Wineries, breweries and distillers didn’t know it at the time, but the high-seas transport of alcohol inexorably changed on April 26, 1956, the day the world’s first commercial container ship, Malcom McLean’s SS Ideal-X, set sail from Newark, New Jersey.

In the second half of the 20th century, alcohol producers realized there was margin to be made transporting alcohol in huge volumes aboard oceangoing tankers. What they’ve come to realize in the 21st century is that there’s even more margin to be made via containerization.

According to Alison Leavitt, managing director of the Wine & Spirits Association, “If you think about just how much cheaper it has become over the years to ship a container from Rotterdam to New York, for example, and you think about the ships getting larger and larger, it has just become so much more cost-effective to use containers.”

Damien McClean, CEO of SIA Flexitanks, told FreightWaves, “There are huge implications for your cash flow if you can buy in container loads. With containers, you can spread out your purchasing in a much more intelligent way than if you had used a full parcel tanker.

“You also have much more flexibility with containers,” he added, citing a hypothetical example of a winery that was shipping 60% red wine and 40% white wine. “A parcel tanker would have to be all red or all white,” he pointed out. The non-containerized bulk-liquor model of the past no longer adds up.

Containerized shipping options

Different types of alcohol are transported aboard container ships in different ways. Spirits are mostly shipped either bottled and packed in standard containers or in ISO (International Standards Organization) tank containers. The ISO tank container is stainless steel, fits in a 20-foot slot, carries 24,000 liters of spirits and is multimodal.

At sea, beer in ready-to-drink form is generally shipped in cans, bottles and kegs. In intermediate form, beer is also transported in tank trucks and tank containers.

Wine is shipped either bottled in standard containers or increasingly, in so-called “flexitanks.” A flexitank is a flexible bladder placed within a 20-foot container. In the case of wine, the standard flexitank carries 24,000 liters.

Spirits can’t go in flexitanks and must go in ISO tank containers. “Anything over 40% alcohol by volume can’t go in a flexitank,” Leavitt told FreightWaves. The reason is the fire hazard, a particular concern for large container ships on the open ocean.

The reason beer is rarely shipped in flexitanks relates to carbonation. “It’s like if you shake a can of beer and open it, it goes all over the place,” explained McClean.

The reason wine in bulk goes in flexitanks not ISO tank containers is cost. “Flexitanks are super cheap compared to tank containers,” said Leavitt. “A tank container is probably triple the cost. You have to lease them, and they’re scarce.”

The reason more wine is being shipped by sea in flexitanks as opposed to bottles is, again, cost. “You’ll get 9,000 bottles of wine into a 20-foot container. In a flexitank, the 24,000 liters is the equivalent of around 30,000 bottles, so there’s your answer,” said McClean.

The evolution of flexitanks

Flexitanks were initially commercialized in the mid-1970s, starting in the U.K., he explained. The early flexitanks were rubber-based, reusable, lasting about 10 years, and very expensive, at around $5,000 apiece.

“The disadvantages were the initial capital investment and the fact that if you shipped it to Australia or something, you’d had to have someone ship it back to you,” McClean explained. Another disadvantage was that if you used the flexitank on a backhaul run for another cargo, such as industrial oil, it would be unusable for wine after that, limiting the flexitank’s flexibility and thus its utilization over its lifetime.

A plastic flexitank came into use in the 1990s that was lighter and cost around $1,800, he continued. Then, in 2001, McClean patented a new design that would ultimately become the industry standard.

This modern flexitank is made out of multiple layers of polyethylene, is very durable, can carry a wide variety of products ranging from wine to hydrocarbons, costs just $500 per unit and is disposable as opposed to reusable.

The new, much more affordable concept led to a surge in flexitank usage. McClean cited estimates that there were about 1 million flexitanks loaded in 2015, around 1.4 million in 2018 and this year’s tally should end up at 1.8-2 million. In contrast, the largest owner of flexitanks in mid-1980 had an inventory of around 12,000 units.

Breaking it down by region, he said that Asia currently accounts for around 60% of flexitank usage, Europe 15%, North America 8%, South America 7% and the rest of the world 10%.

The world’s largest two flexitank providers are Hillebrand and Braid, followed by SIA Flexitanks (which, unlike the top two, is not a freight forwarder). Virtually all of the world’s flexitanks are manufactured in China, as is the case with ISO tank containers and dry and refrigerated shipping containers.

The future

McClean believes current volumes of wine shipped by sea using flexitanks are not even close to their full future potential. “The market is very, very far from reaching its zenith,” he affirmed, noting that there are still shippers using smaller intermediate tank containers. “The growth over the last seven or eight years has been exponential. We’re just scratching the surface,” he said.

One development that could bring even more alcohol into flexitanks is a potential shift in some beer volumes to this transport concept.

One way to overcome the “shake the can” carbonation conundrum is to transport the beer in cold temperatures. SIA Flexitanks is exploring this solution with brewers.

This would need to be done in 40-foot reefer containers, not the 20-footers used for flexitanks. “The walls of a 20-foot container are not very strong. We’re looking at a 40-foot container so that we can safely ship the product in a refrigerated environment without damaging the container,” he explained, noting that “it would be almost the same payload” as is carried in a 20-footer, but the flexitank would have a “lower profile” — i.e., it would take up less height in the larger container.

Another way that more beer could flow on high-seas routes in flexitanks is if the product is transported in an intermediate form with its water and carbonation removed and added back after transport.

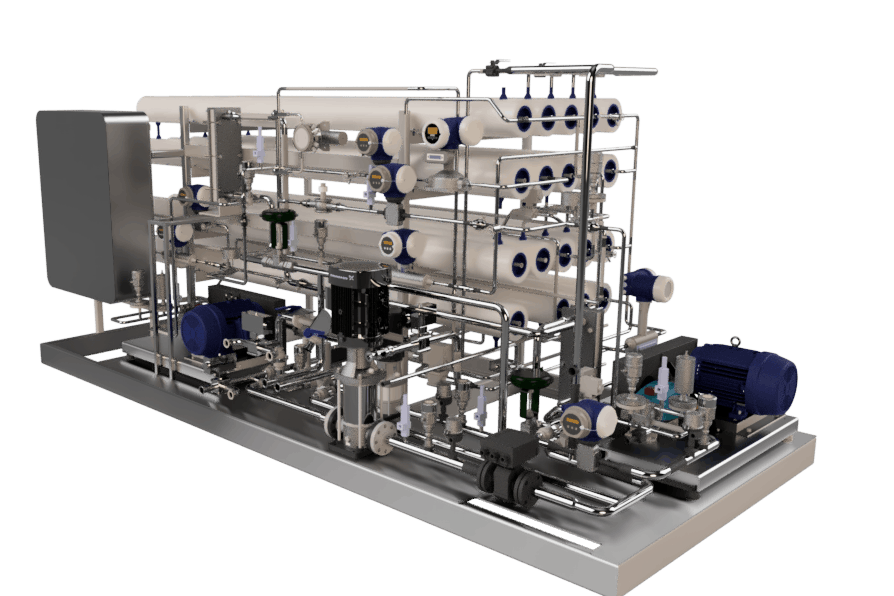

This is the path being pursued by Massachusetts-based Sandymount Technologies, a startup that claims its Revos membrane-based technology can remove water from beer without impacting taste. The resultant ultra-high-gravity (i.e., ultra-high-density) beer is transported in much lower volume, with the water added back in before consumption. The system is designed to operate at a scale of 20 million liters per year.

Sandymount CEO Ronan McGovern told FreightWaves that his technology has been tested with three big-name brewers. The first kegs using the technology are being sent this week and a high-scale contract using both kegs and flexitanks should be operational next year.

“With our technology, we’re able to fit eight times the amount of beer into a container than with bottles, so you’re taking seven containers off the ocean,” said McGovern.

The environmental aspect

Going forward, environmentalism is likely to be a major issue for bulk transport of liquor by sea. The green agenda is having a huge impact on all aspects of ocean shipping. There’s no reason to believe flexitanks will not be increasingly judged by environmental standards.

Cheap, disposable plastic flexitanks significantly reduce carbon emissions for sea transport — a big plus from a greenhouse gas-reduction perspective. According to McClean, using flexitanks versus shipping bottled wine “is one of the quickest and easiest ways to reduce the carbon footprint” of the transport process, by moving much more wine per container. He pointed to the “Courtauld Commitment” signed by U.K. grocers in 2005, a voluntary agreement to reduce waste that led to a widespread shift from bottles to flexitanks for wine imports.

At the same time, however, the manufacture of disposable flexitanks inherently creates a large volume of “single-use plastic” – a major red flag in the current political environment. Commenting on the single-use-plastic issue, McClean emphasized that the flexitanks are meant to be recycled. “We as an industry are doing a lot of work in terms of sustainability and recycling,” he said.

McGovern believes that “in practice, a lot of flexitanks are actually land-filled or incinerated.” Consequently, Sandymount is developing a reusable flexitank that will debut in the second quarter of next year.

“We’re seeing a lot of interest due to the environmental aspect,” he said. “There’s a huge willingness to pay for doing the right thing sustainability-wise. If you’re saving so much money [via the volume reduction of the ultra-high-gravity process and using flexitanks] then you’re more willing to spend a little bit more to not have disposal issues with the flexitanks.” More FreightWaves/American Shipper articles by Greg Miller

MrBigR504

As if wine in the box wasn’t bad enough! But i will hook my truck up to that tank full of Crown Royal and Grey Goose! Burrrrrrp….is there a problem ociffer? LMAO…bring on the hooch by bulk!