Welcome to Check Call, our corner of the internet for all things 3PL, freight broker and supply chain. Check Call the podcast comes out every Tuesday at 12:30 p.m. EST. Catch up on previous episodes here. If this was forwarded to you, sign up for Check Call the newsletter here.

Inside this edition: It’s time for Lunar New Year stoppages; rent is on the rise; and big promotions in the logistics world.

This weekend marks the beginning of Lunar New Year, the celebration of the arrival of spring and the beginning of a new year on the lunisolar calendar. 2023 is the year of the rabbit. The year of the rabbit occurs every 12 years and symbolizes longevity, positivity, auspiciousness, wittiness, cautiousness, cleverness, deftness and self-protection. We can expect relaxation, fluidity, quietness and contemplation. I for one feel that the freight markets could use a little relaxation.

Lunar New Year only lasts a week, but factories tend to close for two weeks to a month before to allow factory workers time to spend with their families. This closure does mean that goods from the factories will not be delivered to ports, which in turn means goods will not be imported to the U.S. Factories will likely reopen on Feb. 5 after the Lantern Festival.

Ideally, preparations will have been made a few months or weeks ago to combat any potential supply chain disruptions that can occur at this time. Shippers that are familiar with manufacturing in China should be used to this. However, now that COVID restrictions have been lifted in China, workers are actually able to visit home and spend time with families for potentially the first time in a few years.

Rent is on the rise. Prologis, the logistics warehouse owner and operator, has said demand for space remains firm and there is little indication that there will be a meaningful slowdown in demand for space. Current occupancy rates for its properties are at 98.2%, with almost all space either under lease or in negotiation.

The market has stabilized and as a result demand isn’t sky high, but it’s not exactly nonexistent either. Demand for warehouse space is still prevalent but in less of a “we need to get this space now or else we will be stuck with nothing” kind of way. Short of a massive event, rent will be expected to rise and space will still be at a premium. If you’re one of the unlucky souls who has to search for warehouse space in this environment, I’d put a pep in that step to ensure you get space at a reasonable price.

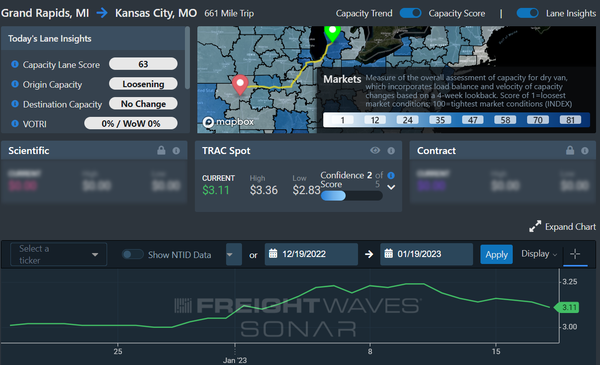

TRAC Thursday. This week’s TRAC lane is from Grand Rapids, Michigan, to Kansas City, Missouri. Capacity is loosening in Grand Rapids given that outbound tender rejections are dropping 225 basis points week over week. This lane is likely headed back to the $3-a-mile range. If there will be any change to that indication, watch for the Outbound Tender Rejection Index to increase as that will take spot rates with it. With loosening capacity, tender lead times are as high of a priority as it should be easier to find capacity.

Who’s with whom? Executive leadership teams have had some big developments lately. There are two particularly exciting developments in the supply chain world going down. The first one is OneRail. OneRail has added Shawna Baker as its new VP of partnerships and business development. Baker has 17 years of experience in assembling and motivating high-performing teams. Bill Cantania, founder and CEO of OneRail, said, “Adding industry luminaries like Shawna will become the difference-maker in how the industry views our trajectory in the market, and her proven experience will be a tremendous asset to us as we continue to scale our business.”

The other big mover is Circle Logistics. It has promoted Derek Holst from vice president of sales and operations to senior vice president. Holst is responsible for managing the day-to-day operations of the company’s headquarters in Fort Wayne, Indiana. “Derek is an exceptional leader who cares about being a solution for shippers and carriers seeking to move quality loads successfully at the best price,” said Eric Fortmeyer, president and CEO of Circle Logistics.

The more you know

J.B. Hunt hopeful for Q2 demand inflection

Logistics giant Ryder to lay off 800 workers in Texas

Nulogy partners with CEVA Logistics

FedEx preps to further reduce Sunday delivery services

Bank of America bullish on TL stocks as ‘truck demand near floor’