Forwarders and ocean carriers are betting a major holiday in Asia and seasonal inventory building at U.S. retailers will provide a boost to container shipping rates. Despite the short-term bump, one outlook for 2019 suggests the container shipping industry will remain challenged.

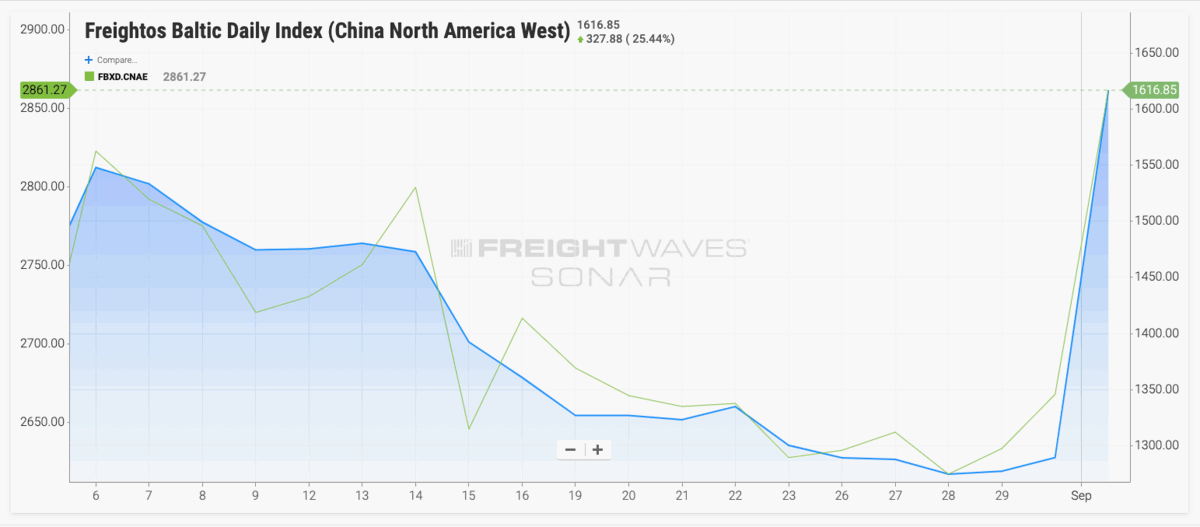

Spot rates on one of the busiest ocean trade lanes for moving containerized goods are starting September at the highest level seen in nearly two months. The Freightos Baltic Daily Index (SONAR: FBXD.CNAW) for China-North America West Coast sat at $1,617 per forty-foot equivalent unit (FEU) as of September 3.

The index reflects spot transactions for capacity on eastbound trans-Pacific container ships.

The $329 per FEU jump from August 30 reflects the general rate increases that container ship lines have thus far pushed through to customers. Mediterranean Shipping Company (MSC) issued a $1,000 increase per standard FEU for eastbound shipments from Asia to U.S. ports starting in September. The increase drops to $600 per FEU on September 15.

MSC is increasing rates as steamship lines are “challenged to maintain service profitability since freight rates are at levels that are no longer sustainable,” it said in a statement announcing the increase. But it will not be the first carrier to push through an increase as rates remain weak.

APL, a unit of CMA CGM, likewise sought a $1,000 per FEU at the beginning of August. But with container shipping demand still uneven, spot container rates drifted from $1,565 down to $1,288 per FEU.

But there is some reason for forwarders and container lines to believe the rate increases will stick thanks to heavier than usual demand in September, according to Freightos Chief Marketing Officer Ethan Buchman. China’s exporters are expected to push out more goods ahead of the country’s Golden Week celebration starting October 1.

In addition, U.S. shippers face an October 1 deadline for tariffs on $250 billion worth of Chinese goods increasing from 25 percent to 30 percent.

Buchman also noted that West Coast shipping rates rose much faster than those for the China-North America East Coast trade lane (SONAR: FBXD.CNAE), which suggested some front-loading of containers is expected during the month.

“The latest price rise looks to have kicked off peak season. Prices this September will likely be supported by rush orders ahead of October 1’s tariff increases, the Golden Week bottleneck and Black Friday inventory stocking,” Buchman said in a report on the index.

During summer, trans-Pacific spot container shipping rates peaked at about $1,680 per FEU in July, coinciding with some of the best growth seen in volumes. Container shipping consultancy Maritime Strategies International (MSI) said headhaul volumes on the trans-Pacific market were “broadly positive” in July, growing 4.2 percent year-on-year.

“US consumer demand, while weakening, does remain healthy, and both wholesalers and retailers once again added to inventories in July,” MSI said.

The rise in the dollar’s value versus the Chinese yuan may take some of the sting of new tariffs and existing ones, MSI noted. But the ongoing uncertainty in U.S.-China trade means that MSI expects the rates and volumes to fall ahead. Its last container rate forecast shows trans-Pacific container rates falling to $1,372 per FEU in October, while three-month volumes are expected to decline 5 percent.

“We continue to expect severe pressure on the trans-Pacific trades toward the end of 2019, and we expect healthy consumer demand will come to play less of an offsetting role,” MSI said.

Russian tanker crosses ice free Arctic waters

Sovcomflot ship carried crude oil on vessel powered by liquefied natural gas. (Lloyd’s List)

Hapag-Lloyd splits European operations

Split of North and South markets reflects Hapag-Lloyd’s 2023 investment strategy. (Marine Link)

U.S. Coast Guard has rescued 47 during Dorian

But agency still working as ports closed from Miami up through Savannah. (Coast Guard News)