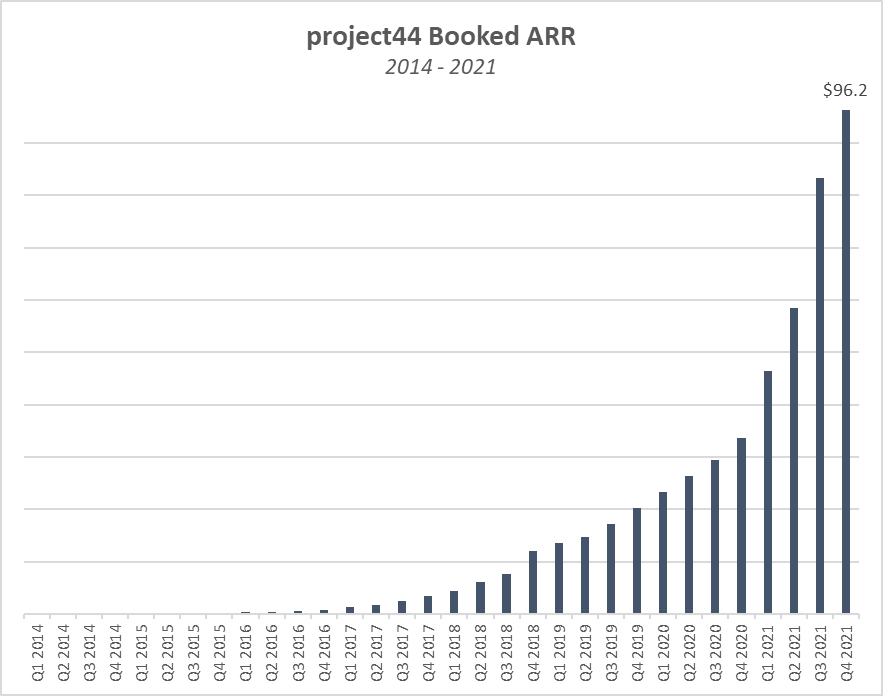

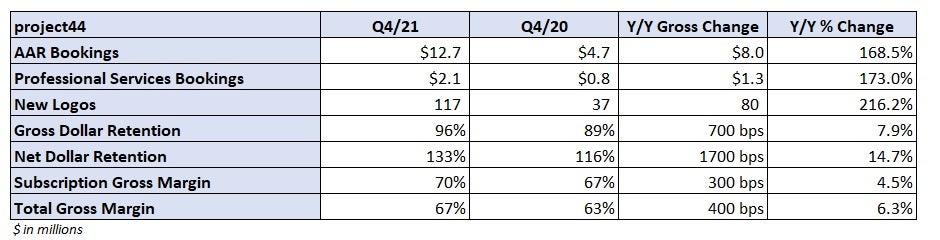

Real-time supply chain visibility provider project44 reported record quarterly bookings during the fourth quarter. The privately held, venture-backed company said annual recurring revenue (ARR) bookings were $12.7 million during the period, 168% higher year-over-year and 3% above plan.

The fourth-quarter result put total 2021 ARR bookings at $96.2 million for the Chicago-based company.

Professional services bookings were $2.1 million in the period. Consolidated revenue as defined by generally accepted accounting principles was $18 million in the quarter.

“We had a record-breaking quarter across all major bookings, financial and customer metrics, Jett McCandless, founder and CEO, told FreightWaves in an interview. “ARR bookings of $12.7 million beat our previous quarter high by almost $2.7 million.

“Our network has grown to 140,000 carriers, up 60% year-over-year, and 2.9 million trackable assets. We also released Cooperative in early Q4, the first data-driven solution in the market to increase transparency in the freight management process,” McCandless added.

Cooperative was launched in mid-October. It allows third-party logistics providers to get carrier info via application programming interface integration 48 hours ahead of when a carrier will be available for a load.

The company added 117 new logos, also a quarterly record, with agreements from shippers (more than four times higher than the year-ago quarter at 61) driving the increase. Management said its win rate against competitor FourKites was 93% on a logo basis (80% on a ARR comp) as it won 42 deals and lost three.

Historically, project44’s customer base has been shippers whereas FourKites has traditionally sold to 3PLs.

As new accounts were onboarded, there was little attrition. Gross dollar retention was above plan at 96% with net retention coming in at 133%.

“Supply chain issues are front-page news and a topic of conversation in board rooms around the globe,” McCandless continued. “The resurgence of COVID, port congestion/shutdowns, rising shipping costs, and a myriad of other issues has created urgency in customers who are looking to digitize and fortify their supply chains.

“Project44 is uniquely positioned to support these efforts as the clear, global leader in the industry, which has led to five consecutive quarters of record new ARR bookings, and we are booking more new ARR than our closest competitors combined.”

Project44 has also seen efficiency gains across the company. Subscription gross margin was 70% exiting 2021, a 300-basis-point increase year-over-year. Total gross margin improved by 400 bps to 67%. Platform improvements and the acquisition of high-margin businesses were key drivers of the improvement.

Project44’s go-to-market function continues to scale as well, with its magic number (current quarter net bookings divided by prior quarter sales and marketing expense) at 1.4x during the fourth quarter. Typically, a number of 0.7x or better is viewed as healthy.

The growth trend for bookings is expected to continue.

Project44 is guiding contract values to represent $109 million in ARR by the end of the first quarter. McCandless said higher demand, rising win rates and a number of late-stage deals in the pipeline will drive the improvement. He also noted geographic expansion and cross-sell opportunities at recently acquired companies as catalysts.

In September, project44 acquired Convey, a last-mile tech company, for $255 million. It bought ClearMetal, which focuses on international freight visibility and predictive planning, in May and added Ocean Insights, an ocean vessel tracking company, in March.

“We will continue to focus on taking market share and providing value to our customers. One of our five Values at p44 is: ‘Obsess over the customer.’ That is the gravity of the business,” McCandless concluded.

- Warehouse, transportation capacity tight with retailers potentially ‘over-ordering’

- Schneider adds dedicated fleet in $263M deal

- Trinity Logistics expands territory with Team Eagle Logistics acquisition