The Port of New York and New Jersey published its plans on how it will handle an expected doubling of container volume over the next 30 years, all while trying to mitigate pollution and congestion.

The plan has major implications for the region’s four largest marine terminals as the Port Authority of New York and New Jersey figure out which side of the Bergen Peninsula it wants to expand on.

In its master plan for the largest U.S. East Coast maritime gateway, the Port Authority of New York and New Jersey says container volumes could reach anywhere from 12 million to 17 million twenty-foot equivalent units (TEU) by 2050.

To reach those volumes, the Port Authority said it may look to expand container handling at its Port Newark marine terminal, which is already home to a container terminal operated by Ports America.

But Port Newark also houses terminals for handling non-container bulk and liquid freight. In the Port Authority’s plan, it says a site currently occupied by scrap recycler Sims Metal Management could be turned into a container terminal.

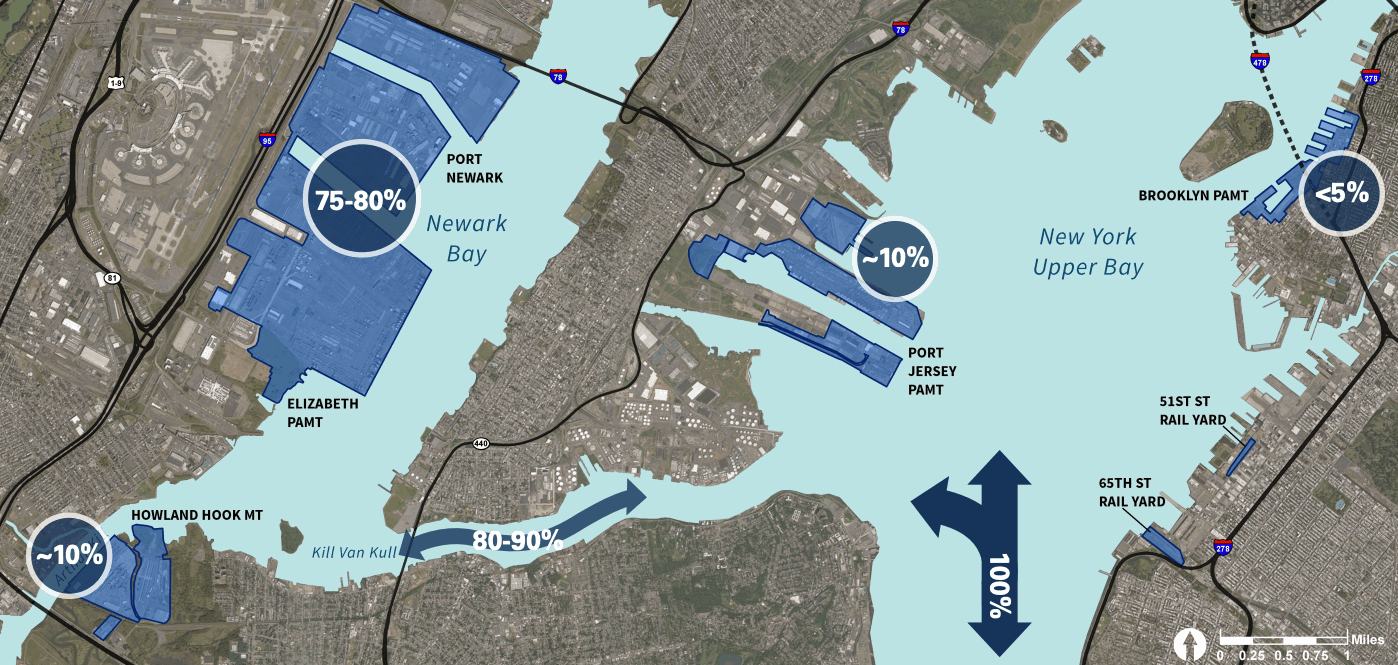

Port Newark and the neighboring Elizabeth-Port Authority Marine Terminal to the south account for up to 80 percent of the container freight coming into the region, thanks to being the site of the two largest marine terminals, APM Terminals and Maher Terminals.

The Port Authority raised the Bayonne Bridge by 64 feet and dredged the Kill Van Kull waterway to 50 feet to accommodate larger box ships. Still, large ships may only transit at high tide and only one at a time.

Drafting the master “revealed the heightened criticality of the Kill Van Kull to the Port’s ability to handle increasing throughput and increasing vessel size,” according to the master plan.

To that end, the Port Authority said it may consider ways to boost the container handling capacity on the eastern side of the Bergen peninsula, which connects directly to New York harbor and does not face the restrictions of Kill Van Kull.

“There is a primary decision point to determine the location of additional container capacity in the Port – either east or west of the Kill Van Kull waterway,” according to the master plan.

That would mean having to build up container handling at its Port Jersey site, which is home to GCT Bayonne’s marine terminal. The Port Authority’s potential plan envisions a major expansion of GCT Bayonne, including adding distribution and warehouse infrastructure in the surrounding areas.

“The Port Jersey facilities… could be expanded to form a major integrated hub of container

handling and distribution capacity, relieving the stress on the waterway and road infrastructure currently servicing the Port’s Newark and Elizabeth facilities,” the plan said.

A big part of New York-New Jersey’s growth plan hinges on capturing more of the discretionary cargo that moves through the port to other states. That will require expanding the Millenium Marine Rail yard on the Newark-Elizabeth side, the ExpressRail facility on the Port Jersey side, and the Cross Harbor Railcar Float, which takes rail cars to Brooklyn.

Beyond container handling, New York-New Jersey management is also considering how the port can be part of a low-carbon future. The feasibility of adding liquefied natural gas bunkering sites for ship fuel is being considered.

As for trucking, the Port Authority said it wants to promote the use of electric Class 8 trucks once they are readily available as it “expects diesel trucks to eventually be phased out in the Port.”

Port of Virginia sees busiest month ever

May volumes were up 10 percent from a year earlier with imports just as strong. (Safety4Sea)

Japanese line seeks scrubber-equipped bulker

NYK expects ship to be delivered by 2021 against charter for steel company. (Seatrade Maritime)

Arrested tanker could be forfeit to U.S.

Maritime lawyer says U.S. could go after ship that was carrying Iranian crude. (TradeWinds)

Tanker company bullish on LNG fuel use

Sovcomflot says its LNG-fuelled tankers emit 30 percent less carbon dioxide. (VesselFinder)