Tanker stocks have a “tree falls in empty woods and no one hears it” problem. They have a compelling longer-term pitch — almost no newbuild contracts, a giant plus for rates — but buyers are looking elsewhere.

A new FreightWaves analysis reveals the extent of the slide in trading value and volumes for tanker and dry bulk shares.

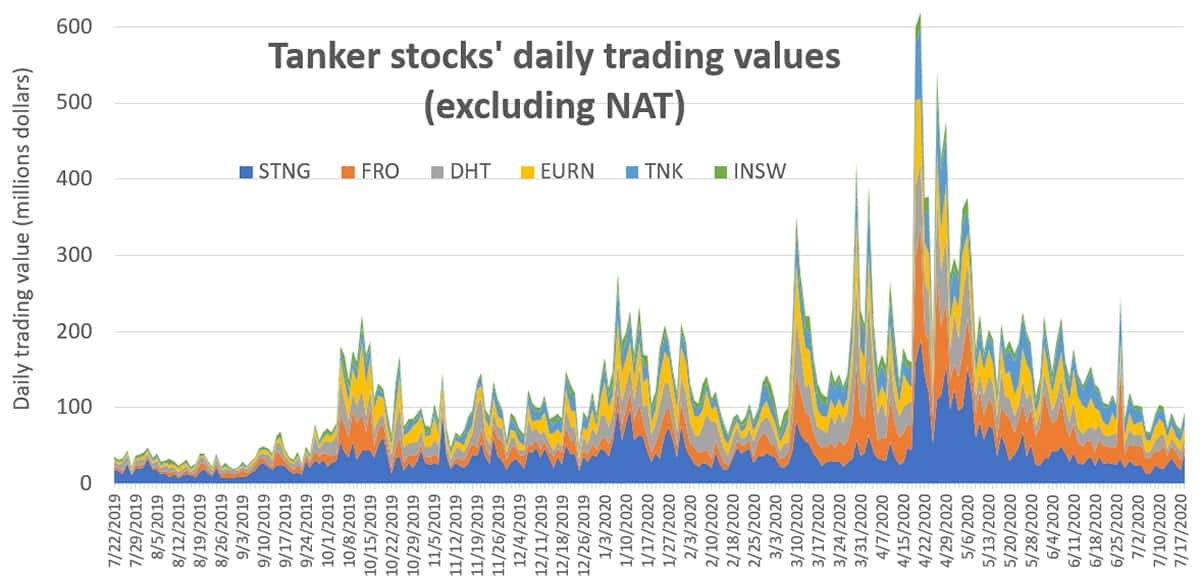

Tanker stock daily trading values

The number of shares traded per day is one indicator of investor interest. To account for widely divergent share prices, the data can be analyzed in terms of dollar value.

FreightWaves used data from Yahoo Finance and NASDAQ on the number of shares traded per day, multiplied by the average of the daily high and low price to estimate daily trading value.

Data was compiled over a one-year period (July 22, 2019-July 21, 2020) for the seven tanker stocks with the highest market capitalizations: Euronav (NYSE: EURN), Frontline (NYSE: FRO), DHT (NYSE: DHT), Scorpio Tankers (NYSE: STNG), Nordic American Tankers (NAT), Teekay Tankers (NYSE: TNK) and International Seaways (NYSE: INSW).

For the full year, Scorpio had the highest average daily trading value: $38 million. International Seaways had the lowest, at just $8 million.

NAT blew everyone else away in terms of the annual peak, as retail traders on the Robinhood platform flocked to the stock. Volumes took flight in the wake of NAT CEO Herbjorn Hansson’s appearance on Jim Cramer’s CNBC show “Mad Money” on April 24.

Removing the NAT outlier from the data offers a clearer picture of trading values for the other large tanker owners.

Recent daily trading values for the group are averaging about a third of peak levels in April and early May. But on the positive note, daily values are still over double where they were a year ago. Buyer interest in tanker stocks may be down, but it hasn’t completely collapsed.

Tanker stock daily trading volumes

Another way to measure trading liquidity is the number of shares bought and sold. This data removes distortions from share price. FreightWaves used a 10-day trailing average of the number of shares traded, indexed to the first trading day of the year.

This data shows that trading in most tanker stocks is back to where it was in early January, with the exception of higher volumes for Frontline and Scorpio.

Over the first half of the year, NAT once again far outperformed, with Frontline and Scorpio seeing higher gains in volume than other tanker names.

Excluding the NAT outlier, daily volumes for the group are about one-sixth of peak levels in April and early May.

FreightWaves also ran the trading-volume numbers indexed to one year ago. The result: Volume is much higher now that it was then, around triple on average (with the caveat that the bar was low). International Seaways once again brought up the rear, with a 56% year-on-year gain.

Dry bulk stocks: much worse than tankers

The tanker data shows a fall-off in investor interest from the floating-storage-induced highs, but a year-on-year improvement nevertheless. The dry bulk data points to a sector with very little interest from investors — and one that is getting worse.

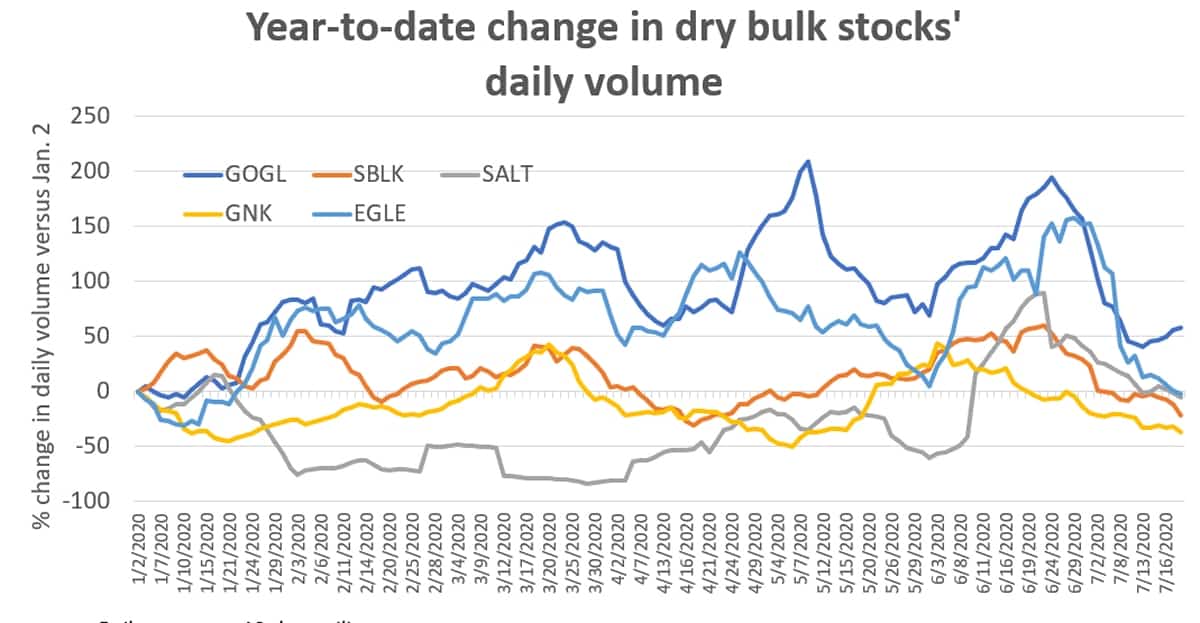

FreightWaves compiled trading data for the five U.S.-listed bulker owners with the largest market caps: Star Bulk (NASDAQ: SBLK), Scorpio Bulkers (NYSE: SALT), Golden Ocean (NASDAQ: GOGL), Genco (NYSE: GNK) and Eagle Bulk (NASDAQ: EGLE).

Total daily trading value for the group is down to around half of where it was a year ago. The owner with the most daily trading value, Star Bulk, has seen a significant decline. In contrast, trading in Scorpio Bulkers is up more recently, although price action implies this is because stockholders are selling.

The 10-day trailing average of the number of shares traded, indexed to Jan. 2, paints an unimpressive picture.

Dry bulk trading volumes are flat or down, with the exception of Golden Ocean’s. Volume patterns are largely directionless. To the extent volume data shows some rising first-half interest in dry bulk, it also shows interest subsequently fizzling.

Why trading volume matters

The best formula for sustainable shipping-share appreciation is a bedrock of strong institutional buying and retail as gravy.

As J Mintzmyer, analyst at Seeking Alpha’s Value Investors Edge, told FreightWaves last month, “For tanker prices to appreciate meaningfully in the longer term, we need to see large funds come back to the space. Retail interest and traders will help at the margins and will improve liquidity, but cannot support stock valuations. There just aren’t enough buyers with deep enough pockets out there.”

Jon Chappell, analyst at Evercore ISI, warned in a report last week, “Broader institutional support of this sector will not emerge as long as there are brief super-spikes directly followed by long downturns.

“We believe there are stocks in which to invest in this industry [as an institutional buyer], but our view of differentiation has morphed from market exposure and valuation to one overriding issue: liquidity,” said Chappell. “You either have it or you don’t, and if you don’t, the measures necessary to ensure it have hurt investors time and time again.” Click for more FreightWaves/American Shipper articles by Greg Miller

MORE ON SHIPPING STOCKS: Why pricing predictions for tanker stocks have become more difficult: see story here. How traders are turning to shipping penny stocks: see story here. A look at tanker and bulker stock pricing trends in the first half: see story here.