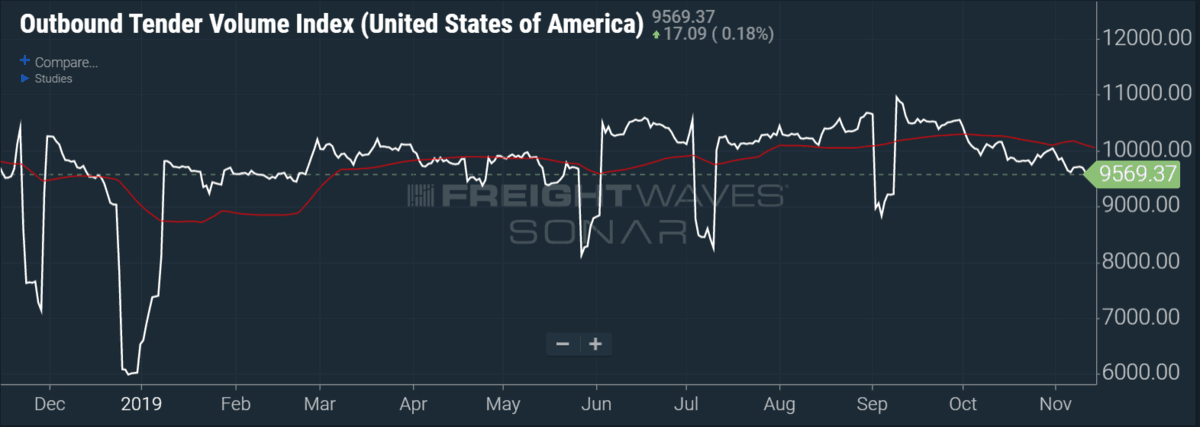

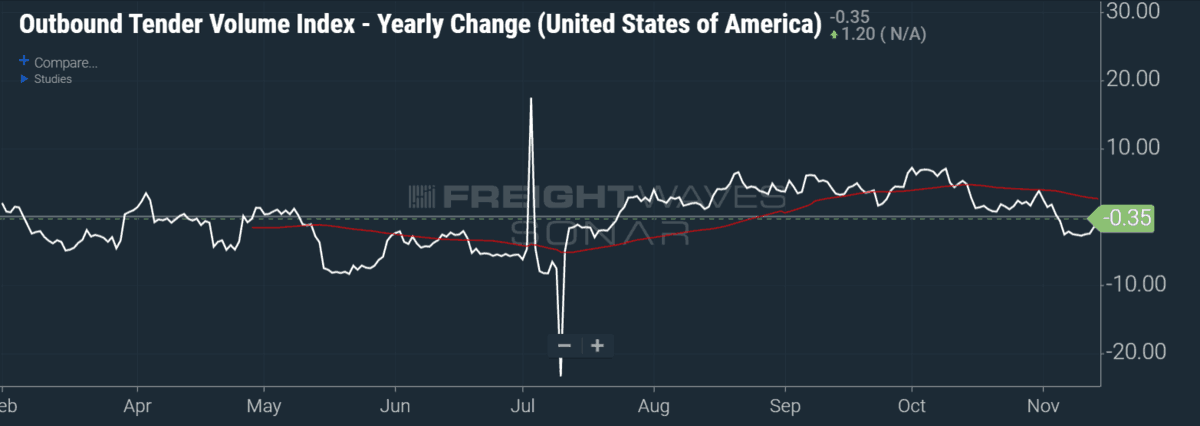

Outbound tender volumes (OTVI.USA) fell by 0.35% year-over-year this week and now sit well off the year-to-date high of 6.78% from early October. Volumes have been in a consistent downtrend for the last several weeks. Most importantly, this week’s negative results in volumes are the second straight week of breaking a nearly three-month “winning streak” of positive volumes dating back to late July, when OTVI first crossed over to positive on July 24.

Nationally, outbound tender volumes fell 0.35% year-over-year this week. Month-over-month volumes are tracking down 3.08%, while week-over-week volumes are down 1.29%. As we enter the heart of peak season, it seems fair to now question if we are going to actually have a peak season at all. This is a stark reversal from a month ago when things were looking up, but this can be a volatile index so all is not lost yet.

On a market-by-market basis, seven of the 15 major markets FreightWaves tracks were positive on a week-over-week basis. On the upside, Memphis, Tennessee, led the way, up 13.28%, followed by Cleveland, up 7.05%, and Chicago, up 6.16%. On the downside, the worst markets week-over-week included Ontario, California, down 6.86%, Miami, down 5.65%, and Fresno, California, down 5.65%.

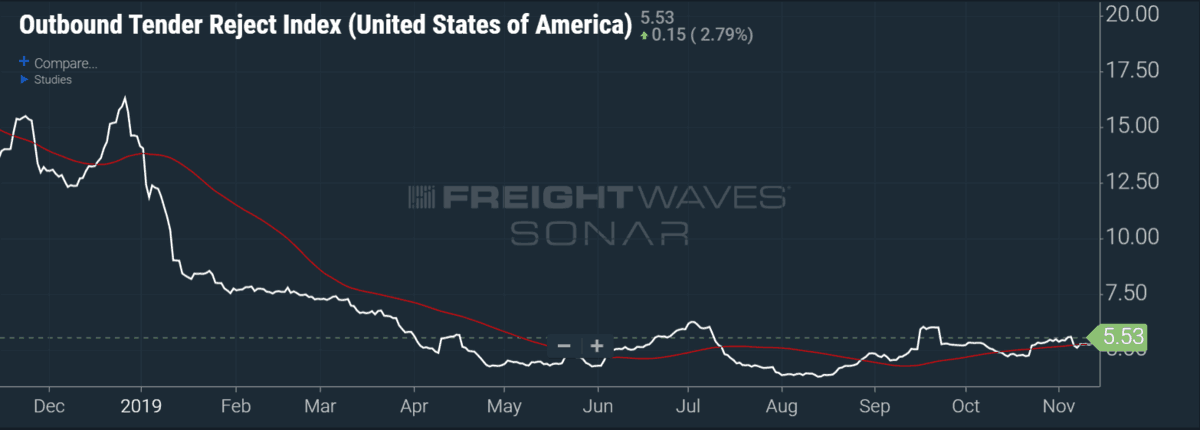

National rejection rates rise this week

National tender rejections now sit at 5.53%. The tender rejection story has been much slower to develop, likely a reflection of stubbornly high capacity in the market. This week actually brought positive news on this front with rejections rising 44 basis points (bps) week-over-week.

OTRI.USA briefly broke above the 6% level for the first time since March back on Sept. 17, but has since taken a noticeable step back. On a month-over-month basis, rejections are up 8 bps, while year-over-year it is down 838 bps compared to 13.84% at this time last year. On a trending basis, OTRI.USA looks good but not great, having risen in 10 out of the last 13 weeks with tender rejections rising off of the 3.75% bottom experienced in mid-August. National tender rejections have moved above their 60-day moving average by 5.13%.

Year-over-year comparables for national rejection rates are still extraordinarily difficult due to the daunting 2018 numbers in which rejections never fell below double digits. As a result, on a year-over-year percentage basis, OTRI.USA is down 60%. As can be seen in the chart below, comparisons do not start to ease until the January and February time frame in 2020.

Noble1

Perhaps one should keep an eye on this as well .

Quote:

“Freightos Baltic Index container price update.

By: AJOT | Nov 13 2019 at 10:39 AM

• China-US West Coast prices (FBX01 Daily) are $1,530/FEU. In an affirmation of peak season demand, early November’s 15% increase seems to be holding (still 13% up). While still 37% under 2018’s blockbuster prices the gap has closed 8% points since last week. Prices are even 6% up on 2017 prices.

• China-US East Coast prices (FBX03 Daily) are at $2,664/FEU. The recent price rise has already largely retracted. Less affected by advance shipping, the gap on last year’s prices (25%) is narrower than the West Coast, and they are 35% up on this week in 2017.

Commentary

“Historically, peak season prices hit their zenith in early November, with 2018 seeing peak season prices then shed 8% between the middle and end of November. This year, transpacific peak prices are hovering at around $1,500 – nearly $900 less than peak season last year. But will they be dropping from here?

Even though December 15’s trade tariff was recently deferred, there will still be a steady stream of advance shipping orders which may help avoid a total price free-fall. Early indications are that prices will indeed fall and that we’ve reached the peak of peak season. While 2020’s new low-sulfur fuel regulations may help keep prices from falling too dramatically, most signs are pointing to this being the full extent of peak season. Flagging global production, some diverting of sourcing from China and strong supply management by suppliers have held prices back,” said Eytan Buchman, CMO, Freightos.”

Re-quote:

“Historically, peak season prices hit their zenith in early November”

Remember this article on Freightwaves in September 2019 titled :

“Keep your eye on containers in global circulation”

Quote:

“One way to measure the health of global trade is to follow ocean shipping rates, on the assumption that higher rates equate to higher cargo demand.”

You may also want to read this article on American Shipper titled :

“Ocean freight rates now pointing downward after November rise” , However, they posted it a day ago , 3 days after AJOT did .

In my humble opinion …………