The views expressed here are solely those of the author and do not necessarily represent the views of FreightWaves or its affiliates.

The lockdowns caused by COVID-19 around the world have created disruptions to the normal processes and procedures required to ensure the smooth flow of global trade and commerce. In India, this has prompted the Ministry of Shipping and the Ministry of Commerce to increase their efforts to adopt technology to keep the volume of imports and exports at pre-pandemic levels.

Defining the problem

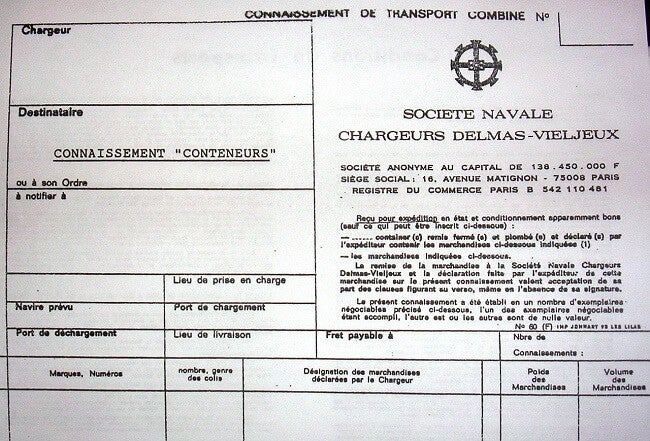

In a letter dated April 16, 2020, Gopal Krishna, Secretary of the Ministry of Shipping of India, outlines the problem when he states that with social distancing norms in place, the requirement that critical documents required to facilitate international trade be provided in hardcopy format creates a bottleneck in the free flow of exports and imports through India’s ports.

In the letter, Krishna lists bills of lading, delivery orders, certificates of origin and letters of credit as being of particular concern. However, freight forwarders and customs brokers will tell you that these are by no means the only documents required to enable international trade.

The problem is that social distancing regulations mean that it is impossible to transact business face-to-face using hardcopies of these documents. And even if hard copy documentation can be mailed between counterparties, work from home rules that accompany the lockdowns resulting from COVID-19 create yet another obstacle to document processing.

In his letter, Krishna describes the current process as requiring up to 11.5 hours of person-to-person contact. Based on other work I have done on tech platforms in maritime shipping, I think that is an understatement.

What India is doing to solve this problem

On June 11, CargoX issued a press release, Government of India drives digitalization of the bill of lading and trade documents with Portall and CargoX. CargoX is based in Ljubljana, Slovenia.

Most recently I interviewed Stefan Kukman, CEO and Founder of CargoX, for Commentary: How supply chain startups are surviving COVID-19, which ran on FreightWaves on April 23, and the company demonstrated its platform to members of The New York Supply Chain Meetup in November 2018 and again in January 2020.

(Photo: Flickr/Moriz mdz)

As Kukman told me in April, “The CargoX platform enables blockchain document transfer (BDT). This allows companies to send and transfer ownership of original documents in a highly secure, reliable, fast and cost-efficient way. It also enables companies to prove the ownership of the documents, as required in logistics, financial and other adjacent industries.”

The Indian Ports Association (IPA) has been working on the Indian Port Community System (PCS), a digital platform to facilitate the creation, storage and exchange of electronic documentation required to facilitate trade without the need for paper-based processes. The platform is built and designed by Portall Infosystems, a subsidiary of the JM Baxi Group, a supply chain logistics, services and transportation conglomerate with more than 100 years of experience in India.

PCS was initially launched in December 2018, and so far has successfully digitized and integrated electronic delivery orders, electronic invoices and electronic payments.

The next big push is to digitize the bill of lading, letters of credit, and any other remaining documentation required to fully eliminate paper-based and manual processes from the import and export trade processing procedures at all of India’s major ports.

To that end “CargoX and Portall Infosystems have entered into a partnership to digitalize the processing of bills of lading and the transfer of trade documents.” This comes after the successful testing of the CargoX platform for BDT by Portall, IPA and PCS, for the creation, exchange and storage of electronic bills of lading.

In February, CargoX reported that it has been approved as a blockchain document transfer provider by the International Group of P&I Clubs, an international body whose members “provide marine liability cover [protection and indemnity] for approximately 90% of the world’s ocean-going tonnage.” CargoX joins Wave BL and edoxOnline as approved vendors. However, of the three, CargoX is the only provider built on the neutral and public Ethereum Network.

I have seen a demonstration of the CargoX platform a few times, most recently during a 90-minute phone call with senior members of the CargoX team in early April. It can process and store other types of documentation beside bills of lading. It is designed for ease of use, and to be interoperable with other systems and platforms – hence the decision to build on the Ethereum Network. It works for containerized and breakbulk freight.

(Photo: Jim Allen/FreightWaves)

Wrapping things up

According to a May 2016 report from the Associated Chambers of Commerce & Industry of India, the country could save $10 billion across the economy for every percentage point gain in supply chain logistics efficiency. The report pegs logistics costs as contributing 14% to the cost of goods sold in India, and suggests that $50 billion of savings could be realized by reducing that number by 5 percentage points, bringing it down to 9%.

Given India’s rank of 44 out of 160 countries that are ranked on the World Bank’s 2018 Logistics Performance Index, there is much room for improvement. For comparison: Brazil is ranked 56, Russia is ranked 75, China is ranked 26, and South Africa is ranked 33. Germany is ranked 1. Singapore is ranked 7. The U.S. is ranked 14.

It is too early to know if the Indian Port Community System will work as planned. However, the trend towards platforms like PCS is a trend that I uncovered and highlighted in Updates – Industry Study: Ocean Freight Shipping (#Startups) – see the third bullet under “What are the biggest opportunities for startups?” This trend is unfolding in other ways; for example, FreightWaves ran Commentary: FedEx/Microsoft partnership points to era of supply chain platforms on June 10.

However, platforms like the one FedEx and Microsoft are building will not be effective if they can’t plug into systems like PCS. In other words, without systems like PCS government agencies that must inspect and approve documents and transactions will become bottlenecks in international trade.

With early testing out of the way, it now remains to be seen if participants in the import and export business in India will adopt the new technology and tools made available by PCS. If it gains popularity and supplants the old processes, that may encourage more governments to start taking steps towards digitizing the processes that enable trade with the rest of the world. The team at CargoX has said they are in conversations with government agencies in a few other countries. I assume those agencies will be watching developments in India with keen interest.

If you are a team working on innovations that you believe have the potential to refashion global trade and supply chain networks, we’d love to tell your story in FreightWaves. I am easy to reach on LinkedIn and Twitter. Alternatively, you can reach out to any member of the editorial team at FreightWaves at media@www.freightwaves.com.