Less-than-truckload provider Forward Air announced Thursday further deceleration in tonnage during the fourth quarter as pieces per shipment have declined 20% year over year (y/y).

“Our customers and we are experiencing what we believe is a temporary but significant softening in the freight environment,” Chairman, President and CEO Tom Schmitt commented in regard to declines the company logged in October and November.

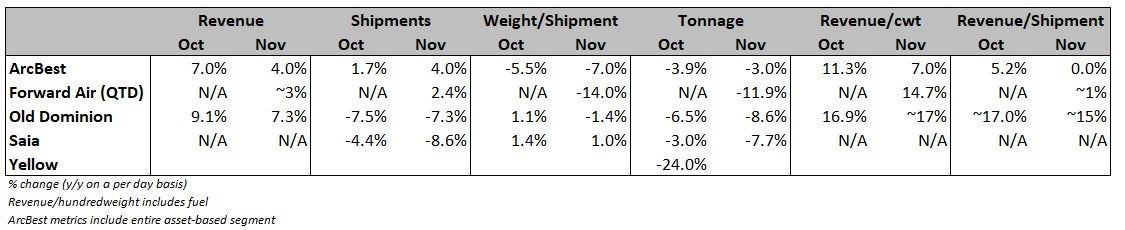

Forward’s (NASDAQ: FWRD) expedited freight segment, which includes asset-light LTL services, reported that shipments were up 2.4% y/y through the first two months of the quarter but weight per shipment was down 14%, resulting in a tonnage decline of 11.9%. The company’s weight-per-shipment comparisons to 2021 are formidable given prior actions to remove freight with lower weights from the network in favor of heavier, higher-valued goods.

“Our focus on high-value freight, operated in an efficient operating environment, priced accordingly and offered to an increasing customer set is getting traction,” Schmitt said.

Implied revenue in the segment is up roughly 3% y/y given the metrics provided, a notable step down from the double-digit growth rates the unit posted in recent quarters. The company’s fourth-quarter guidance calls for consolidated revenue growth between 7% and 11%. That revenue guide was constructed on the expectation of an increase in in-person events, share wins from core customers and a decision to start selling directly to shippers that are not using forwarders.

“The effectiveness of initiatives to bring our live events business back, sell to customers who do not use value-added intermediaries and, most of all, enable our core customers who know us best to win more high-value freight, stand out as evidenced by the increase in the number of shipments we handled during the period,” Schmitt continued.

But shipments are only up slightly so far in the fourth quarter against a weak comp from the 2021 fourth quarter (down 14% y/y).

Forward saw tonnage first turn negative y/y in September and decline by 5% y/y in October, which implies a high-teen-percentage falloff during November. That level of decline outpaced updates provided by asset-based carriers.

Old Dominion (NASDAQ: ODFL) reported an 8.6% y/y decline in tonnage during November, 210 basis points worse than the October rate of decline. The drop in Saia’s (NASDAQ: SAIA) y/y tonnage comps accelerated 470 bps to down 7.7% in November.

ArcBest (NASDAQ: ARCB) saw the rate of decline improve slightly in November. The carrier said tonnage in its asset-based unit, which includes LTL, was down 3.9% y/y in October and off 3% y/y in November. However, its comps to the 2021 fourth quarter were easier given the muted increases it recorded last year relative to Old Dominion and Saia.

Forward Air reiterated its expectation for earnings growth again in 2023.

“We continue to be laser-focused on our Grow Forward initiatives that include building out our terminal footprint organically and inorganically, and as a result, we expect that these initiatives will outweigh the tremendous short-term headwinds, and we reiterate our expectation in a record 2022 and our target to top it in 2023,” Schmitt concluded.

GRI announcements continue to roll in

Forward Air also announced Thursday it will implement a 5.9% general rate increase (GRI) on shipments tendered starting Feb. 6. The company had previously indicated more robust expectations, something closer to the 7.9% increase taken last year.

Other carriers have also begun announcing GRIs. TForce Freight (NYSE: TFII) announced a 5.9% increase and FedEx Freight (NYSE: FDX) said base rates would go up between 5.9% and 7.9%. Yellow implemented a 5.9% GRI on Oct. 3.

Forward Air’s GRI will allow the company to continue to invest in the network and its expedited service offering. The increase is also expected to help offset cost inflation, which it said is up by double-digit percentages compared to last year.