It’s officially crunch time — the IMO 2020 rule comes into force in less than two months. Yet even today, no one actually knows what mix of fuel the world’s shipping industry will consume.

The ultimate mix will affect the cost of ocean transport, the demand for different types of tankers, the economics of exhaust-gas scrubbers, the bottom lines of public ship owners, and the competition for refining capacity between marine fuel and diesel.

Starting Jan. 1, vessels with scrubbers can continue to consume cheaper 3.5% sulfur high-sulfur fuel oil (HSFO), but those without such systems must burn either 0.5% sulfur fuel — known as very low sulfur fuel oil (VLSFO) — or 0.1% sulfur marine gasoil (MGO).

Since MGO is more expensive than VLSFO, scrubber economics will improve to the extent shipping opts for MGO over VLSFO. As the premium versus HSFO increases, the payback period for scrubber investments will shorten.

More broadly, the greater the proportion of MGO used in the overall marine-fuel mix, the more expensive ocean transport will become and the more marine-fuel demand will compete with diesel consumed by trucking and other land-based transport. MGO is a middle distillate like diesel, while VLSFO is only partially comprised of middle distillates.

Anthony Gurnee, CEO of product-tanker owner Ardmore Shipping (NYSE: ASC), maintained during a conference call with analysts on Nov. 5 that the pendulum has just swung more toward MGO and away from VLSFO.

Unexpected transition timing

One factor that bodes well for MGO over VLSFO is that MGO is more available and well-known and VLSFO is an entirely new product.

Ship owners had previously thought VLSFO would have already been positioned at the world’s refueling facilities by now. To a large extent, that hasn’t happened. Instead, ship owners appear to be waiting until the last possible moment to make the switchover to compliant fuel, and bunker suppliers are not preemptively bringing in VLSFO before ship owners make that switch.

At the Capital Link shipping forum in New York on Oct. 15, Hamish Norton, president of Star Bulk (NASDAQ: SBLK), said, “I was expecting demand for compliant fuel to be greater than it is today. People are planning to switch over later than I had expected. It looks like it will take people less time to switch over than I had thought.”

On the Ardmore conference call, CEO Anthony Gurnee said, “Third-quarter stockpiling [of compliant fuel] was lower than we anticipated. As a consequence, we expect there will be a particularly heightened disruption to cover demand in the fourth quarter and into 2020.” Ardmore CFO Paul Tivnan added that according to industry estimates, marine-fuel facilities were only 10-15% supplied with VLSFO as of the end of September.

The bulk of the demand shift toward VLSFO and MGO will occur “at the end of November and early December, and by Dec. 10 the switchover should be largely complete, so it will be extremely abrupt and quite impactful,” Tivnan said.

If there is not enough VLSFO available on Jan. 1 because bunker suppliers did not position enough ahead of time, the fallback position for ship owners to comply with IMO 2020 will be to buy MGO.

Rate upside consequences

The past month has witnessed an enormous surge in spot rates for crude tankers, as well as very strong rates for larger product tankers and liquefied petroleum gas (LPG) carriers.

Particularly in the case of very large crude carriers (VLCCs, tankers that can carry 2 million barrels of crude oil each), owners are opting to delay scrubber installations planned for the fourth quarter and take advantage of higher spot rates instead. Shipyards are open to delaying these installations with no penalty because they’re overbooked with scrubber-installation work and can focus instead on placating clients in the dry bulk and containers sectors, in which spot rates are not as strong.

The fewer scrubbers that are installed before the IMO 2020 deadline, the less HSFO will be consumed in early 2020 versus previous projections, and the more compliant fuel will be required, whether VLSFO or MGO. Scrubber delays were in the spotlight on the recent conference calls of crude-tanker owners Euronav (NYSE: EURN) and DHT (NYSE: DHT) as well as LPG carrier owner Dorian (NYSE: LPG).

According to Gurnee, “Demand for gasoil [MGO] is likely to be higher than previously forecast as a consequence of far fewer scrubber installations as a result of strong tanker markets.” During the Euronav call, executives likewise predicted higher demand for IMO 2020-compliant fuel due to delays in scrubber installations.

VLSFO quality concerns

Gurnee also highlighted “anecdotal evidence of company risk aversion to VLSFO, at least initially.”

A large variety of VLSFO products are being introduced on the market worldwide. The concern is that a ship switching from one VLSFO to another in the course of trading will run into engine difficulties due to incompatibility issues between the two VLSFO products. The conservative, though likely more expensive, course of action is to initially stick to MGO — an already trusted fuel source for ocean shipping — and watch what happens with ships using VLSFO from the sidelines.

Companies like Euronav were so concerned about the compatibility issue that they have preemptively bought and stockpiled pre-tested VLSFO supplies.

Crude vs. product tankers

Another major consequence of the MGO-versus-VLSFO choice is how it affects global tanker demand. So-called “dirty” tankers carry crude oil and cargoes like HSFO. When IMO 2020 forces the switch to compliant fuel, only some of the lost HSFO volumes will be converted to volumes carried aboard so-called “clean” product tankers.

MGO is definitely a product-tanker trade, but a combination of crude and product tankers may carry VLSFO, depending upon the blend.

Furthermore, some VLSFO may be created via a combination of clean and dirty cargoes that are mixed at the destination. Gurnee said that “the new VLSFO blends will be heavily middle distillate in the beginning, which means more gasoil [MGO] demand.”

Asked by FreightWaves how post-IMO 2020 marine-fuel cargoes would be split between crude and product tankers, Jefferies shipping analyst Randy Giveans replied, “It’s certainly up for debate. I asked that very question to a panel of crude-tanker owners last year, and they said VLSFO blends would be transported on crude tankers. Then I asked the same question to a panel of refined product-tanker owners last month, and they said VLSFO blends would be transported on products tankers.

“Depending on blending components and specs, some VLSFO blends will be considered dirty and some clean. It will be a delicate balance as charterers won’t want to put VLSFO in a cargo tank after crude or HSFO was carried — but charterers also won’t want to put diesel in a cargo tank after VLSFO was carried.”

Product-tanker earnings performance

The recent surge in the crude-tanker markets has had a positive knock-on effect in product-tanker earnings, but the consequences in financial results for all tanker sectors won’t be felt for at least one more quarter.

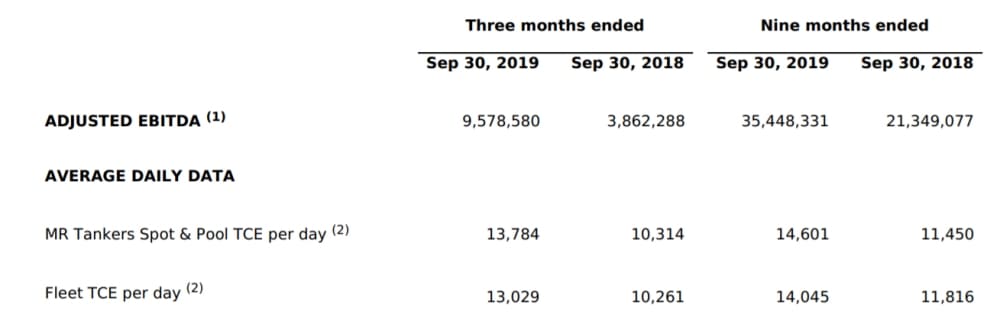

On Nov. 5, Ardmore reported a net loss of $5.7 million for the third quarter of 2019 versus a net loss of $12.2 million for the same period last year. The loss of $0.17 per share from continuing operations was in line with the analyst consensus.

Executives speaking on the call focused on the future. According to Gurnee, “After a difficult three years, we believe the market is in the early stages of a sustained upcycle characterized by repetitive spikes with settling periods in between, but at levels well above the recent past. Sentiment has fundamentally changed over the past month. Rates are now pushing up against a demand ceiling rather than bouncing along a supply floor.” More FreightWaves/American Shipper articles by Greg Miller