Heads of trucking companies remain constructive on peak season and contractual rates all the while acknowledging the macroeconomic environment has clearly slowed over the last several weeks. After nearly two years of operating in peak-like conditions every day, management teams appear to be embracing the opportunity to operate in a more normalized freight environment.

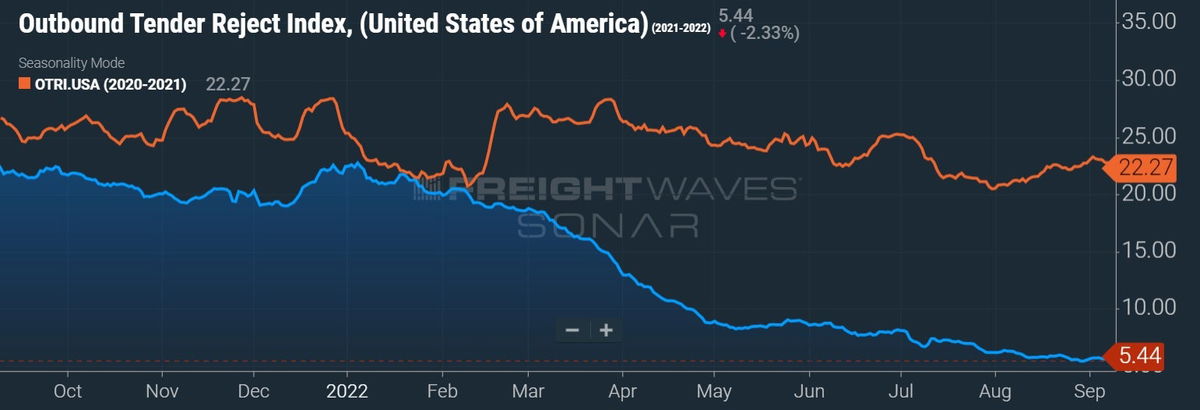

The spot truckload market has loosened significantly since the spring. Many drivers made the leap to operating under their own authority last year as spot rates reached new highs. However, many of those first-time entrepreneurs are struggling to not only find loads but also rates that will cover their rising costs.

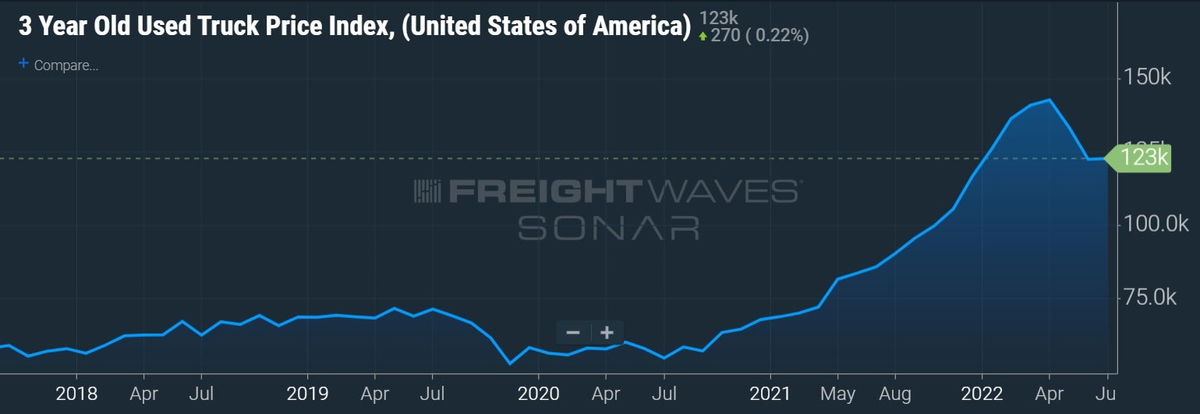

New operators bought equipment at the peak of the market, meaning they overpaid. Some also modeled their new ventures off of best-ever spot rates and are now having difficulty servicing inflated debt payments and navigating inflation in all areas, including supplies, insurance and fuel.

“I think a lot of folks have woken up to the reality that you simply can’t pay what was being paid for used equipment, driver pay, etc. and then go chase spot rates that have declined 40% year to date. You’re not going to last very long in that environment,” Derek Leathers, chairman, president and CEO of Werner Enterprises (NASDAQ: WERN), explained to investors at Cowen’s transportation conference on Wednesday.

“It’s a troubling place to be and if that’s where your business is operating … you’ve got a shrinking bowl of freight with a large level of participants.”

Too much capacity?

Leathers thinks some of the capacity that was added wasn’t necessarily incremental and is leaving just as fast as it showed up. He pointed to a reduction in net activations of Department of Transportation authorities, which have been in decline for 13 straight weeks (totaling more than 40,000 units).

Further he believes the “added capacity” was more of a “migration out of owner-operator models or company-driver models into these new registrants that were chasing this robust market.” Now that the market has soured and costs are at all-time highs, this group is moving back to company fleets, which may be inflating employee counts throughout the industry.

“But did that actually add any actual rolling stock? It’s hard to say it did with the production levels we’ve been making over the last couple of years as an industry,” Leathers said.

When discussing production headwinds at the OEMs and overall changes to supply, Mark Rourke, CEO and president at Schneider National (NYSE: SNDR), said he doesn’t see much changing in terms of new equipment coming into the market.

“2023 is not going to be any materially different than what we’ve experienced in ’21 and ’22,” said Rourke, referring to both tractor and trailer production. He said constraints at the OEMs have placed a cap on incremental supply, which typically leads to the end of most trucking upcycles.

“I think the math is just clear. We’ve got multiple years of sub-replacement level builds,” Leathers added.

Both carriers want to allocate more capital toward refreshing their tractor and trailer fleets. Werner’s average tractor is now 2.2 years old, and management believes it will take a year or two to lower the age to two years, which it views as the optimal number for managing maintenance expenses.

Schneider also wants to lower its fleet age but said doing so will likely extend beyond 2023. The company’s current guidance calls for net capex of $500 million this year. It is using that number as a placeholder for next year’s budget with hopes of surpassing it.

Supply constraints, cost inflation provide ‘floor’ for contract rates

Rourke said Schneider is accepting most contract tenders each day and that truck capacity and loads are closer to in sync than they have been in several quarters. The bulk of the carrier’s truckload business is contracted with spot freight representing only a mid- to high-single-digit percentage of the mix.

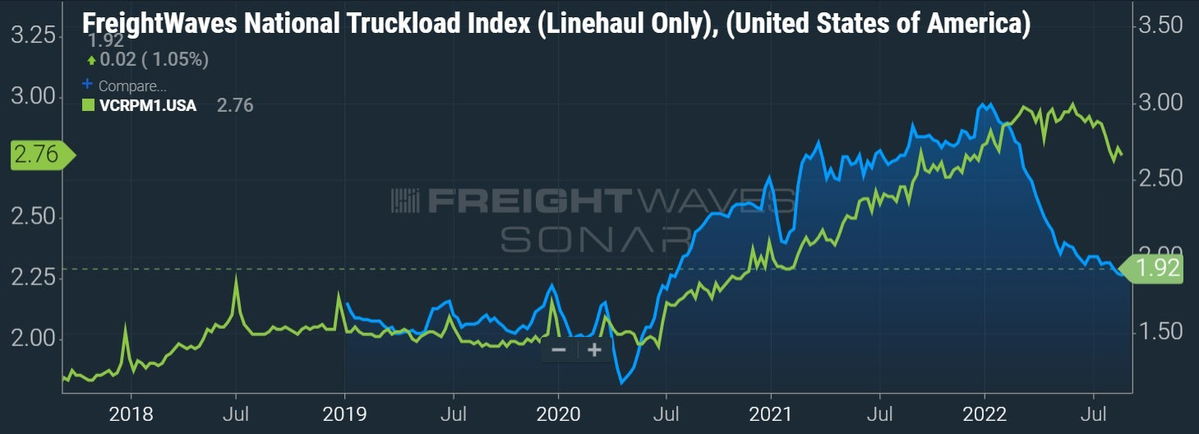

When pressed on how long contract rates can hold before following the path of spot rates – which typically occurs in most cycles — Rourke said a support level for contract rates has likely been established due to higher carrier expenses.

“Inflation … particularly around driver wages, which is the highest [expense] element of our income statement … equipment availability, equipment cost, maintenance, you name it, I think all of those are here for a while, and I think they put a floor on where [price] can reasonably go.”

The higher cost profile for “truck, trailer, tire, fuel, labor” and the inability for OEM production schedules to close the demand gap has Leathers believing contract pricing will remain firm. He said the typical lag between spot and contract rates is still six to nine months, which puts the potential inflection point around next year’s bid season.

“If we keep seeing attrition in this net activation level that we’ve been seeing over the next several months, if you see the consumer kind of come back off the couch and get more engaged in the economy because they still have dry powder, they still have savings rates that are still in excess of pre-pandemic levels … I think there’s a lot of different ways you could end up positive next year.”

He said they’re preparing for all scenarios currently and working on lowering costs and improving freight mix and yields.

What about peak season?

Rourke is calling for the 2022 peak season to be more like the ones seen in 2018 and 2019. “A little more murkier picture today than we’ve had the last couple of years … Certainly it’s not as crazy and chaotic as we experienced.”

He said freight demand will ultimately come down to the amount of promotional activity retailers have to use to drive sales. That will determine the amount of project freight Schneider sees, which can determine how strong the peak will be.

“I think we’re seeing more robust expectations in our e-commerce customer base, some of our off-price retail customers. I think you could likely throw the extreme-value of retail into that category. We also have some other customers that aren’t as sure,” he added.

Leathers hopes to get a freight bump as consumers move down the value chain to combat inflation. That historically aligns well with the discount stores Werner serves.

“I don’t think it’s quite as clear as any of us would like it to be,” Leathers said, noting that peak season is “still coming together.”

“I think what’s safe to say at this point is that peak season this year is not going to shape up with the amount of project opportunities as it did in ’21 and ’20,” Leathers continued. “I think it’s too early to say that it won’t replicate kind of pre-pandemic peak-season levels.”

More FreightWaves articles by Todd Maiden

- ArcBest update shows signs of moderation; Saia EPS estimates cut

- LTL stocks sag on weaker-than-expected Q3 updates

- Transportation, logistics M&A not slowing down

Craig Leonard

Does Rourke really think that his cost structure is what sets a floor for rates? Tell that to owner operators right now. It shocks me he thinks shippers will not follow his lead from the last two years and go deep into the spot market. The shipper does not care what his costs are. They need to recover from the rates they have been paying and they have an easy out right now,

Carolyn Watson

The freight rates offered to Owner Operators are despicable. The cost for fuel is outrageous. There needs to be an increase in rates. We are completely blown away by companies offering anything less than $3.00 a mile. Actually we are insulted. Cost to drive our truck with current fuel prices is $1.25 a mile. Throw in insurance, tires, tolls, IFTA, registration, heavy weight vehicle tax…do i need to go on? SOS – When Trump was in office we were heading towards transparency with Brokers, what happened to that? Both CH Robinson and JB Hunt were on truckers radio bragging about their record profits. I think that extra money for loads was ment for the additional cost of disel – not for the executives. Anyway – SOS – rates need to be better.

ThaGearjammer25/8

Thanks for the great article. From my understanding when the game changes. It’s the little guy of today that pops up outa no where and becomes the big carrier of tomorrow. All that money power fame it won’t mean a thing.

Stephen Webster

in parts of ont 10% of owners ops say they will leave when elogs come in.🇨🇦 we have no shortage of drivers except for hauling grain from the field Sept 20 to Nov 10 in ont. We do not need to allow large trucking companies to bring in foreign drivers often as students . The same trucking industry refuses to pay for sick days and long-term rehab saying that it will take too much of their profits. Also say drivers in rehab will make a truck driver shortage?