Is the shift in global crude flows due to the Ukraine-Russia war a fleeting event or the start of a new era?

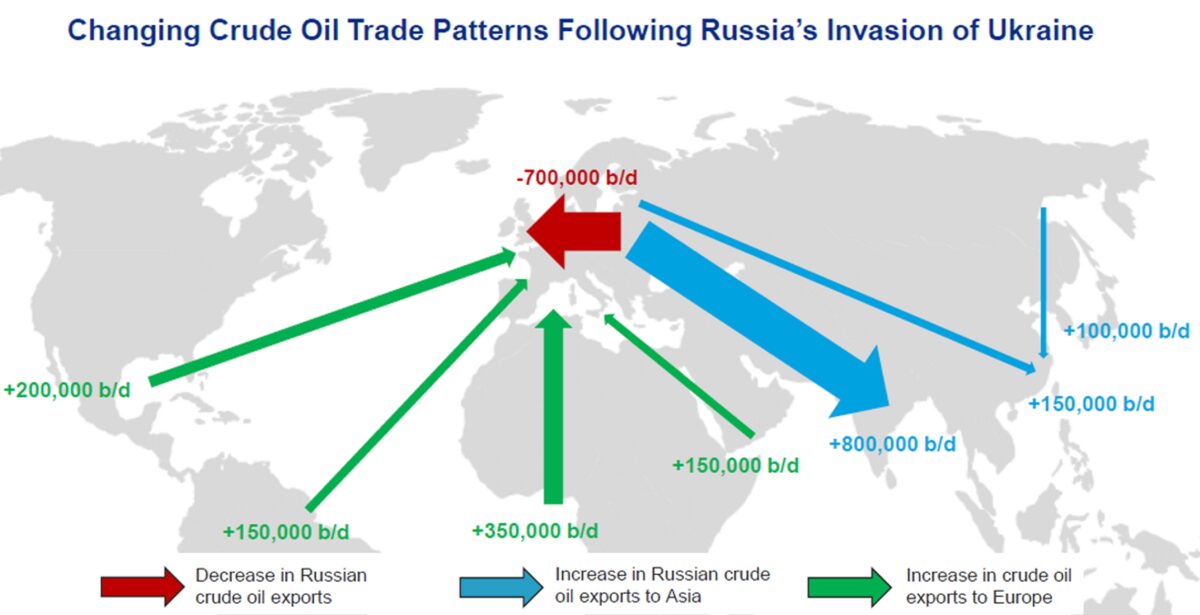

At first, many market watchers and investors viewed it as short-lived. It now seems like something to count on for at least the medium term. More Russian crude will likely head to India and China for a longer period of time, and more Atlantic Basin and Middle East crude will head to Europe to replace Russian barrels.

“Oil supply chain disruptions related to Russia’s invasion of Ukraine are proving to be durable and marked by significantly longer average voyages,” said Steward Andrade, CFO of Teekay Tankers (NYSE: TNK), during Thursday’s quarterly conference call. “These trade pattern changes are likely to be long-lasting.”

Executives of Euronav (NYSE: EURN) highlighted the same point on their quarterly call on Thursday. According to Brian Gallagher, Euronav’s head of investor relations, “This isn’t some event that happens over a few weeks. There’s a longevity to the structural change.”

Only the beginning

The EU ban on crude oil and petroleum product imports doesn’t take effect until Dec. 5 for seaborne shipments and Feb. 5, 2023, for pipeline imports.

As of now, Europe is still importing large quantities of Russian crude. Pre-invasion, volumes were around 4 million barrels per day (b/d). Various estimates put the reduction to date at around 700,000 to 1 million b/d. Tanker effects are already significant despite the transition being just one-quarter complete.

“We are only seeing the beginning of a story that will have a long tail,” said Euronav CEO Hugo De Stoop.

Upside for smaller and midsize tankers

War-driven trade changes have mainly impacted smaller tankers known as Aframaxes (with capacity of 750,000 barrels) and midsize Suezmaxes (1 million barrels). Larger tankers known as very large crude carriers (VLCCs, with capacity of 2 million barrels) are too big to call at Russian terminals.

Andrade explained, “Short-haul exports of Russian crude oil to Europe have fallen by around 700,000 b/d compared to pre-invasion levels, with Russian crude oil increasingly being diverted to destinations east of Suez, particularly to India and China.

“Europe is having to replace short-haul Russian barrels with imports from other regions, most notably from the U.S. Gulf, Latin America, West Africa and the Middle East. These changes are primarily benefiting Aframax and Suezmax tankers due to the load and discharge regions involved.”

“When oil imported into Europe previously came five days from the Baltic and now comes approximately 20 days from the Middle East on a Suezmax or approximately 20 days from the U.S. Gulf on an Aframax, that is obviously helpful for ton-mile demand.”

Tanker demand is measured in ton-miles: volume multiplied by distance. The longer the average distance, the more tankers you need to carry the same volume.

“When China imports oil from the Baltic on Aframaxes — which we’ve seen recently — it’s another example of increased ton-mile demand due to changing trade patterns,” added Andrade.

More ship-to-ship transfers to VLCCs?

Euronav expects the war effect to benefit VLCCs as well, for two reasons: because of ship-to-ship transfers in the Russia-to-Asia trade and because of the strong interconnection between Suezmax and VLCC markets.

“The most efficient way to transport crude oil over long distances is obviously on a VLCC. So ideally, they would do transshipment,” said De Stoop, referring to Aframaxes or Suezmaxes loading in Russia and transferring cargo to VLCCs.

“We’ve already seen a few of those, largely off Africa. We’ve also seen cargo being discharged in Libya and Egypt for relatively short periods then lifted again on bigger ships. The part of the industry that can do that [carry Russian oil] is trying to find the most efficient way to carry that oil to the Far East.”

Suezmax-VLCC connection

Meanwhile, if Suezmax rates rise too high versus VLCC rates, oil shippers traditionally combine two Suezmax cargoes into one lot and use a VLCC instead.

“There are a lot of markets where two Suezmax cargoes can go into one VLCC, so you have this push-pull effect,” said De Stoop. “When the Suezmax market is doing very well, and is seeing many more cargoes, that would naturally have a knock-on effect on the VLCC market. Those two markets are really, really interconnected.

“When we speak to the chartering desks of our clients, it’s usually the same people [booking Suezmaxes and VLCCs] and they monitor the price of one versus the other. In the last two or three weeks, we have seen a lot of cargoes that were shown to our Suezmax desk and then they disappeared and popped up in the [VLCC] pool. Two cargoes were being combined in order to be carried by a VLCC.

“Normally, it’s the VLCC segment that is doing the heavy lifting for all the other segments. This time around — because the disruption is coming from Russia and Russia is not a VLCC market — the pushing is coming from the smaller sizes.

“The Aframaxes are pushing the Suezmaxes and the Suezmaxes are now pushing the VLCCs. Simply because when you compare rates of Suezmaxes to VLCCs, it’s a lot cheaper to use VLCCs. [According to Clarksons, Suezmax rates are currently 30% higher.]

“And that’s what we have seen in recent weeks. That’s the main reason why we believe the VLCC market improved after the Suezmax had already improved.”

Tanker earnings roundup

The VLCC market may be improving, but it was extremely weak in the second quarter and the early part of the third quarter.

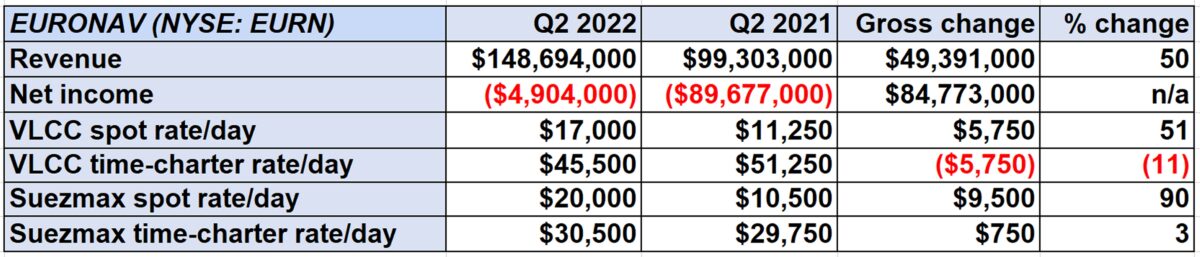

Euronav, which owns VLCCs and Suezmaxes, reported a net loss of $4.9 million for Q2 2022 compared to a net loss of $89.7 million in Q2 2021. Its adjusted loss of 12 cents per share was just shy of the consensus outlook for a loss of 11 cents.

Euronav’s VLCCs earned an average of $17,000 per day in Q2 2022. So far in the third quarter, the company has 47% of available VLCC days booked at a significantly lower rate: only $12,700 per day. De Stoop attributed this to longer-haul voyages booked during a period of weak rates and VLCCs employed on lower-earning repositioning voyages.

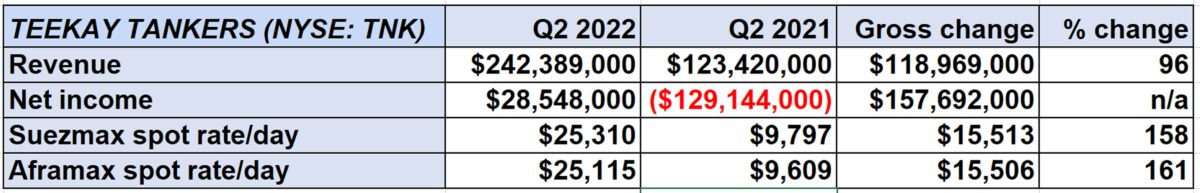

Teekay Tankers — which owns a fleet of Suezmaxes, Aframaxes and product tankers — reported net income of $28.5 million for Q2 2022 versus a net loss of $129.1 million in Q2 2021. Adjusted earnings per share of 76 cents topped the consensus forecast for 61 cents.

Teekay’s spot-trading Suezmaxes earned $25,310 per day in Q2 2022. So far in the third quarter, the company has 43% of its available Suezmax days booked at an even higher average rate: $29,600 per day.

Click for more articles by Greg Miller

Related articles:

- US exports of crude oil and diesel are climbing even higher

- In topsy-turvy commodity trades, small ships outperform big ships

- Tankers carrying diesel and gasoline rake in cash amid pain at the pump

- How new EU sanctions on Russia will shake up global energy trade

- Russia tanker business is alive and well. Oil exports ‘remain strong’

- The world is ‘crying out for diesel.’ Product tankers could win big

Cheryl75

Get this Administration out. Blue has literally destroyed American lives!