Truckload carrier Marten Transport (NASDAQ: MRTN) had a blowout fourth quarter, establishing numerous records in its financial performance.

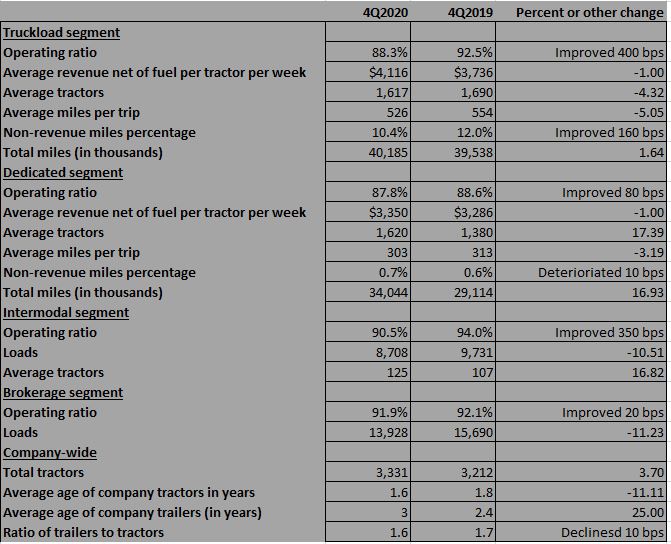

On a 4.7% increase in operating revenue to a record $227.3 million, Marten recorded gains in the operating ratios of all its units. The OR for the entire company improved to 88.8%, gaining g by 250 basis points from 91.3% in the fourth quarter of last year. The Truckload segment’s OR strengthened to 88.3% from 92.5% and its Dedicated segment improved to 87.8% from 88.6%. Intermodal posted an OR of 90.5%, up from 94%, while the Brokerage sector improved slightly, to 91.9% from 92.1%.

The improvement in the Truckload OR was helped by a 5.4% gain in the segment’s revenue, net of fuel, rising to $87.46 million from $83 million in the fourth quarter of 2019. Operating income rose to $11.27 million from $7.11 million, a jump of 58.5%.

The revenue for Marten’s Dedicated sector net of fuel grew by far more, up 14.1% to $71.31 million from $59.57 million. Operating income climbed 22.1% to $9.9 million from $8.11 million.

Intermodal revenue net of fuel dropped $1.5 million to $20.81 million, though it too reported improved operating income of $2.17 million, up from $1.47 million.

Marten’s brokerage group saw its revenue inch up by less than $1 million to $27.38 million, a jump of 3.4%. Operating income was up $127,000 to $2.22 million, a jump of 6.1% that allowed for the small gain in OR.

Randolph Marten, the company’s chairman and CEO, gushed about the earnings in a prepared statement. (Marten does not hold earnings calls with analysts).

“Our relentless pursuit of continuous operating improvement just produced the highest operating revenue and operating income for any quarter and year in our 75-year history,” he said. “Our 2020 operating ratio, net of fuel surcharges, was also the best ratio for any year since we became a public company in 1986.”

The improvement in the company’s OR for the full year was not across the board in its segments. The full Marten OR strengthened to 89.3% from 90.9%, the Truckload segment improved 270 basis points to 89.5% and Dedicated moved higher to 86.8% from 88.3%. But the Intermodal segment weakened to 93.5% from 92.7%, and Brokerage weakened by 100 basis points to 92.8%.

Truckload’s operating revenue for the year, net of fuel, moved up 4% to $342.35 million. It was Marten’s Dedicated division net of fuel that saw the biggest jump, climbing 21.3% to $271.5 million from $223.93 million. The Dedicated segment was helped by several key benchmarks, including driving 16.9% more miles and a 1% improvement in average revenue net of fuel per tractor per week.

Intermodal’s revenue net of fuel climbed $2.2 million to $79.94 million. Brokerage operating revenue took the biggest hit, declining to $96.7 million for the year, down from $108.9 million, though the OR weakened by only 100 basis points.

Marten’s cash on its balance sheet more than doubled from the end of last year. It stood at $66.1 million at the end of the year, up from $31.4 million.

One notable line item under costs: Marten’s use of purchased transportation, even in a market notable for a significant driver squeeze, declined less than $1 million to $40.9 million from $41.6 million. It was down about $4.4 million for the year.

After a day in which its stock sagged a little more than 2%, Marten’s stock after the release of the earnings was up 2.16% at approximately 5:40 p.m.

More articles by John Kingston

First 3Q earnings report is from Marten and it isn’t a blockbuster

Marten, Heartland stock prices get boost after strong quarters

Marten’s Dedicated division keeps company steady overall in first quarter