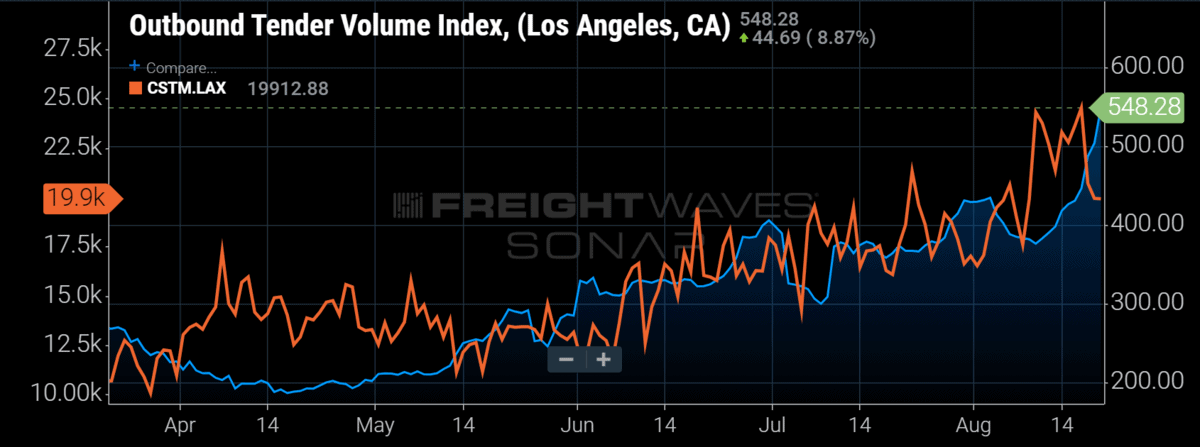

Chart of the Week: Outbound Tender Volume Index – Los Angeles, Customs Import Shipments – Los Angeles SONAR: OTVI.LAX, CSTM.LAX

Anyone who regularly consumes FreightWaves information knows there is a strong connection between import volumes and the domestic freight market. This year, total custom shipments were 17% higher in early August versus the same period in 2019 — mostly driven by imports into Los Angeles — and trucking tender volumes out of LA are 73% higher year-over-year (y/y).

In demand-driven markets, like the one we have today and had in 2017, there is a tight correlation between trucking volumes and imports with little lag. In low-volume markets, freight tends to spend more time in warehouses and on containers before moving to the final destination or distribution center, like the one seen in 2019 where the trade war inspired shippers to import well in front of demand.

FreightWaves customs data measures shipments as they clear customs. These are bills of lading and not twenty-foot equivalent units (TEUs). Since mid-May, customs shipments have been steadily increasing into the ports of Los Angeles and Long Beach, with shipment volumes now showing 58% higher for the week ending Aug. 16 versus May 10.

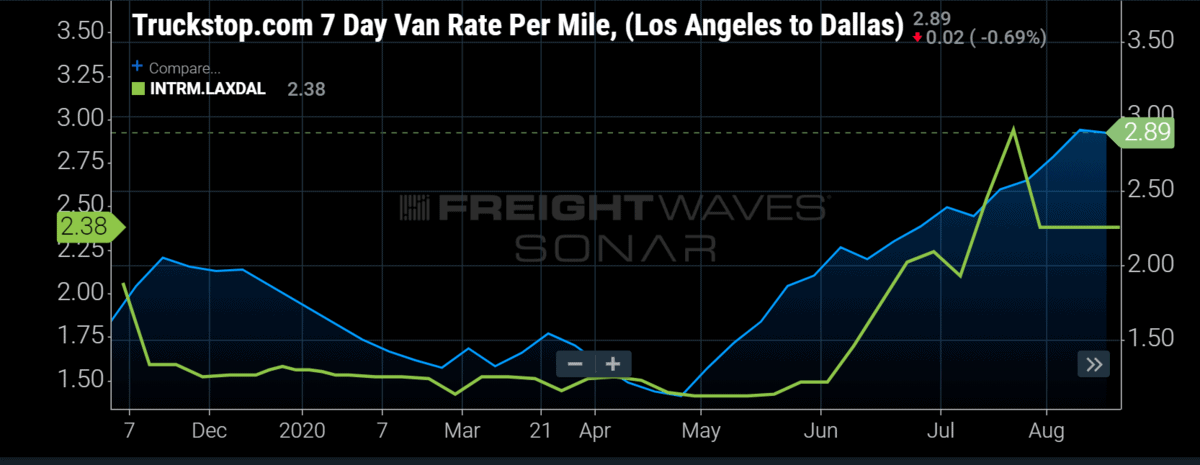

On the surface transportation side, the Outbound Tender Volume Index (OTVI) for LA has more than doubled, pushing tender rejection rates from under 4% to near 26% over the same time. Spot rates have followed suit, with Truckstop.com reporting the average van rate from LA to Dallas increasing from $1.31 to $2.89. The normally stable intermodal sector saw spot rates for containers shipping on the rail jump significantly from $1.41 to $2.38 from May to mid-August.

August through October is typically considered peak season for ocean shipments coming to the U.S., with many of these shipments being retail goods for the holidays. Prior to mid-July, customs shipments were still consistently underperforming 2019 levels. Some of that had to do with a reduction of capacity as carriers and shippers both expected an extended lull in demand due to the COVID-19 pandemic. Most of the capacity has been returned to the water, and rates are still expanding due to increasing demand.

Looking into the near future, FreightWaves’ Ocean Shipments Index shows that bookings for shipments bound for the Port of Los Angeles are up 56.1% y/y, with TEUs up over 60% over the next seven days. The lead time on these shipments hitting the West Coast port from Asia where most of it originates is roughly three to five weeks out, meaning the Southern California freight boom may still have several months to go.

As for the other parts of the country, the Eastern ports have been relatively subdued compared to the West Coast ports due to the need for speed on many of the goods. But that is changing as many of the Eastern ports such as New York/New Jersey and Savannah, Georgia, are now seeing significant increases in inbound customs shipments. This is a double-edged sword as it could mean a more even distribution of freight in the U.S., which relieves some pressure on carrier networks, or it could just mean more freight, which strains them further.

About the Chart of the Week

The FreightWaves Chart of the Week is a chart selection from SONAR that provides an interesting data point to describe the state of the freight markets. A chart is chosen from thousands of potential charts on SONAR to help participants visualize the freight market in real time. Each week a Market Expert will post a chart, along with commentary, live on the front page. After that, the Chart of the Week will be archived on FreightWaves.com for future reference.

SONAR aggregates data from hundreds of sources, presenting the data in charts and maps and providing commentary on what freight market experts want to know about the industry in real time.

The FreightWaves data science and product teams are releasing new data sets each week and enhancing the client experience.

To request a SONAR demo, click here.