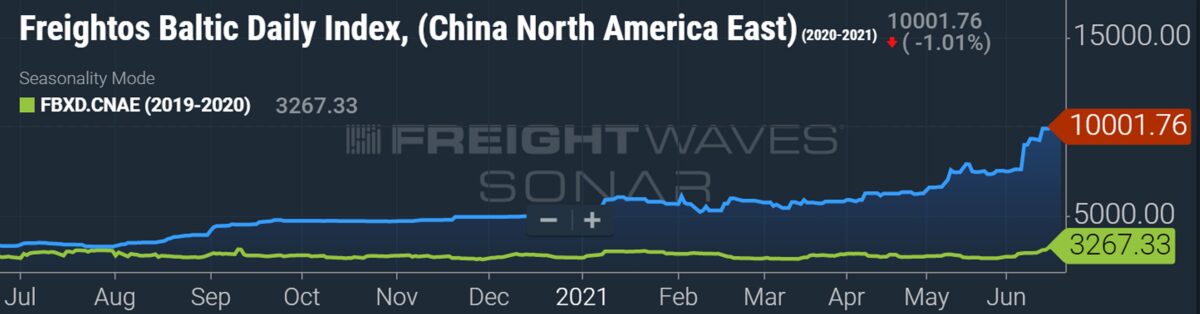

The trajectory of trans-Pacific spot rates brings to mind the retail-trader catchphrase “to the moon.” Index rates (which do not include premium charges) have just crossed the line into five figures per day.

Carriers implemented general rate increases (GRIs) on June 1. Spot rates rose. They enacted more GRIs on June 15. Rates jumped again. Another wave of GRIs is set for July 1 and more have just been announced for July 15. Add fallout from China port congestion to the mix, and it’s a recipe for rates to keep climbing.

“Despite record highs, rate levels continue to sharply increase,” said Lars Jensen, CEO of consultancy Vespucci Maritime.

Past predictions on spot rates have been repeatedly proved wrong — and far too conservative.

Last September, carriers met with Chinese regulators, who reportedly told them: You’re making a lot of money on the trans-Pacific, so don’t push it too high. For the following three months, index rates did seem to plateau at around $3,800 per FEU on the Asia-West Coast route and around $4,700 per FEU on Asia-East Coast.

Current rates to the West and East coasts are around 80% and 110% above those levels, respectively. If Chinese regulators did apply pressure to temper rate growth in Q4 2020, they definitely took their foot off the brake in 2021.

Then came the full-year guidance from ocean carriers, released in early 2021. Analysts noted that carriers’ initial guidance implied that H2 2021 spot rates would fall materially versus rates in H2 2020.

The beginning of the second half is now one week away. Given current rate trends and the imminent onset of peak-season demand, those earlier carrier spot-rate assumptions look increasingly implausible, barring an unforeseen event that causes a precipitous drop in U.S. demand.

New high for Asia-East Coast

On June 15, the day carrier GRIs were implemented, the Freightos Baltic Index daily assessment for Asia-East Coast jumped 7%. It kept rising after that, reaching an all-time high of $10,104 per FEU by the end of the week — the first time this route index breached $10,000. As of June 22, it was at $10,002 per FEU assessment, up 205% year on year (y/y).

S&P Global Platts provides daily assessments of Freight All Kinds (FAK) rates. Its North Asia-East Coast FAK assessment was $7,100 per FEU on June 22.

Drewry released its latest weekly rate assessment for the Shanghai-New York route on June 17: $8,017 per FEU, up 195% y/y.

Index moves offer guidance on the trend in the supply-demand balance, but amid current market conditions, they’re much less reflective of actual costs. Not only are different indexes reporting widely varying numbers, but these assessments do not include premium charges that are often required to get cargo loaded. Those charges can reportedly reach as high as 10,000 per FEU.

American Shipper was told that a carrier just quoted an all-in Asia-East Coast rate of $19,990 per FEU (which seems to include a $10 “discount” to avert the $20,000 threshold).

New high for Asia-West Coast

The Freightos Baltic Index daily assessment for Asia-West Coast also jumped after the latest round of GRIs. By June 22, it was at a new all-time high of $6,681 per FEU, up 160% y/y.

Drewry’s latest weekly rate for Shanghai-Los Angeles was $6,358 per FEU, up 197% y/y. S&P Global Platts’ daily North Asia-West Coast FAK assessment for June 22 was $5,800 per FEU.

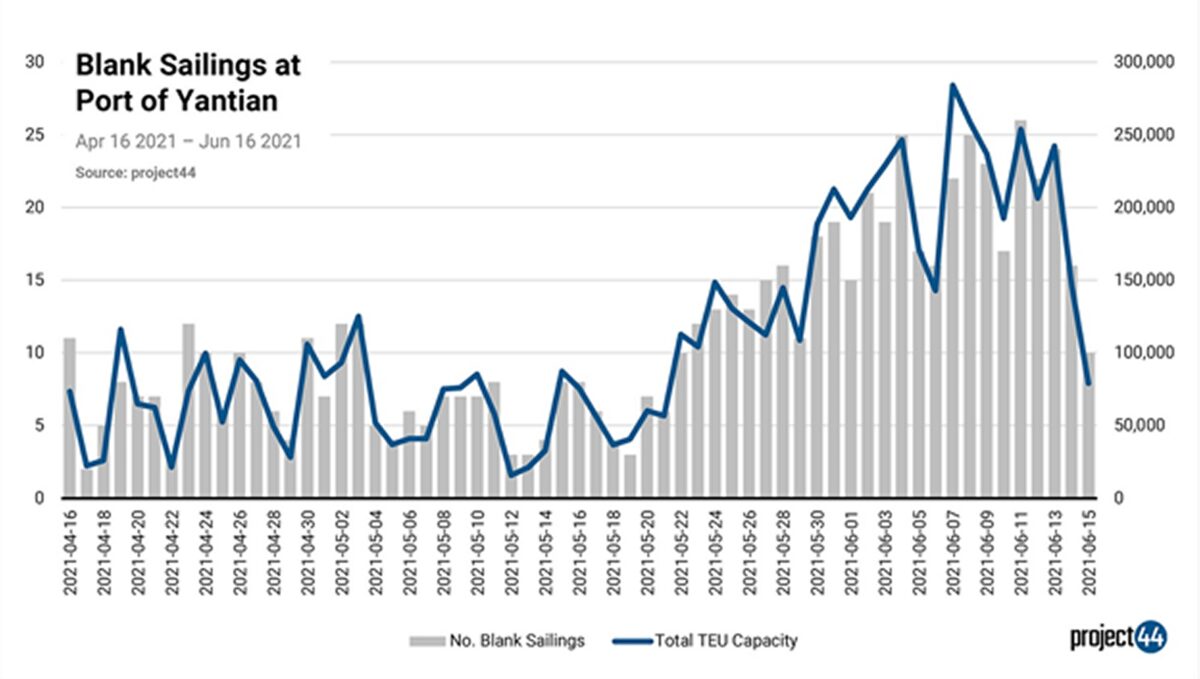

Escalating Yantian fallout

It’s not just GRIs and U.S. import demand driving rates higher, it’s COVID-induced logjams in the Chinese ports of Yantian, Shekou and Nansha. While productivity in Yantian is gradually recovering, knock-on effects will continue. Cargo delayed by the outbreak should start arriving at U.S. ports en masse in July.

According to Maritime Strategies International, “Yantian handles a quarter of China’s shipments to the U.S. The impact of the congestion is clearly reflected in the freight markets and is expected to be worse than what was seen post-Suez accident.”

Jensen commented, “Yantian is on a slow path towards a beginning recovery. But that does not mean normal shipping service levels are resuming anytime soon. Both HMM and Maersk show extensive vessel omissions for the rest of June on their mainline services.”

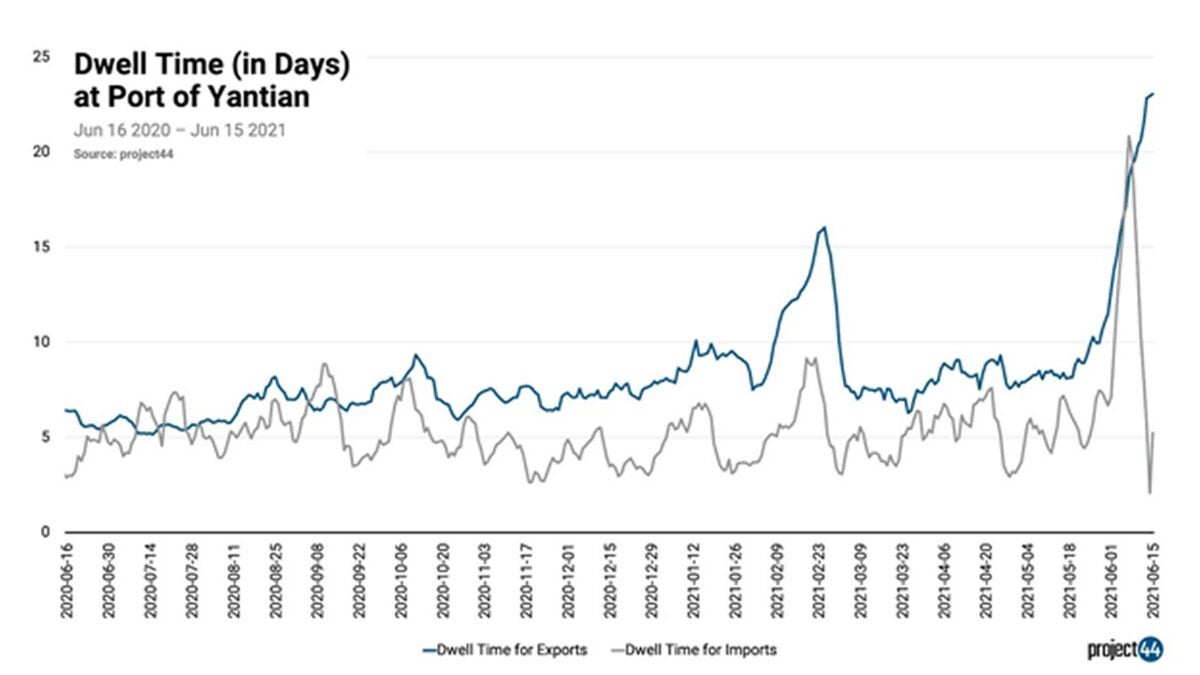

Project44 released data on June 17 showing the extent of the disruption. In the first half of June, 298 container vessels with a total capacity of over 3 million twenty-foot equivalent units skipped calls in Yantian, according to project44. Even in a best-case scenario, “it could take weeks to process backlogged containers and shippers should expect serious delays,” it said.

“Dwell times at YICT [Yantian International Container Terminals] also paint a grim picture,” added project44. Over the first half of the month, the seven-day average of median dwell times for export containers doubled, to 23.06 days as of June 15.

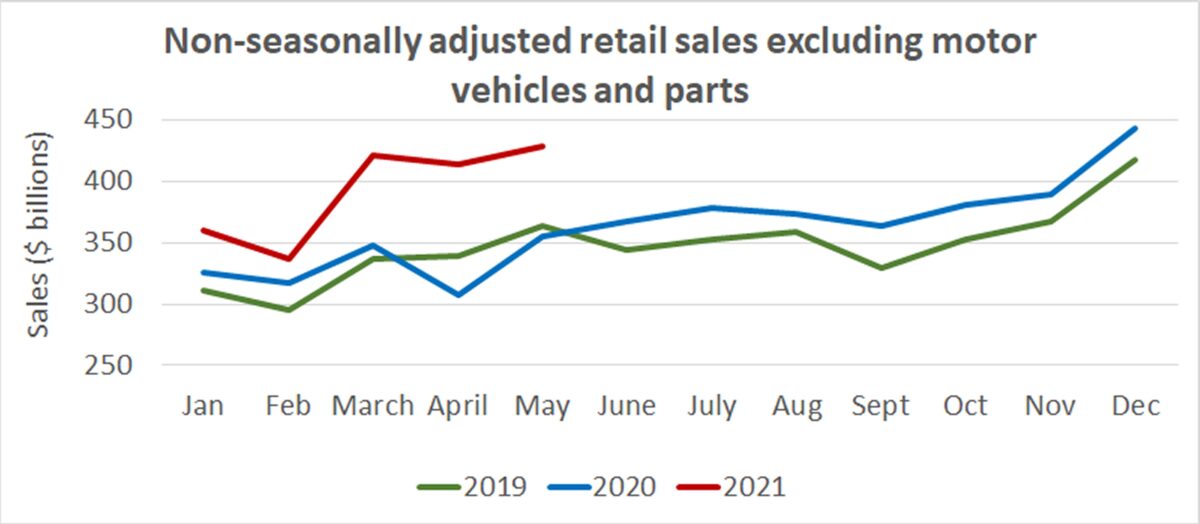

Retail sales still exceptionally strong

Ultimately, spot rates won’t fall until demand pulls back. It has been widely hypothesized that Americans will spend less on goods as more are vaccinated and they spend more money on services (restaurants, travel, etc.).

Both The New York Times and The Wall Street Journal partly attributed May’s seasonally adjusted 1.3% drop in retail sales versus April to a shift in consumer spending to services from goods.

However, a far better gauge for container shipping is non-seasonally adjusted retail sales excluding vehicles and parts, given that vehicles are not shipped in boxes and that the automotive industry is being impacted by a chip shortage.

According to this dataset — provided to American Shipper by Jason Miller, associate professor of supply chain management at Michigan State University’s Eli Broad College of Business — May spending related to containerized imports increased.

May’s number, $429.1 billion, was up 3.6% from April’s and up 17.5% from May 2019, prior to COVID. It was the highest monthly total of 2021 and second only to December 2020 overall.

Autumn import decline?

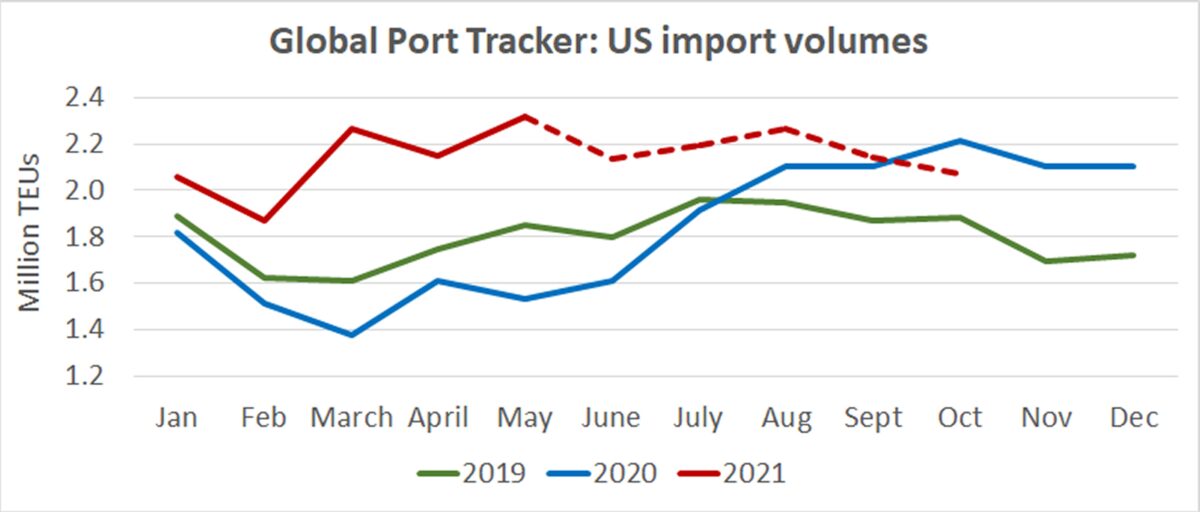

The National Retail Federation (NRF) foresees a moderation of containerized imports during the fall season. Consultancy Hackett Associates and the NRF produce the monthly Global Port Tracker report. The latest edition forecasts that U.S. containerized imports in October will fall 10% versus a peak hit in May.

An import decline caused by congestion would not decrease spot rates. But rates would theoretically decline if there were a decrease in demand caused by a shift in consumer spending away from goods toward services, and/or if future demand fell because it had been pulled forward.

Asked by American Shipper for the rationale behind the lower October forecast compared to the May estimate, NRF Vice President for Supply Chain and Customs Policy Jonathan Gold replied, “The numbers we’re seeing now are high because there has been so much pent-up demand and more vaccines mean people are finally getting out of the house to shop again. Retailers have had to import record amounts of merchandise to keep up.

“We expect consumer demand to remain strong, but with the ongoing supply chain disruptions and port congestion we’ve seen for months now, many retailers are moving up their holiday imports to be sure that holiday merchandise arrives in time,” said Gold. “That means the peak season that would traditionally come in October will likely come sooner this year, and much of the holiday merchandise will already be here by October.”

But in general, forecasting future import flows has proved extremely challenging in the pandemic era, given the lack of precedent. Case in point: At this time last year, Global Port Tracker forecast total volume for the five months from June-October 2020 of 8.28 million TEUs. The final number for those months came in at 9.95 million TEUs — 20% higher.

Click for more articles by Greg Miller

Related articles:

- Mounting evidence that container crunch will persist into 2022

- Home Depot has it’s own ship. That’s an ominous sign

- Time to start prepping for Christmas shipping capacity crunch

- Top 10 liners control 85% of the market — and they’re not done yet

- Inside container shipping’s COVID-era money-printing machine

- Why stratospheric container rates could rocket even higher