After a decade of head fakes and disappointments, investors can be forgiven their skepticism toward shipping stocks. Add to that the pandemic unknowns. As Diamond S (NYSE: DSSI) CEO Craig Stevenson said on Friday’s analyst call, “The trouble is that you’re predicting something [the COVID recovery] that has not happened before. There is no history.”

And yet, there’s no denying the positive momentum for shipping stocks. Each sector continues to rise from a different liftoff point.

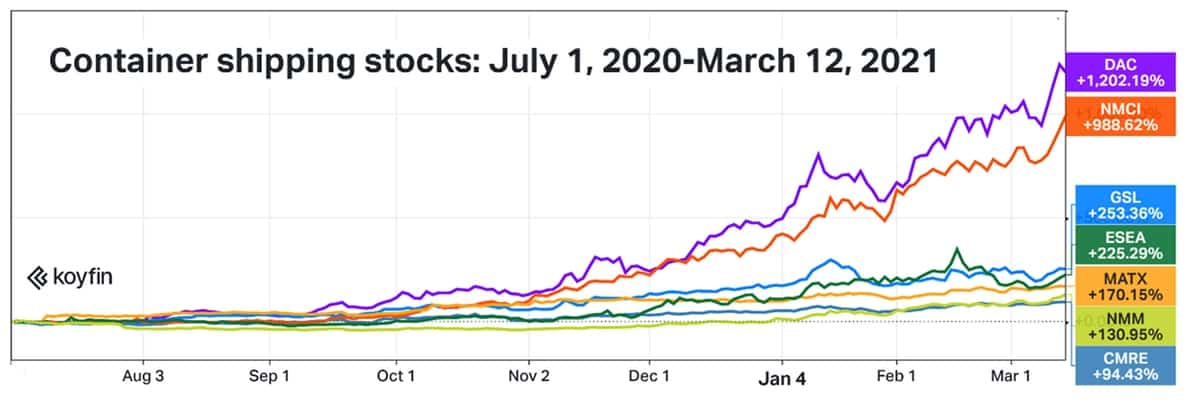

Container-shipping shares began their meteoric ascent in July, when it became clear that COVID made consumers buy more goods — a lot more — not less.

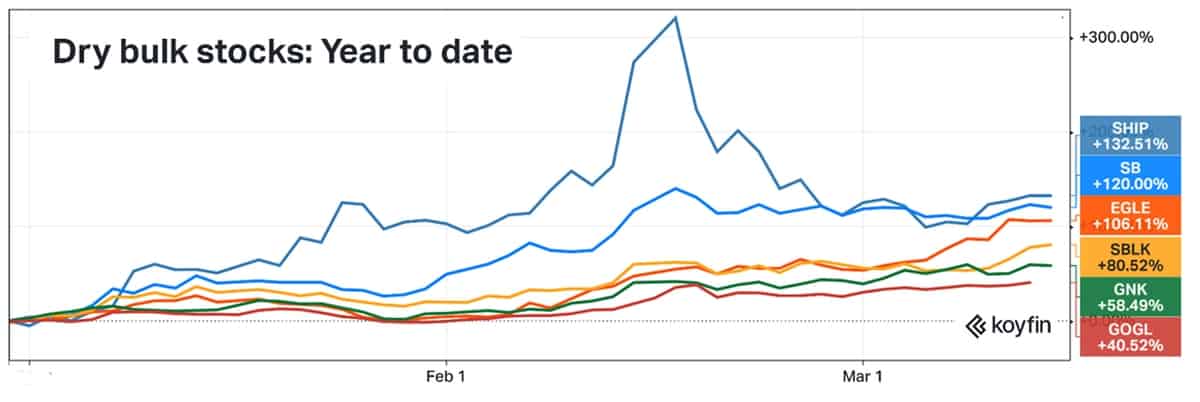

Dry bulk stocks started to move up in earnest at the beginning of this year. Surprisingly strong spot rates pointed to a tight supply-demand balance at a time when commodity prices were surging.

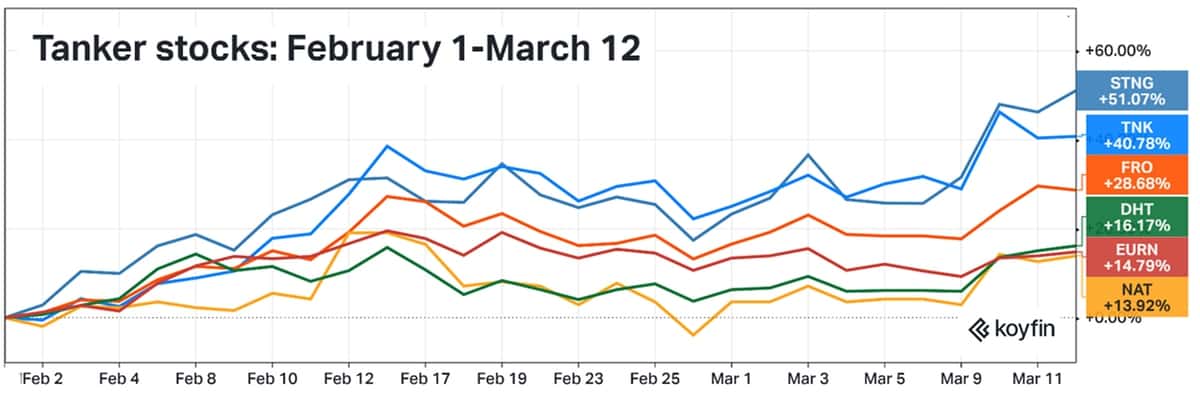

Tanker stocks started to rebound in early February. Spot rates remain painfully low but optimism toward a second-half recovery remains undaunted.

As Jefferies shipping analyst Randy Giveans told American Shipper, “Shipping is the place to be anytime you have an investor rotation from momentum and growth names into economically sensitive, value, global-trade-oriented names.”

Container shipping’s rise

The newest Wall Street shipping entrant, container liner operator ZIM (NYSE: ZIM), has performed extraordinarily well since Jan. 28, when its IPO priced at $15 per share and its stock began trading. It closed Friday at $25.25, up 68% in its first month and a half.

Giveans and Clarkson Platou Securities analyst Omar Nokta initiated coverage of ZIM on Feb. 22, both with a 52-week target of $30 per share, a goal that’s already within reach.

But ZIM hasn’t been around long enough to pile up the even more prodigious gains of most other container-shipping stocks, which began their turnaround in mid-2020.

Since July 1, the biggest winner has been the stock of ship-lessor Danaos Corp. (NYSE: DAC) — up 1,202%. Its current value is 13 times higher than in mid-2020.

Nokta initiated coverage of Danaos on Thursday with a price target of $66 per share, well above the Friday close of $47.73.

“While the shares have gained materially, we believe there remains further room to run,” said Nokta. He maintained that the company’s net asset value (NAV) “is much higher than the prevailing share price, the NAV is set to rise materially in the coming months,” and the company is set to generate a “significant level of free cash flow in the coming quarters and years.”

The second-best performer since last July has been Navios Containers (NASDAQ: NMCI), which is being acquired by Navios Partners (NASDAQ: NMM). Navios Containers shares are up more than tenfold since mid-2020.

Other big gainers in the container space over that period: Global Ship Lease (NYSE: GSL) is up 253%, Euroseas (NASDAQ: ESEA) 225%, Matson (NYSE: MATX) 170%, Navios Partners 131% and Costamare (NYSE: CMRE) 94%.

Dry bulk’s year to date

Rates for Capesizes — bulkers with capacity of around 180,000 deadweight tons (DWT) — briefly shot up to 10-year highs in January. Since then, smaller bulker classes have outperformed. Clarksons reported Friday that Supramaxes (45,000- to 60,000-DWT bulkers) were earning an average of $22,600 per day. That’s the highest rate for Supramaxes since 2010.

According to Clarksons Platou Securities analyst Frode Mørkedal, “Dry bulk equities are the best-performing sector year-to-date, up 58% on average, and are pricing in 1.09 times NAV on average. Investors should not look too closely at the dry bulk NAVs, however, as vessel values are significantly lagging time-charter rates, which are at a 10-year high. Based on vessel values seen in prior periods when freight rates were at the same level, dry bulk NAVs could roughly double.”

Since Jan. 1, shares of Seanergy (NASDAQ: SHIP) are up 133%, Safe Bulkers (NYSE: SB) 120%, Eagle Bulk (NASDAQ: EGLE) 106%, Star Bulk (NASDAQ: SBLK) 81%, Genco (NYSE: GNK) 58% and Golden Ocean (NASDAQ: GOGL) 41%.

Tanker stocks up since February

Container and dry bulk stock gains make sense in relation to freight rates. Not so with tanker stocks.

“Crude and products tanker equities are up … while spot rates are down pretty much across the board,” wrote Giveans in a client note on Friday. “While odd on its face, digging a bit deeper reveals the multiple factors we believe the market is pricing in.”

He contended that broker rate assessments are too low because their fuel-cost assumptions are too high. “Shipowners have recently reported much better quarter-to-date rates than the broker averages during the same time frame.”

Another factor: One-year time charter rates are higher than spot rates, which “reflects the market sentiment that rates will recover in the coming months,” Giveans believes.

He also thinks tanker stocks are pricing in declining crude and product inventories, a very low orderbook “and the reopening trade.”

Since Feb. 1, shares of product-tanker owner Scorpio Tankers (NYSE: STNG) are up 51%. Shares of mixed-fleet owners Teekay Tankers (NYSE: TNK) and Frontline (NYSE: FRO) are up 41% and 29%, respectively. Shares of crude-tanker owners DHT (NYSE: DHT), Euronav (NYSE: EURN) and Nordic American Tankers (NYSE: NAT) are up 16%, 15% and 14%, respectively.

Crude vs. product tanker recovery timing

During Friday’s quarterly call, DSSI’s Stevenson was asked which he thought would recover first: product tankers or crude tankers?

Stevenson responded, “There are people out there who think the product side is going to move first. Historically, that’s not what happens. The crude side of the business moves first. I would say the latter half of the year certainly looks better for both businesses [crude and products].

“We do see gasoline in the U.S. starting to pick up pretty significantly. What we need is air travel. I think there’s a tremendous amount of pent-up demand. I think you could make an incredibly bullish statement about that.

“But the trouble with predicting these things is that the second you get bullish, you can have setbacks. So, I’m reluctant to get ahead of myself.” Click for more FreightWaves/American Shipper articles by Greg Miller

MORE ON SHIPPING STOCKS: What new boom in vessel sales means to shipping stocks: see story here. Shipping stocks are suddenly revving up across the board: see story here. Shipping’s Wall Street saga: rags to riches to rags to occasional riches: see story here. Container rates are on fire. How can you invest in that? See story here.