Maersk chose profitability over market share in the third quarter as the container shipping giant bolstered its bottom line on lower revenues.

A.P. Moller – Maersk (APMM) said its ocean container shipping division generated freight revenues of $6.373 million in the quarter ended September 30, down 0.9% compared to a year earlier. However, earnings before interest, taxes, depreciation and amortization (EBITDA) climbed 12.6% in the period to $1.268 million.

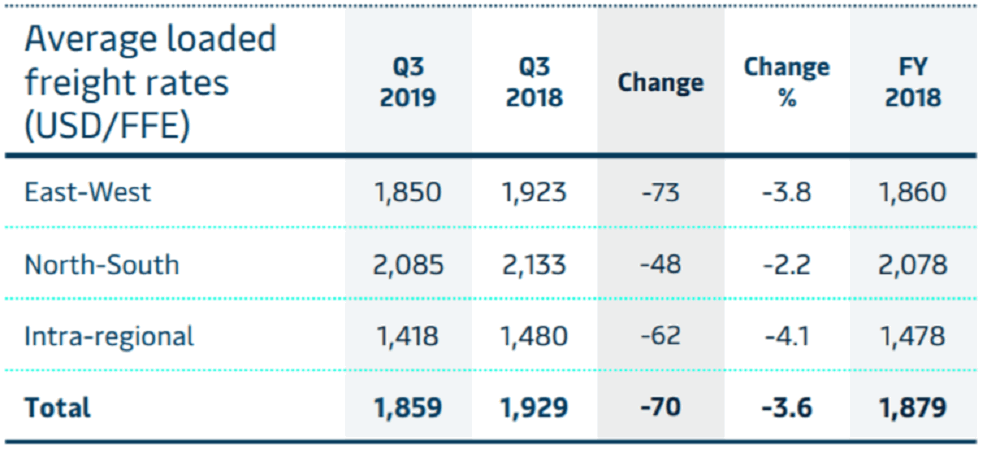

The result was achieved despite the carrier’s average loaded freight rate declining 3.6% year-on-year in Q3 2019 and volumes increasing by only 2.1%.

Lars Jensen, CEO of SeaIntelligence Consulting, said Maersk’s third quarter performance was accomplished primarily through a reduction in underlying operational costs of 2.3% and offered further proof of the company’s “ability to continuously improve operational efficiency.”

He added, “Profitability measured as EBITDA margin increased to 17.4% – a tiny fraction ahead of Hapag-Lloyd.

“Both these carriers clearly exhibit a successful approach based on a ‘profits over market share’ prioritization. Especially when contrasted with Evergreen, Yang Ming and HMM, which are clearly still struggling with how to become profitable.”

Maersk said the total volume increase of 2.1% was mainly driven by a 4.3% increase in backhaul volumes, with headhaul volumes up just 1.2% in the third quarter.

“Global volume growth was around 1.5%,” Maersk said in a statement. “The East-West volume decrease was led by North America trades due to trade restrictions, while Europe was on par.”

The Maersk announcement also stated, “The North-South volume increase was driven by higher import volumes to Africa, while the negative demand in Latin America continued.“

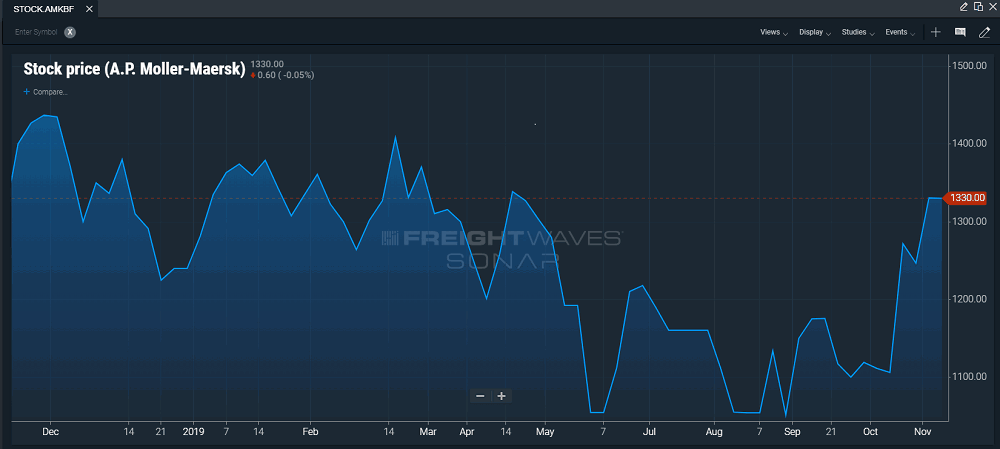

APMM (CPH: MAERSK-B) reported group revenues of $10.1 billion in the Q3 2019, down 0.9% year-on-year, and EBITDA of $1.7 billion, an increase of 14%.

Maersk CEO Soren Skou said, “While the global container demand, as expected, was lower in the third quarter due to weaker growth in the global economy, A.P. Moller – Maersk continued to improve its operating results.”

Skou, who has also taken on the role of COO after it was announced on 11 November that Søren Toft had left to “pursue an opportunity outside the company,” said the group had delivered strong free cash flow and a return on invested capital of 6.4%.

This was achieved as a result of “strong operational performance in Ocean, higher margins in Terminals and solid earnings progress in Logistics & Services,” he added.

APMM’s Terminals & Towage division posted EBITDA of $313 million, up 23% compared to a year earlier. Division revenues rose 5.8% to $986 million in the period.

The company’s Logistics & Services division recorded EBITDA of $94 million, up 34% compared to the third quarter of 2018. Revenues increased 2.6% to $1.622 million and were “positively impacted by increasing revenue in intermodal and warehousing and distribution, offset by declining revenue in sea and air freight forwarding and supply change management,” said a company statement.

The statement added, “Volumes in air and sea freight forwarding were negatively impacted by general weaker demand and year-over-year effects from strategic initiatives taken earlier in the year to exit some countries.”

As announced on 21 October, APMM now expects EBITDA this year in the range of $5.4-5.8 billion, up from its previous forecast of $5 billion

“The strong performance for the quarter combined with our expectations for the rest of the year, led to the recent upgrade of our earnings expectations for 2019,” said Skou. “We will continue our focus on profitability and free cash flow in the fourth quarter and into 2020.”

More FreightWaves articles by Mike