Transportation and logistics provider ArcBest said it leaned on transactional freight to offset declining less-than-truckload demand, which intensified as the fourth quarter progressed.

ArcBest (NASDAQ: ARCB) reported fourth-quarter adjusted earnings per share of $2.45 Friday before the market opened. The result was 8 cents below the consensus estimate and 34 cents lower year over year (y/y). The number excluded several items, most notably 94 cents per share in acquisition-related costs, including a change in fair value to a contingent deal earnout, and expenses from a freight handling pilot.

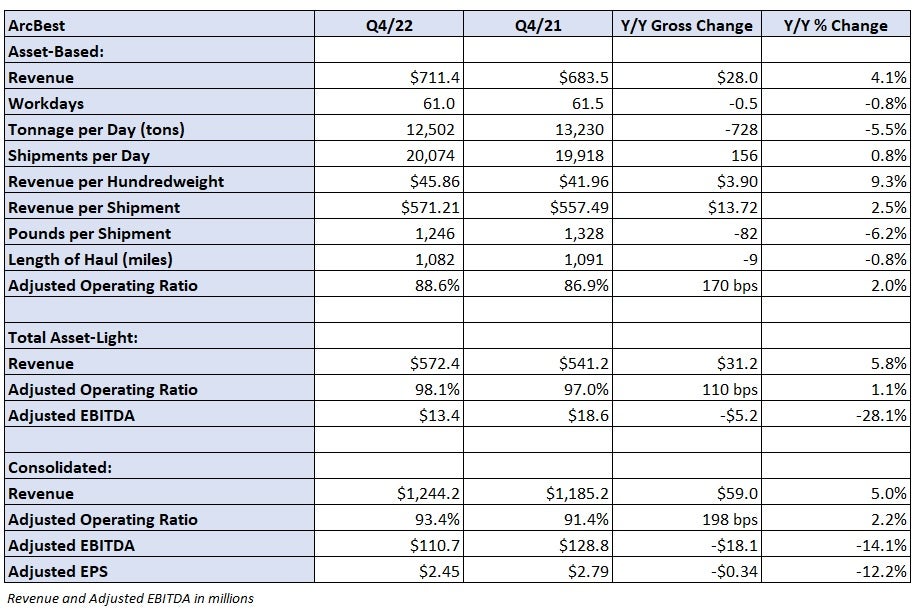

The asset-based segment, which includes LTL services, reported a 4% y/y revenue increase to $711 million. Total tonnage fell 6% y/y as shipments were up 1% and weight per shipment declined 6% (LTL weight per shipment was down 2%).

Revenue per hundredweight, or yield, increased 9%. The metric was up by a low-single-digit percentage for LTL freight, excluding fuel surcharges. Contract renewals and deferred pricing agreements increased by 5.4%.

Demand slumped as the quarter progressed, driving a decline in shipment sizes. Tonnage per day was down y/y by 4% in October, 3% in November and 9% in December. The preliminary result for January shows tonnage was up 1% y/y on an easy comp from a year ago (up 2% y/y in January 2022). Management said the weakness had been contained mostly to the retail sector but noted industrial-related freight demand softened as the quarter advanced.

Wednesday data from the Institute for Supply Management signaled contraction in the manufacturing sector for a third straight month. The Purchasing Managers’ Index registered a reading of 47.4. A level below 50 signals contraction. Subcomponents like new orders, production and order backlog remained in decline during the month.

ArcBest used a dynamic pricing model to stem declining demand during the quarter. The program utilizes tech to better match available capacity in the network with noncontractual shipment opportunities in the market. The company said the shipments are executed at profitable pricing but not at rates as strong as what it sees from core LTL customers. Those rates were up by double digits y/y in the quarter and in January when excluding the impact of fuel.

Daily revenue in the asset-based unit was up 1% y/y in January as yield was flat albeit on a tough comp (up 20% y/y in January 2022). A decline in truckload shipments weighed on the results during the month. Management said that even with the January tonnage increase, overall demand trends haven’t really changed from the fourth quarter.

The division posted an 88.6% adjusted operating ratio, 170 bps worse y/y. Management said the unit normally records 400 bps of sequential deterioration from the fourth quarter to the first quarter but the result can be worse during weaker macro environments.

The asset-light segment, which includes brokerage and the acquisition of TL broker MoLo, reported a 6% y/y increase in revenue to $572 million. The unit recorded an adjusted OR of 98.1%, 110 bps worse y/y. Declines in volumes and market pricing weighed on results, however, TL shipments were up by a high-single-digit percentage compared to the third quarter.

ArcBest signaled it will be looking to cut costs in the segment.

“Moving forward, ArcBest Asset-Light operating costs will be monitored and managed in response to customer demand and on-going market conditions,” a news release stated.

On a per-day basis in January, asset-light revenue was down 23% y/y.

ArcBest forecasts net capital expenditures between $300 million and $325 million in 2023 compared to $211 million in 2022. This year’s budget includes $175 million for equipment purchases and between $55 million and $65 million for real estate projects. The goal is to add capacity sufficient enough to be growing shipment counts at a mid-single-digit rate by the end of 2023.

The company generated $5.3 billion in revenue during 2022 and reiterated a long-term target of reaching between $7 billion and $8 billion in revenue by 2025.

Shares of ARCB were down 5.9% at 11:10 a.m. Friday compared to the S&P 500, which was down 0.2%.

More FreightWaves articles by Todd Maiden

- Schneider’s 2023 outlook better than expected

- Landstar navigates downturn in Q4, points to summer recovery

- Old Dominion handily beats Q4 expectations; shares up 8%