Yang Ming Marine Transport Corp. (TWSE:2609) said it had lower revenue and a larger loss in the third quarter of 2019 than in the same period last year.

But the Taiwanese company said it is optimizing operating costs with new container ships and redelivery of chartered vessels. It has redelivered 13 of its high-cost chartered vessels and plans to redeliver an additional five ships next year.

Anticipating ongoing U.S.-China trade disputes and a shift in the global supply chain, Yang Ming said it will also continue to optimize its intra-Asia service network.

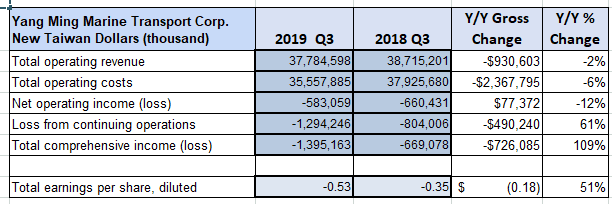

Yang Ming had operating revenue for the third quarter of 2019 of 37.78 billion New Taiwan Dollars (NTD) or $1.22 billion U.S., down from $38.72 billion NTD in the same 2018 period. Its loss after tax for the third quarter in 2019 was 1.29 billion NTD compared to a loss of 804 million NTD in the third quarter of 2018. The company moved 1.44 million TEUs in the third quarter of 2019, about 2% more than in the same 2018 period.

The company said a strategic decision not to exercise options with respect to certain formerly chartered vessels impacted its third-quarter results this year.

“By opting out, the company incurred obligations under the charter parties, which were then recorded as potential impact as mandated by the International Financial Reporting Standards. The potential effects of the arrangement were estimated at NTD 1.39 billion (USD 44.75 million) and lowered Yang Ming’s third-quarter results, which otherwise would have showed a profitable quarter. Nevertheless, Yang Ming’s cash flow and operations were not affected, and the company continues to see encouraging results.”

Yang Ming cited projections by analysts at Alphaliner that it said suggested “a softer market demand than was previously expected.” They show annual container capacity growth is forecast at 3.7% and global throughput growth for 2019 is estimated at only 2.5%.

“Meanwhile, the container shipping market remains vulnerable to trade uncertainties and geopolitical tensions. It is unclear the extent of potential impact those tensions and uncertainties will have on demand. Despite unpredictable market conditions, Yang Ming has improved its volume and revenue largely due to the efforts of business strategy and competitiveness enhancements.”

Yang Ming added, “Looking ahead, the container shipping market will undoubtedly need to be prepared for continued world economic and trade volatility. However, based on the data collected by Alphaliner, the estimated market demand growth at 2.8% is moving closer to the capacity growth at 3.3% in 2020. Furthermore, the containership orderbook-to-fleet ratio has fallen to its lowest recorded level at 11%.”

Because of a requirement that ships use low-sulfur fuel or equip their ships with engine exhaust scrubbers beginning next year, “it is expected that the supply-demand gap will gradually narrow,” Yang Ming said, adding that it plans to install open loop exhaust scrubbers on five of its owned ships.

Yang Ming is a member of THE Alliance, a vessel-sharing agreement that includes the German carrier Hapag-Lloyd and Ocean Network Express (ONE), a company jointly owned by Japan’s three largest shipping companies — NYK, MOL and “K” Line. Next year, South Korea’s Hyundai Merchant Marine will join THE Alliance, and Yang Ming said with that addition, “the partnership will be poised to significantly strengthen its service portfolio and increase its competitiveness. The partnership, which has been extended for another ten years, will provide customers with greater stability and long-term commitment in the future.”